- United States

- /

- Commercial Services

- /

- NasdaqGS:CPRT

Is Copart Set for a Rebound After its 20% Drop in 2024?

Reviewed by Bailey Pemberton

Thinking about what to do with Copart stock? You are not alone. The past year has thrown quite a curveball for shareholders, especially with shifts in the broader automotive and insurance sectors influencing investor sentiment. While Copart’s stock price has dipped 18.4% over the past year and is down 20.5% so far in 2024, the bigger picture tells a more compelling story. This is a business that has powered through ups and downs, boasting gains of 59.1% over the past three years and 55.7% over five years. These are returns that grab any investor’s attention.

Volatility like this often sparks questions: is the market reevaluating the risks facing Copart, or are we simply seeing opportunity for buyers looking for value? Over just the last seven days, the stock managed a 1.2% bump, suggesting renewed interest or perhaps just a bit of noise in an otherwise choppy short-term trend.

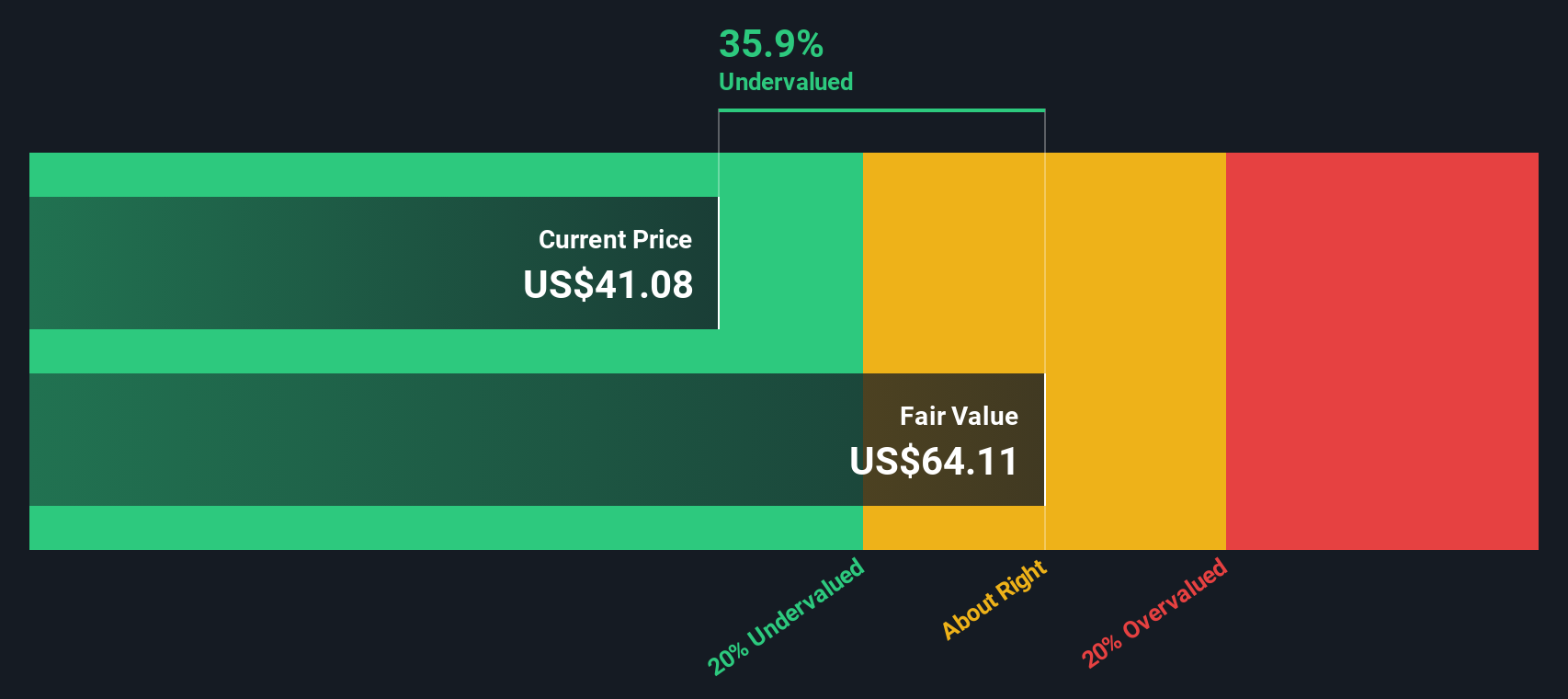

Here is where things get interesting for value-focused investors. According to the latest valuation score, Copart checks the boxes for being undervalued in 5 out of 6 major categories, giving it a strong value score of 5. This alone gets savvy investors leaning in for a closer look. In the sections ahead, we will break down the key valuation methods and what they reveal about Copart’s share price. Stick around until the end for a smarter way to think about what valuation really means for your investment approach.

Why Copart is lagging behind its peers

Approach 1: Copart Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This helps investors gauge what a business is actually worth today, apart from market sentiment.

For Copart, the DCF model starts with a current Free Cash Flow of $1.22 Billion. Analysts provide cash flow forecasts out to 2028, at which point Copart’s Free Cash Flow is expected to rise to around $1.98 Billion. Projections further out, based on Simply Wall St’s estimates, see steady increases each year for the next decade, reflecting long-term growth expectations.

Using the two-stage Free Cash Flow to Equity approach, the model calculates an intrinsic fair value of $62.63 per share. With the stock recently trading about 28.5 percent below this estimated value, Copart shares appear notably undervalued by the DCF measure.

In summary, the DCF model indicates a margin of safety for investors willing to trust the long-term cash flow potential of Copart.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Copart is undervalued by 28.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Copart Price vs Earnings (PE Ratio)

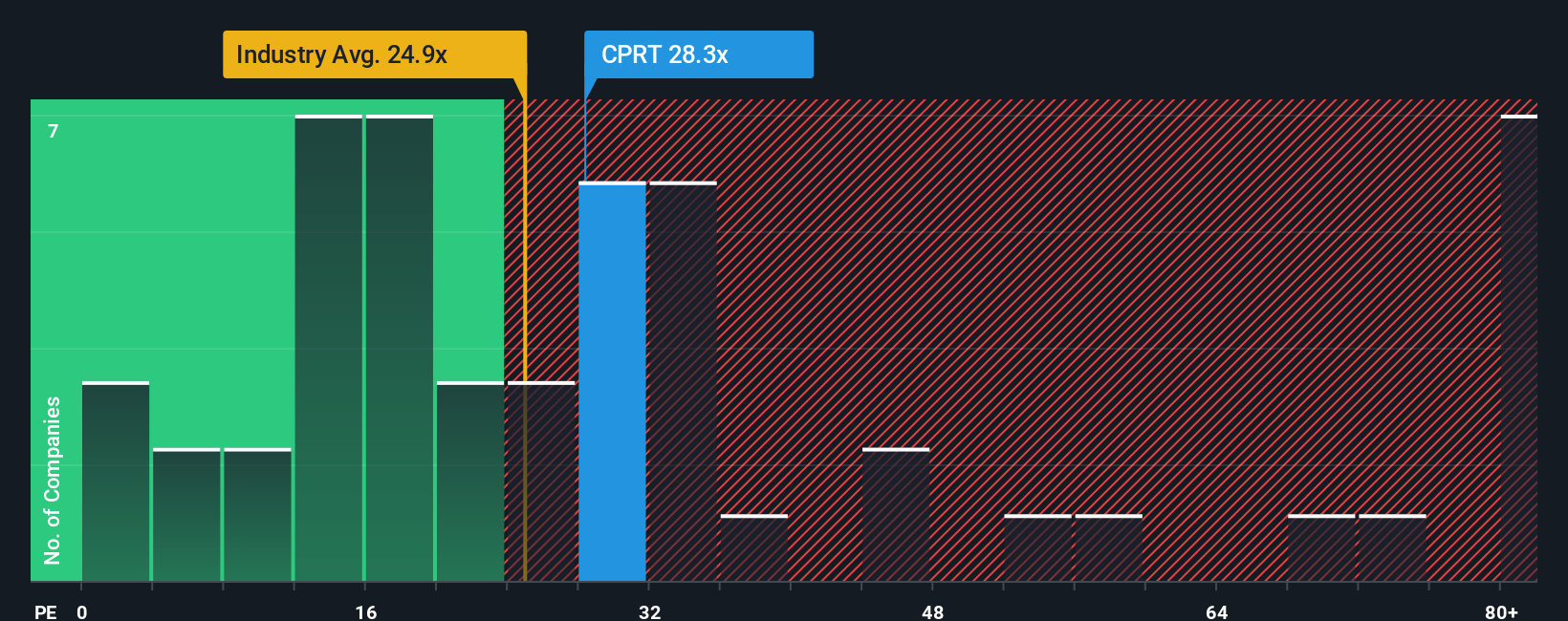

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies, as it reflects how much investors are willing to pay per dollar of a company's earnings. For a business like Copart, which has a track record of consistent profits, the PE ratio helps investors gauge market expectations for future growth and risk.

The "right" or fair PE ratio for a stock is usually shaped by how fast earnings are expected to grow and how risky those earnings might be. Companies with stronger growth prospects or more resilient business models tend to command higher multiples. Riskier or slower-growing businesses usually see their ratios pulled down toward the market average.

Copart is currently trading at a PE ratio of 27.9x. This lines up closely with the Commercial Services industry average of 27.4x, but sits below the peer group average of 37.0x. However, raw comparisons like these do not capture the full story. Simply Wall St's "Fair Ratio" aims to address this by calculating a fair PE ratio of 29.9x for Copart. This model accounts for the company's growth outlook, profit margins, size, and risk profile, providing a more tailored benchmark than simple peer or industry numbers.

The benefit of comparing against the Fair Ratio is that it adjusts for the factors that truly matter to a company's valuation, rather than relying on one-size-fits-all benchmarks. For Copart, the current PE ratio of 27.9x is very close to its fair value of 29.9x, suggesting the market has priced shares just about right based on what is known today.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Copart Narrative

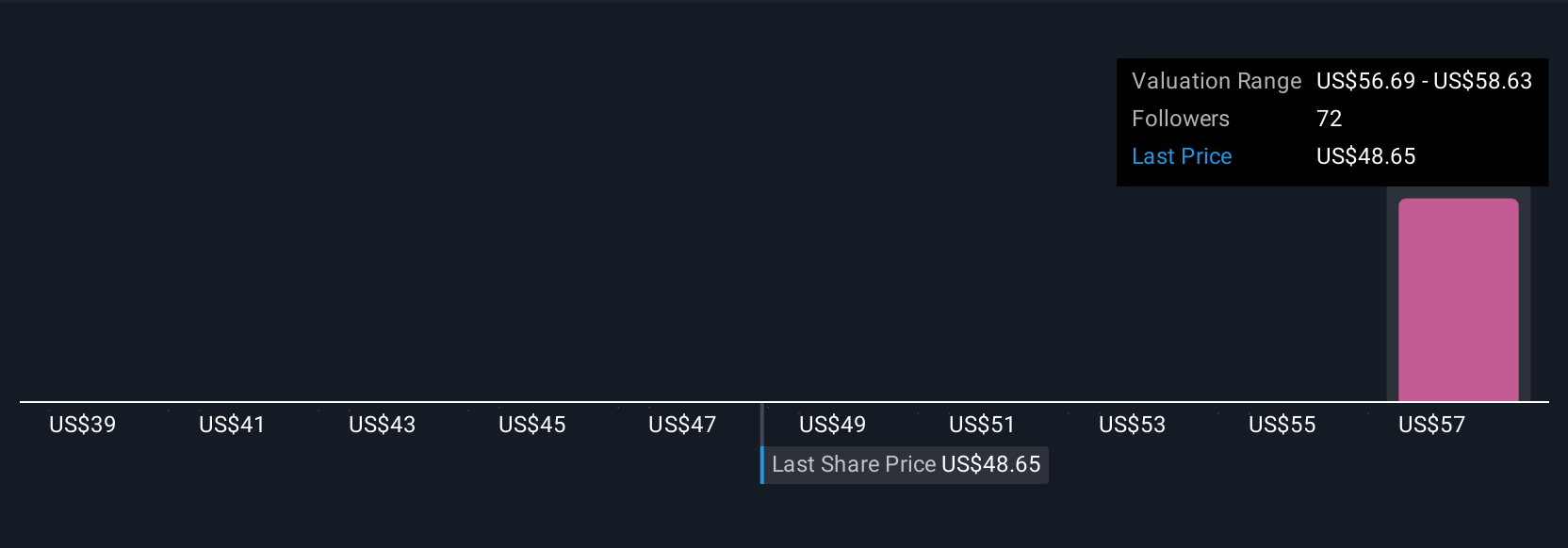

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is the story and perspective you bring to the numbers. It weaves together your assumptions about a company's future revenue, earnings, and margins to arrive at your own fair value for the stock. Instead of simply relying on broad industry ratios or analyst estimates, Narratives connect the business’s real-world story to dynamic financial forecasts and valuations, helping you see the bigger picture behind the numbers.

On Simply Wall St's Community page, Narratives are an easy, powerful tool now used by millions of investors. They allow you to compare your perspective and fair value estimates with those of others, empowering you to see both the prevailing consensus and outlier opinions. When new information is released, such as earnings or industry news, Narratives are updated in real time so your forecasts and fair value stay current.

This approach enables smarter investing. You can quickly compare the Fair Value from your or other users’ Narratives with the current share price to decide if Copart aligns with your specific view. For example, recent Narratives on Copart range from a bullish fair value of $65.00, based on aggressive growth and profitability assumptions, to a more cautious $46.00, reflecting concerns about competition and industry headwinds.

Do you think there's more to the story for Copart? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPRT

Copart

Provides online auctions and vehicle remarketing services in the United States, the United Kingdom, Germany, Brazil, Canada, the United Arab Emirates, Spain, Finland, Oman, the Republic of Ireland, and Bahrain.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives