- United States

- /

- Software

- /

- NasdaqGS:AUR

We Think Aurora Innovation (NASDAQ:AUR) Needs To Drive Business Growth Carefully

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Aurora Innovation (NASDAQ:AUR) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Aurora Innovation

SWOT Analysis for Aurora Innovation

- Currently debt free.

- Shareholders have been diluted in the past year.

- Forecast to reduce losses next year.

- Has less than 3 years of cash runway based on current free cash flow.

- Not expected to become profitable over the next 3 years.

How Long Is Aurora Innovation's Cash Runway?

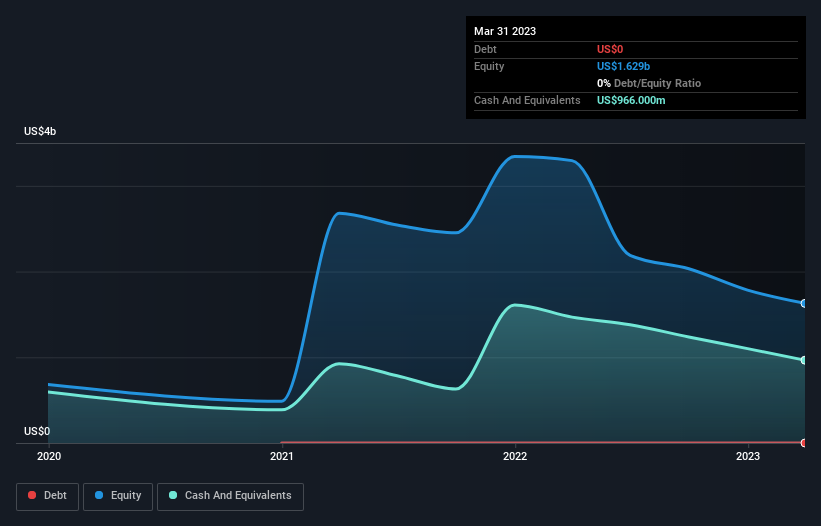

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at March 2023, Aurora Innovation had cash of US$966m and no debt. Importantly, its cash burn was US$520m over the trailing twelve months. So it had a cash runway of approximately 22 months from March 2023. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Aurora Innovation Growing?

Aurora Innovation reduced its cash burn by 13% during the last year, which points to some degree of discipline. In contrast, however, operating revenue tanked 79% during the period. Considering both these metrics, we're a little concerned about how the company is developing. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Aurora Innovation To Raise More Cash For Growth?

While Aurora Innovation seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Aurora Innovation's cash burn of US$520m is about 31% of its US$1.7b market capitalisation. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is Aurora Innovation's Cash Burn Situation?

On this analysis of Aurora Innovation's cash burn, we think its cash runway was reassuring, while its falling revenue has us a bit worried. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. Taking an in-depth view of risks, we've identified 3 warning signs for Aurora Innovation that you should be aware of before investing.

Of course Aurora Innovation may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade Aurora Innovation, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AUR

Aurora Innovation

Operates as a self-driving technology company in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives