- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

How Does ADP Stack Up After Shares Slip and Earnings Beat in 2025?

Reviewed by Bailey Pemberton

Thinking about Automatic Data Processing? You are not alone. For investors weighing their next move, this stock continues to spark debate about potential versus value. Despite a year-to-date slip of 1.5% and a slight 2.5% dip over the past month, the bigger picture for ADP tells a story of steady resilience. Over the past five years, its share price has climbed a remarkable 112.9%, outpacing many market peers. Even after a flat stretch, the three-year return sits strong at 34.7%, which is notable for any long-term holder interested in consistency.

It is true, recent market jitters have nudged many steady performers a bit lower, and ADP is no exception. The market's shifting views on inflation and technology demand have contributed to the short-term volatility seen in many blue-chip stocks. Still, these short-term blips are often just noise in the broader sweep of long-term trends. For those considering an entry point or debating whether to hold, understanding how the current price lines up with the company's underlying value is key.

So, how does ADP's valuation really stack up? According to our scorecard, where we add one point for each of six undervaluation criteria met, ADP earns a healthy 4 out of 6. That places it among the more attractively valued large-caps right now. Next, let us break down what goes into that score by walking through the different valuation methods investors use. If you are looking for an even smarter perspective, stay tuned for our take on a better way to measure true value at the end.

Approach 1: Automatic Data Processing Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a cornerstone of company valuation, relying on detailed forecasts of a company's future cash flows and discounting them to today's value. In essence, it helps investors determine what a business is truly worth now, based on what it is projected to earn in the years to come.

For Automatic Data Processing, the most recent reported Free Cash Flow stands at $4.34 billion. Analysts see this growing solidly, with projections moving to $5.26 billion in 2026 and $6.40 billion by 2028. Beyond the next five years, future cash flows are extrapolated based on modest ongoing growth, with estimates suggesting FCF could reach as high as $8.47 billion in a decade, according to Simply Wall St’s model.

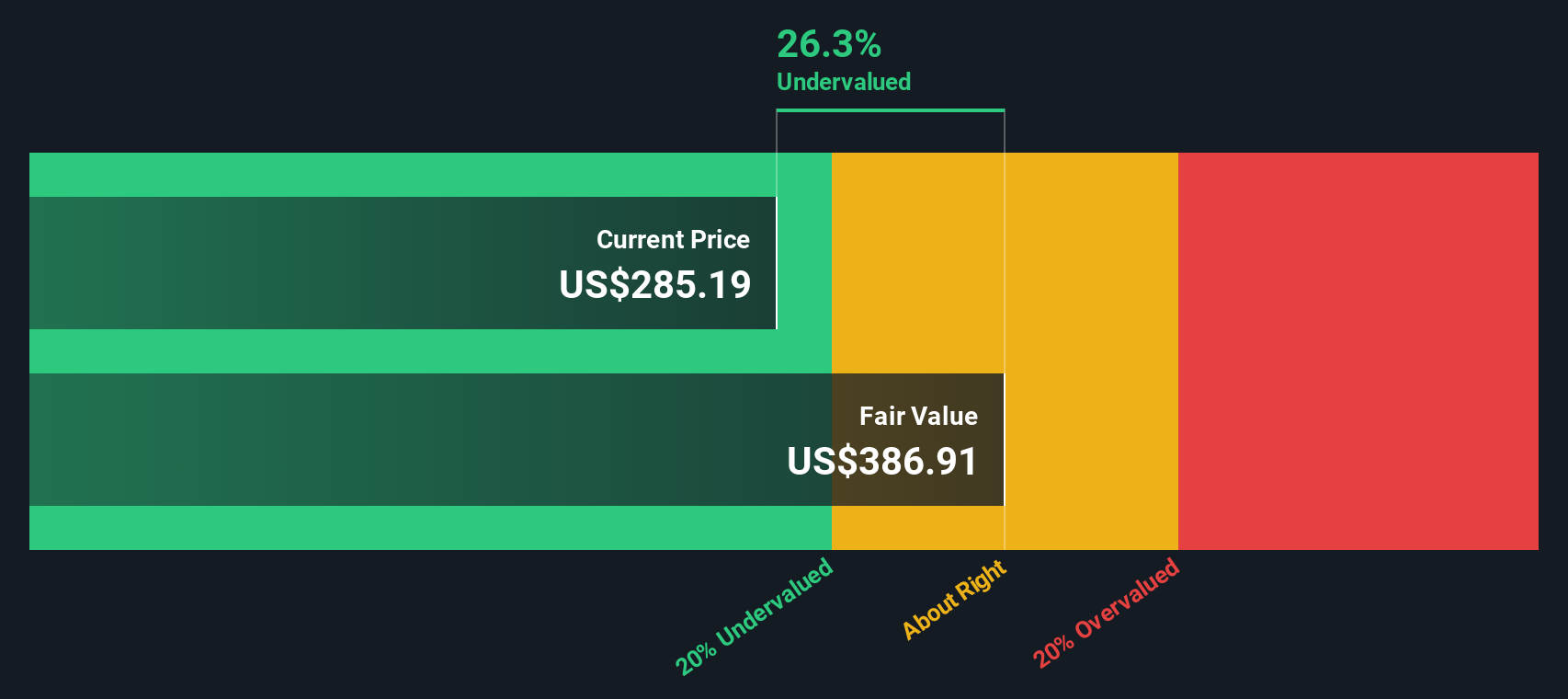

After crunching all these numbers using a 2 Stage Free Cash Flow to Equity model, the result is a DCF-derived intrinsic value of $385.81 per share. Compared to today’s market price, that suggests the stock is 26.1% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Automatic Data Processing is undervalued by 26.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Automatic Data Processing Price vs Earnings

The Price-to-Earnings, or PE ratio, is widely recognized as a relevant metric for evaluating profitable companies like Automatic Data Processing. It offers a straightforward snapshot of how much investors are willing to pay today for each dollar of the company's current earnings. This makes it especially meaningful in the case of firms with solid, ongoing profitability.

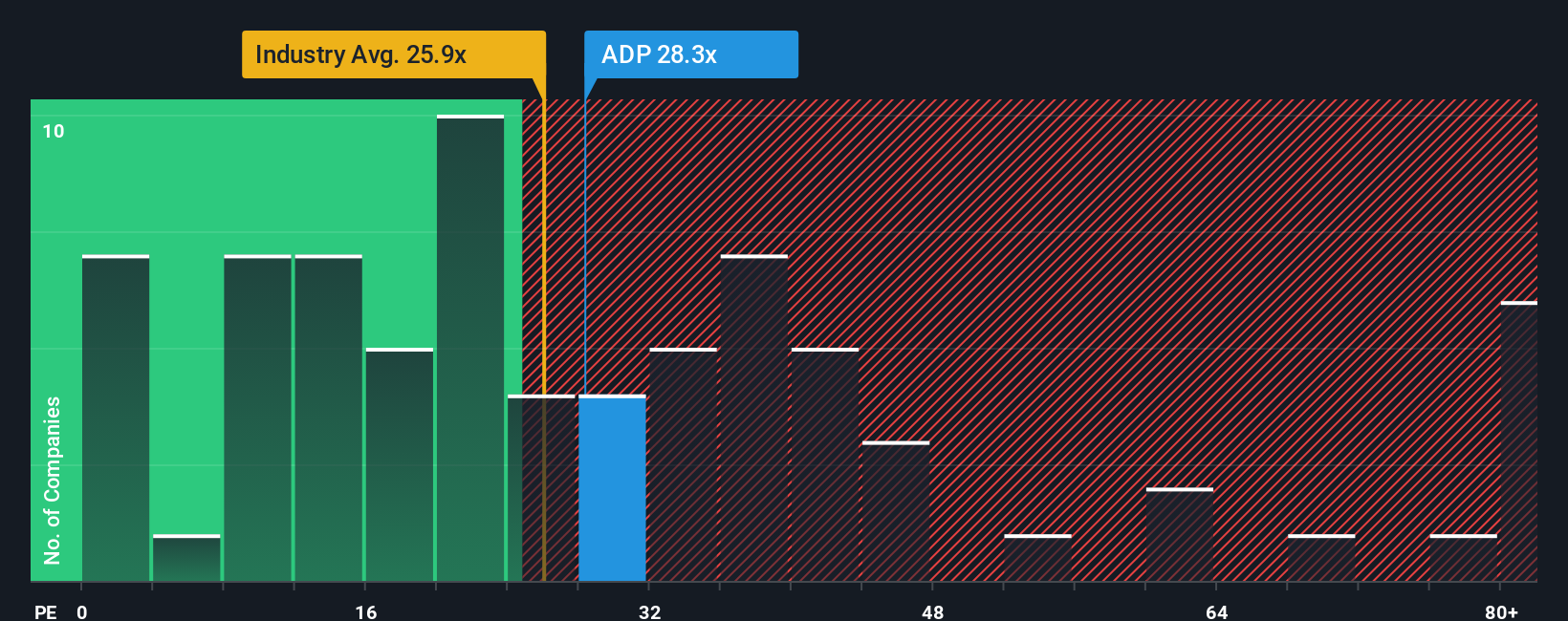

A company’s PE ratio reflects the market’s expectations for growth and the perceived risk of investing in the business. Higher expected growth or lower risk typically justifies a higher PE, while increased uncertainty or slower earnings growth often pushes the ratio lower. For ADP, the current PE ratio stands at 28.3x. This is higher than the Professional Services industry average of 25.4x, yet slightly below the peer group average of 31.2x.

Simply Wall St’s proprietary Fair Ratio model refines the analysis by estimating what the PE ratio should be after factoring in details like ADP's earnings growth, profit margin, market capitalization, and specific industry dynamics. In ADP’s case, the Fair Ratio is calculated at 32.8x. This custom benchmark is more insightful than just comparing with peers or the broader industry because it accounts for company-specific strengths and risk factors in addition to sector trends.

Comparing these numbers, ADP’s current PE ratio (28.3x) is meaningfully lower than its Fair Ratio (32.8x). This suggests the stock may be undervalued given its growth profile and risk level according to this holistic assessment.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Automatic Data Processing Narrative

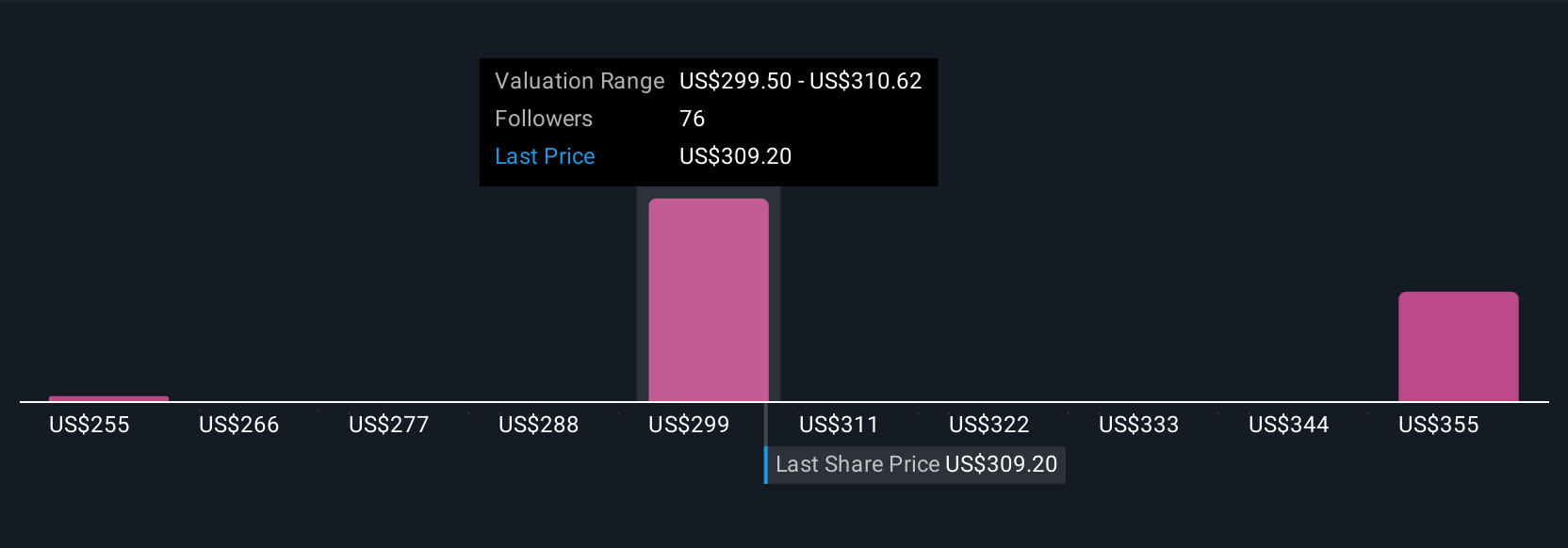

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a user-driven story that connects your own view of Automatic Data Processing, such as where you think its growth, margins, and fair value are headed, to a financial forecast and a resulting fair value estimate.

With Narratives, you bring together your perspective on the company's future and let the numbers follow, making complex analysis approachable for everyone. On Simply Wall St's Community page, investors can easily create and share their Narratives in just a few clicks, joining millions of others who are comparing their own fair values to the latest share price to make timely decisions about when to buy or sell.

What makes Narratives especially powerful is that they are continuously updated with new data, such as quarterly earnings or breaking news, so your view automatically stays current. For example, one investor may believe ADP’s aggressive expansion and cloud-based innovation will propel margins and set a fair value around $385, while a more cautious view, considering cost pressures and stiff competition, lands at a fair value closer to $318. Narratives let you see, compare, and learn from these varying perspectives in real time.

Do you think there's more to the story for Automatic Data Processing? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives