- United States

- /

- Commercial Services

- /

- NasdaqGS:CECO

Earnings Beat and CEO Share Sale Might Change the Case for Investing in CECO Environmental (CECO)

Reviewed by Simply Wall St

- Earlier this month, CECO Environmental reported second-quarter earnings that exceeded analyst expectations and raised its forward guidance, attracting positive attention from both analysts and industry watchers.

- Following these results, CEO Gleason disclosed the sale of US$15.1 million in shares and the exercise of nearly 300,000 stock options, while analysts highlighted CECO’s diversified revenue streams and progress with mergers and acquisitions.

- We’ll examine how CECO’s strong earnings beat and upgraded guidance influence the company’s evolving investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

CECO Environmental Investment Narrative Recap

For those considering CECO Environmental, the core belief centers on continued demand for industrial pollution control and environmental solutions, bolstered by strong backlog growth and recent international expansion. The recent earnings beat and raised guidance reinforce order momentum as a key short-term catalyst, but do not change the company’s main risk: heavy investment and rising leverage mean any slowdown in project wins or revenue growth could squeeze margins and delay profitability improvements.

Among recent news, CECO’s upgraded full-year revenue guidance, now projected between US$725 million and US$775 million, stands out. This announcement is especially relevant given the company’s ongoing push for growth via acquisitions and geographic expansion, directly supporting the current growth thesis while potentially amplifying both the upside of further large contract wins and the risk if expected growth falls short.

However, if rapid spending outpaces incoming revenue, investors should be aware that...

Read the full narrative on CECO Environmental (it's free!)

CECO Environmental's narrative projects $977.2 million in revenue and $54.5 million in earnings by 2028. This requires 14.2% yearly revenue growth and a $2.0 million earnings increase from $52.5 million today.

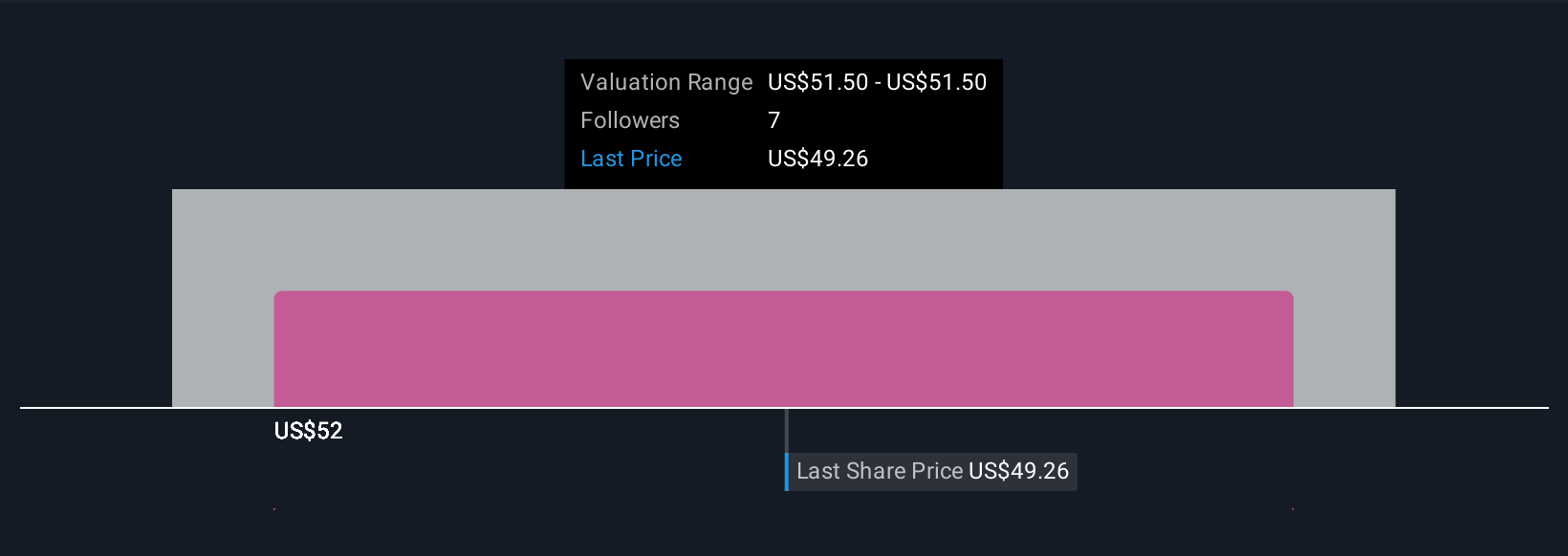

Uncover how CECO Environmental's forecasts yield a $51.50 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community has provided 1 fair value estimate for CECO Environmental at US$51.50. While community outlooks can be close, elevated debt and persistent investment could weigh on future margins, shaping varied views on the company’s next phase.

Explore another fair value estimate on CECO Environmental - why the stock might be worth just $51.50!

Build Your Own CECO Environmental Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CECO Environmental research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free CECO Environmental research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CECO Environmental's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record with slight risk.

Market Insights

Community Narratives