- United States

- /

- Commercial Services

- /

- NasdaqGS:CMPR

How Cimpress’s (CMPR) Bold Fiscal 2026 Outlook May Influence Long-Term Investors

Reviewed by Simply Wall St

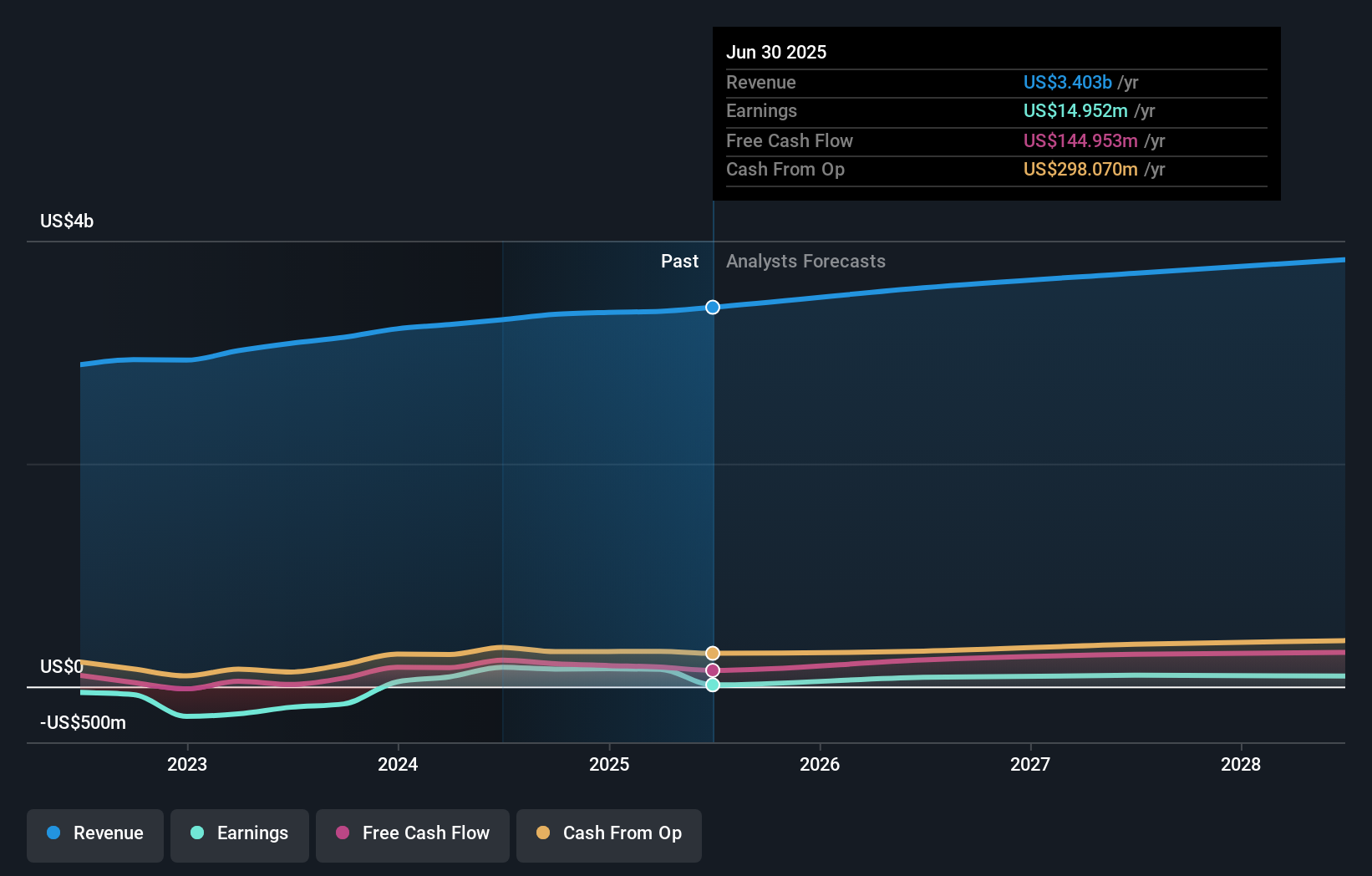

- Cimpress recently reported a fourth-quarter fiscal 2025 adjusted loss of US$1.02 per share, missing earnings estimates despite a 4.4% increase in year-over-year revenue and outlining plans to reduce leverage while expecting revenues to rise by 5-6% in fiscal 2026.

- The company also projected fiscal 2026 net income of at least US$72 million and adjusted EBITDA of at least US$450 million, aiming to generate around US$310 million in operating cash and signaling a focus on improving profitability and cash flow management.

- We’ll examine how Cimpress’s positive fiscal 2026 projections, despite a recent earnings miss, impact its long-term investment case.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Cimpress Investment Narrative Recap

To be a Cimpress shareholder, you need confidence that the company can execute a transition from declining legacy print products to faster-growing, higher-value offerings while managing its elevated investment needs and relatively high leverage. The latest earnings miss does not materially change the biggest short-term catalyst, ongoing growth in customized and digital-first categories, but underscores the most immediate risk: near-term profitability pressures in the face of rising capital expenditures and debt servicing commitments.

Among recent announcements, the fiscal 2026 guidance for at least US$72 million in net income and US$450 million in adjusted EBITDA stands out. This projection, provided just after a substantial quarterly loss, directly addresses the company’s central catalyst: delivering sustainable profit growth and stronger free cash flow by capturing demand in newer product areas, even as legacy categories shrink.

However, against these growth ambitions, investors should not overlook the risk that continued high capital expenditures could squeeze free cash flow for longer than anticipated if ...

Read the full narrative on Cimpress (it's free!)

Cimpress' narrative projects $3.8 billion in revenue and $94.7 million in earnings by 2028. This requires 4.0% yearly revenue growth and a $79.7 million earnings increase from the current $15.0 million.

Uncover how Cimpress' forecasts yield a $72.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Fair value opinions from three Simply Wall St Community members range from US$72 to an outlier at US$3,107.51. Many participants are weighing Cimpress’s ongoing capital investment requirements as a key factor that could affect future earnings power, explore these perspectives to understand where your view fits in.

Explore 3 other fair value estimates on Cimpress - why the stock might be worth just $72.00!

Build Your Own Cimpress Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cimpress research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cimpress research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cimpress' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMPR

Cimpress

Provides various mass customization of printing and related products in North America, Europe, and internationally.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives