- United States

- /

- Commercial Services

- /

- NasdaqCM:CDTG

Market Might Still Lack Some Conviction On CDT Environmental Technology Investment Holdings Limited (NASDAQ:CDTG) Even After 28% Share Price Boost

CDT Environmental Technology Investment Holdings Limited (NASDAQ:CDTG) shares have had a really impressive month, gaining 28% after a shaky period beforehand. But the last month did very little to improve the 80% share price decline over the last year.

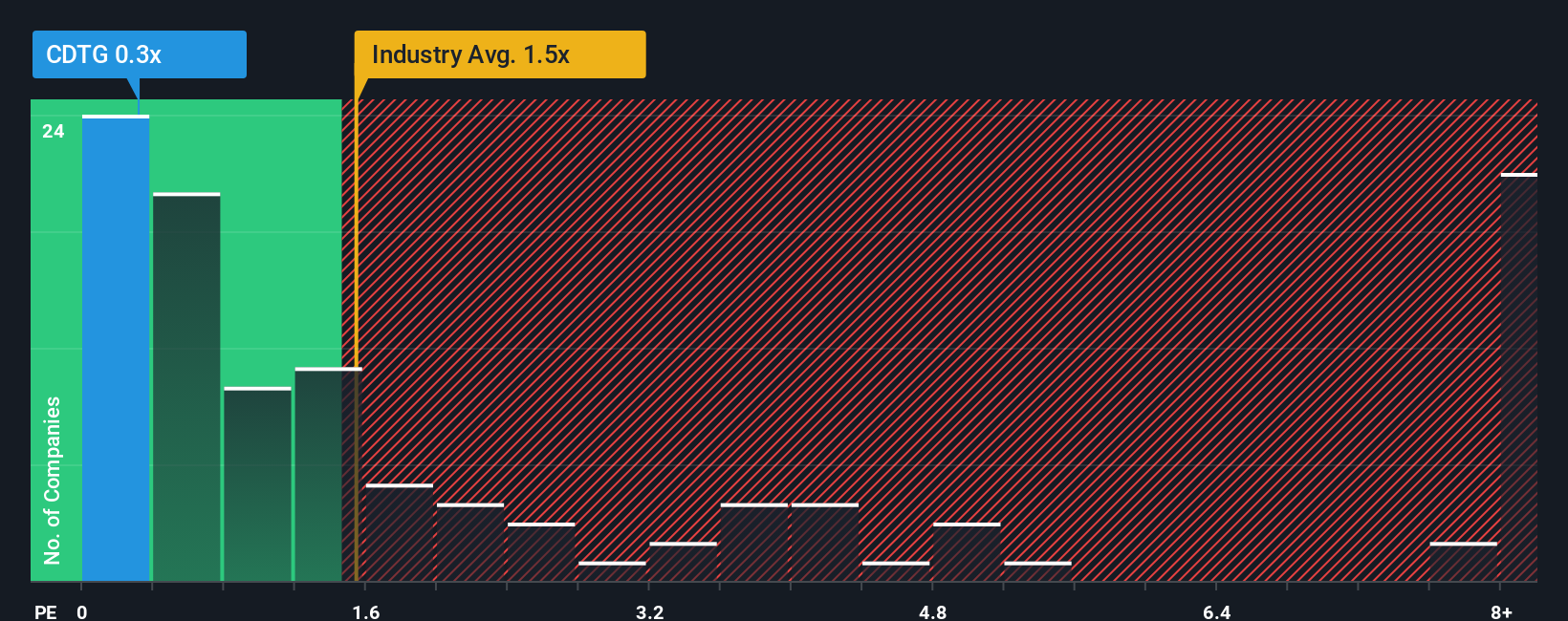

Although its price has surged higher, CDT Environmental Technology Investment Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Commercial Services industry in the United States have P/S ratios greater than 1.5x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for CDT Environmental Technology Investment Holdings

How CDT Environmental Technology Investment Holdings Has Been Performing

For example, consider that CDT Environmental Technology Investment Holdings' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on CDT Environmental Technology Investment Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

CDT Environmental Technology Investment Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.7% shows it's about the same on an annualised basis.

With this information, we find it odd that CDT Environmental Technology Investment Holdings is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On CDT Environmental Technology Investment Holdings' P/S

Despite CDT Environmental Technology Investment Holdings' share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of CDT Environmental Technology Investment Holdings revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

You need to take note of risks, for example - CDT Environmental Technology Investment Holdings has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CDTG

CDT Environmental Technology Investment Holdings

Designs, develops, manufactures, sells, installs, operates, and maintains sewage treatment systems in China.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives