- United States

- /

- Commercial Services

- /

- NasdaqGS:CECO

CECO Environmental (CECO) Valuation: Assessing the Impact of Weaker Earnings Forecasts and Market Uncertainty

Reviewed by Kshitija Bhandaru

CECO Environmental (CECO) landed on the Zacks Rank #5 (Strong Sell) list after analysts revised earnings estimates downward. This development, along with ongoing market uncertainty due to the U.S. government shutdown, has caught the attention of investors.

See our latest analysis for CECO Environmental.

Despite a brief dip of nearly 4% in its latest session, CECO Environmental’s 1-month share price return stands at an impressive 10%, and its 3-month gain exceeds 63%. Momentum has built rapidly this year, propelling the company to an 83% total shareholder return over the past 12 months and a remarkable 539% over five years. However, near-term volatility has crept in following analyst downgrades and broader market jitters.

If today's market moves have you thinking bigger, it's the perfect moment to discover fast growing stocks with high insider ownership.

With shares trading just below analyst targets but still offering a sizable intrinsic discount, investors must now consider whether CECO is undervalued after recent volatility or if its impressive growth story is already reflected in the price.

Most Popular Narrative: 2.9% Undervalued

CECO Environmental's most widely followed valuation narrative indicates that its fair value sits slightly above the current closing price, painting a picture of mild undervaluation despite recent volatility. This narrative is shaped by analyst projections for the company's growth and future earnings power.

Record-high backlog and robust pipeline growth, especially in power generation, industrial water, and natural gas infrastructure, suggest that increasing global enforcement of environmental regulations is translating into sustained demand and forward visibility for CECO's solutions. This supports topline revenue growth over the next 18 to 24 months.

Want to know the secret ingredient in this fair value? Analysts are counting on more than just recurring projects or basic margin expansion. There is a growth engine behind these numbers, along with a bold bet on international markets. The full narrative uncovers the surprising targets and key drivers powering this valuation.

Result: Fair Value of $51.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as slower-than-expected international growth or rising expenses. Both of these factors could impact margins and delay broader profitability improvements.

Find out about the key risks to this CECO Environmental narrative.

Another View: Is the Market Missing Something?

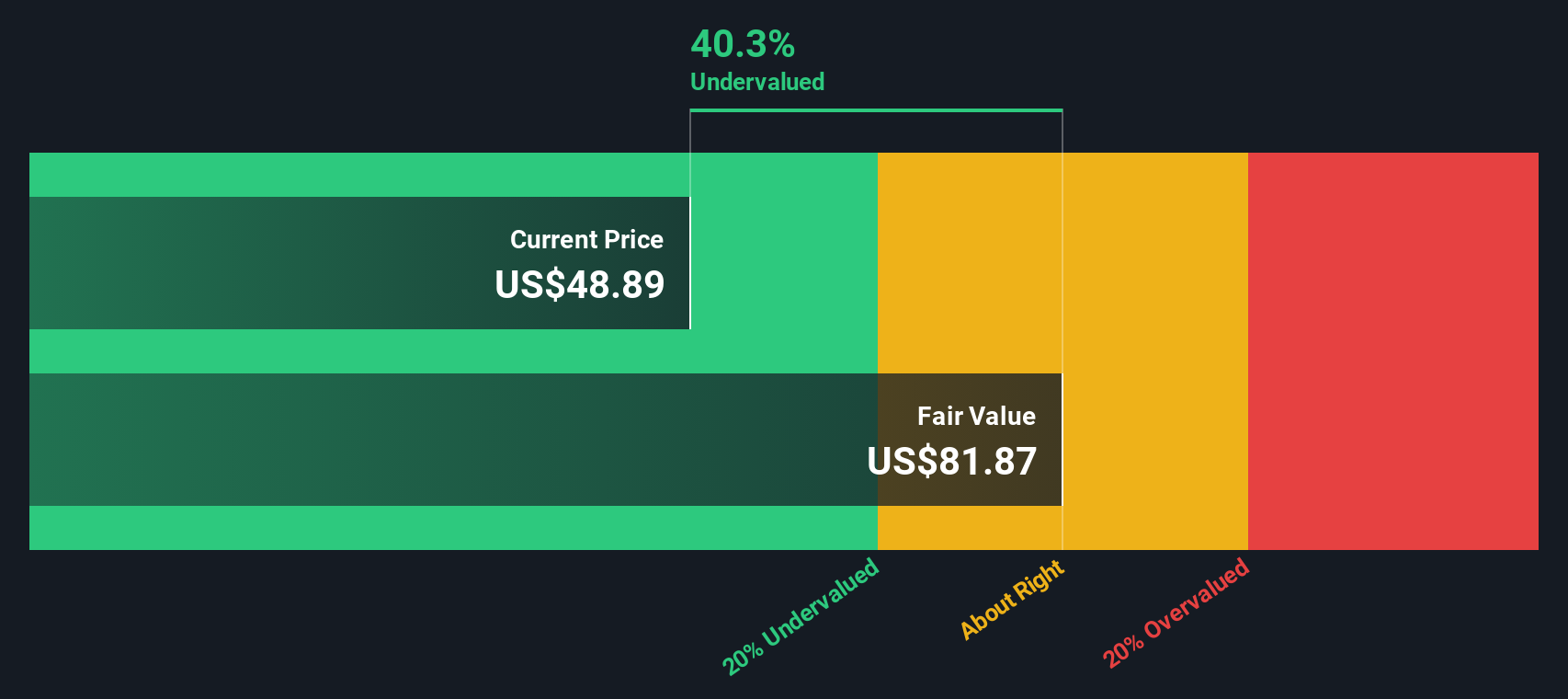

Taking a look through the lens of our DCF model, the outlook for CECO Environmental is dramatically different. This approach estimates the fair value at $80.52 per share. This suggests the current price could be undervalued by a wide margin. Could the market be overlooking longer-term cash flow prospects?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CECO Environmental Narrative

If you want to challenge these findings or prefer to dive into your own analysis, you can build a custom view in just minutes with Do it your way.

A great starting point for your CECO Environmental research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take control of your investing journey. Go beyond the obvious with strategies you might be missing. There are countless promising opportunities waiting to be uncovered.

- Capitalize on undervalued opportunities by seizing these 888 undervalued stocks based on cash flows poised for a rebound based on strong cash flow fundamentals.

- Boost your income stream and long-term stability by tapping into these 18 dividend stocks with yields > 3% offering yields above 3%.

- Ride the AI innovation surge by targeting these 25 AI penny stocks shaping the next era of intelligent technology and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record with slight risk.

Market Insights

Community Narratives