- United States

- /

- Commercial Services

- /

- NasdaqGS:CTAS

Cintas (CTAS): Is the Current Valuation Justified After Recent Steady Share Price Moves?

Reviewed by Simply Wall St

Anyone keeping an eye on Cintas (CTAS) might be wondering what is behind its latest price shift. The stock has been treading water this week, moving just a hair higher, with no headline-making events pushing it either way. While there is not a flashy earnings surprise or big acquisition to dissect, sometimes the absence of drama is noteworthy on its own. For investors, a quiet price move like this can be a subtle nudge to pause and rethink whether the current valuation tells the whole story.

Looking at the bigger picture, Cintas has quietly built a track record of consistent gains, delivering 19% so far this year and clocking in a 107% return over the past three years. Short-term momentum has cooled a bit, as the stock is down 2% in the past month. None of this is out of the ordinary for a company known for steady execution. However, it does invite a closer look at whether recent strength is justified by its growth prospects or if expectations have started to get ahead of fundamentals.

Is the market still underestimating what Cintas can deliver, or have investors already priced in all of the good news? Let us dig into what the numbers and valuation suggest about the opportunity here.

Most Popular Narrative: 1.9% Undervalued

According to the community narrative, Cintas is seen as slightly undervalued, with the current share price sitting just below the consensus fair value. Analysts expect further growth, but the gap between the price and target is slim. This suggests the stock could be fairly valued on balance.

Ongoing customer shift toward outsourcing non-core functions, coupled with high customer retention and successful cross-selling (converting self-managed uniform users to rental programs, bundling services), expands Cintas' total addressable market and supports durable, recurring revenue streams.

Wondering what’s really fueling this premium price tag? The secret lies in a unique combination of recurring revenue, next-level efficiency, and a growth outlook that would turn any competitor green. The full narrative breaks down the core assumptions that keep Cintas valued in rarefied territory. Find out what key numbers justify analysts’ bullish stance.

Result: Fair Value of $221 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent inflation or a shift to remote work could dampen demand and challenge the steady growth story investors have come to expect.

Find out about the key risks to this Cintas narrative.Another View: Testing the Value with a Different Lens

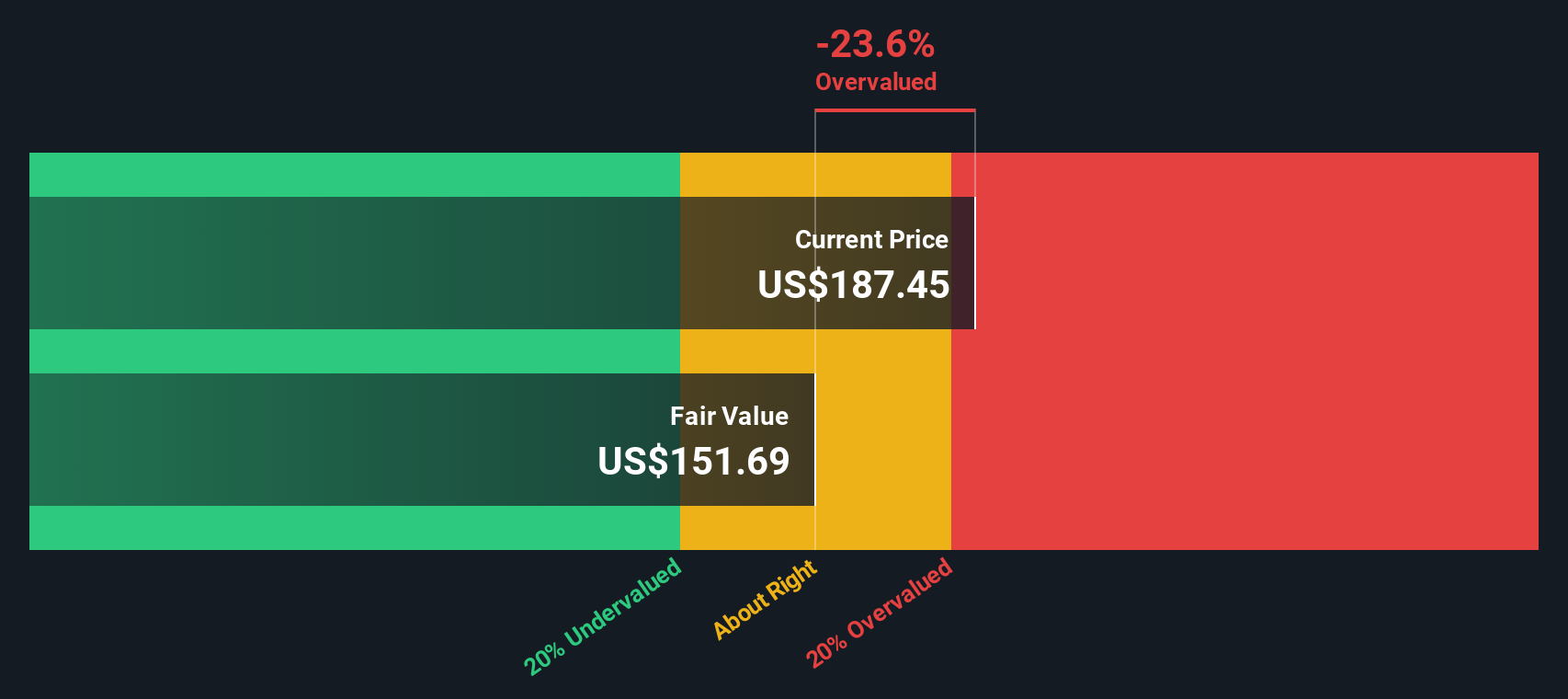

Looking through the SWS DCF model, things look quite different. The analysis suggests Cintas may be priced above what its future cash flows justify. This raises the question: are the current market expectations too high?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cintas Narrative

If you want to challenge these ideas or simply uncover your own angle, you can build a personalised narrative in just a few minutes, do it your way.

A great starting point for your Cintas research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Opportunities?

Do not let your next big idea slip through the cracks. The right screener can open up a world of opportunities tailored to your goals. Use the powerful tools at your fingertips to spot resilient companies and fresh trends others might overlook. Here are three exciting strategies to get you started:

- Target stable income by focusing on top companies offering generous payouts with dividend stocks with yields > 3%. This approach is ideal for building wealth through reliable dividend yields.

- Uncover emerging leaders in healthcare innovation by exploring breakthrough technologies driving the future of medicine with healthcare AI stocks.

- Search for stocks trading below their intrinsic value using undervalued stocks based on cash flows. This strategy can help you find undervalued opportunities ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTAS

Cintas

Engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives