- United States

- /

- Commercial Services

- /

- NasdaqGS:CTAS

Cintas (CTAS): Exploring Valuation as Short-Term Jitters Meet Long-Term Growth Optimism

Reviewed by Kshitija Bhandaru

Cintas (CTAS) has been in the spotlight as a mix of upbeat earnings and company news collides with an undercurrent of short-term market uncertainty. The stock’s recent moves reflect cautious sentiment among investors who are weighing broader economic headwinds against the company’s continued investments for future growth.

See our latest analysis for Cintas.

This latest flurry of activity comes as Cintas shows some short-term volatility, with a share price return of -1.98% over the past day and -7.23% over the last week. This reflects broader market jitters and recent selling pressure. Still, when considering a longer horizon, its three-year total shareholder return stands at a strong 102.47%. This highlights how the company’s growth initiatives have rewarded patient investors even as recent momentum has cooled.

If volatility in names like Cintas has you curious about broader opportunities, now’s a perfect moment to discover fast growing stocks with high insider ownership

With the stock slipping from recent highs and analyst targets still above today’s price, is this current dip a compelling entry point for long-term investors, or is it a signal that the market already anticipates future growth?

Most Popular Narrative: 13.6% Undervalued

Cintas is priced at $187.96 but the leading narrative signals its fair value is notably higher. Here is the reasoning behind those numbers and what drives their optimism.

Strategic investments in technology and automation, including the SAP platform, SmartTruck fleet optimization, and plant auto-sortation, are already delivering operational efficiencies and cost savings. These factors enable sustained margin expansion and improved earnings leverage.

What’s the catalyst for this bullish stance? The full narrative builds its case on bold margin expansion, robust future earnings, and a sector-defying profit multiple. If you want to see which assumptions are the real game-changers, you’ll want a closer look at the projections that make this fair value stand out.

Result: Fair Value of $217.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting workforce patterns and rising automation both have the potential to dampen recurring demand for Cintas’ core services over the coming years.

Find out about the key risks to this Cintas narrative.

Another View: A Premium Relative to Peers

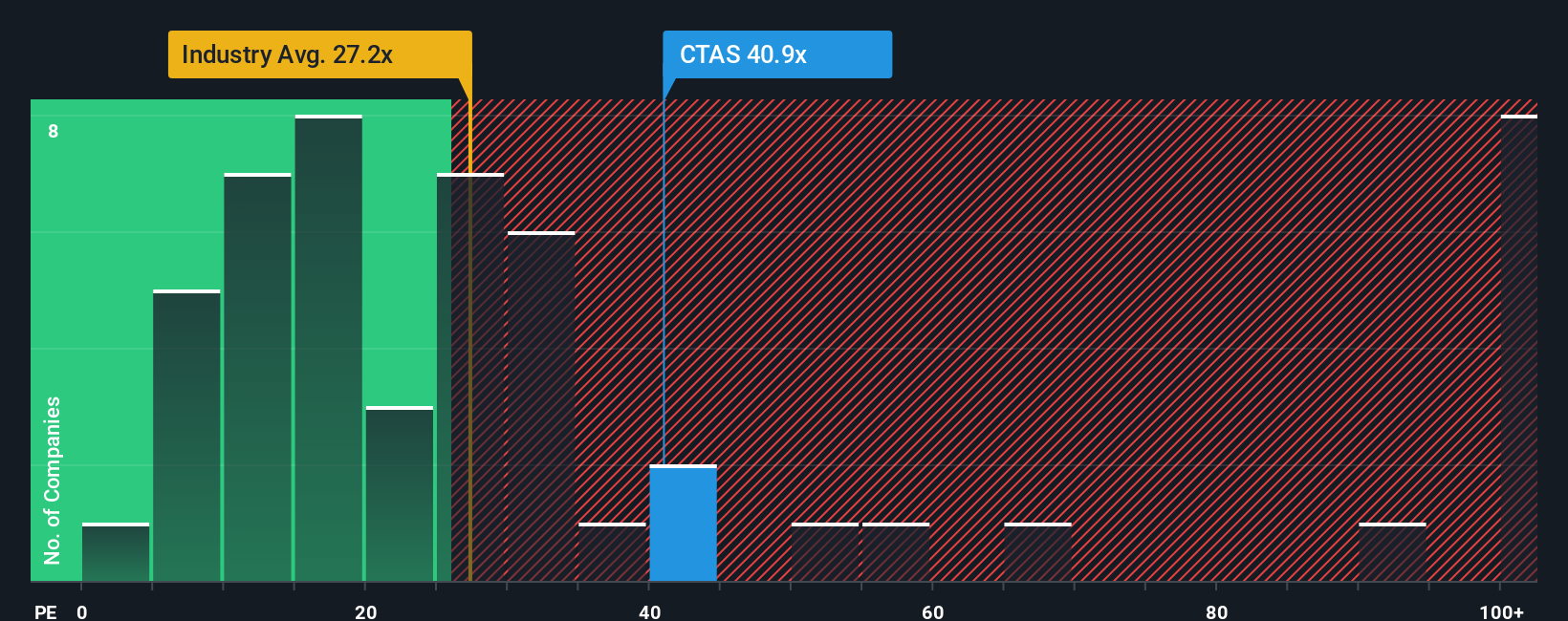

While the consensus narrative sees Cintas as undervalued, a closer look at its price-to-earnings ratio tells another story. Cintas trades at 40.9x earnings, noticeably higher than both its industry average of 27.6x and the peer average of 33.2x. This premium could suggest the market is already pricing in significant growth, introducing a higher valuation risk for investors if expectations are not met. With the market’s fair ratio at 32.6x, should investors expect a correction, or is Cintas’ quality worth the elevated price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cintas Narrative

If you see things differently or want to shape your own perspective, dive into the data and craft your own story in just a few minutes. Do it your way

A great starting point for your Cintas research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let great opportunities slip through your fingers when there are standout stocks just a click away. Open new possibilities for your portfolio with these smart picks:

- Capture the potential of tech disruptors making headlines by checking out these 24 AI penny stocks, which are driving advancements in artificial intelligence and automation.

- Unlock reliable passive income from companies offering strong yields by reviewing these 19 dividend stocks with yields > 3% with steady payout records.

- Step ahead of the crowd and target attractively priced opportunities with these 902 undervalued stocks based on cash flows, which are trading below their intrinsic value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTAS

Cintas

Engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives