- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Did ADP’s New AI-Powered HR Tools Just Shift Automatic Data Processing's (ADP) Investment Narrative?

- At its recent Innovation Day, ADP unveiled a suite of AI-powered enhancements across Workforce Now, Global Payroll, and Lyric HCM, focusing on automating payroll anomaly detection, analytics, compliance, and personalized learning through its ADP Assist platform.

- An interesting development is ADP’s integration of real-time analytics and conversational AI, offering HR teams rapid insights based on data from over 1.1 million organizations worldwide.

- We'll explore how these new AI capabilities in ADP Assist may impact the company's long-term growth outlook for cloud-based HR solutions.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Automatic Data Processing Investment Narrative Recap

For shareholders in Automatic Data Processing, the key belief is in the company’s ability to convert its scale and continuous product innovation into steady demand for cloud-based HR and payroll solutions. The recent launch of ADP’s AI-powered platform enhancements may strengthen this story by advancing operational efficiency and product differentiation, but the most important near-term catalyst remains bookings growth, which was recently below expectations; this news does not materially shift that outlook. The biggest risk to watch is competitive pressure from SaaS-native HR technology rivals, who continue to expand rapidly and may limit margin growth if ADP cannot maintain pricing power or market share.

Among the latest announcements, ADP’s rollout of AI-driven anomaly detection within payroll operations stands out as the most relevant. This offering is specifically designed to reduce manual interventions for payroll teams and streamline workflow by proactively flagging errors, which helps reinforce ADP’s argument for investing in automation as a catalyst for customer stickiness and operational margin improvement. However, as competitors also accelerate their product development and pricing strategies, there’s a risk...

Read the full narrative on Automatic Data Processing (it's free!)

Automatic Data Processing's outlook calls for $24.3 billion in revenue and $5.1 billion in earnings by 2028. This assumes a 5.7% annual revenue growth rate and a $1.0 billion increase in earnings from the current $4.1 billion level.

Uncover how Automatic Data Processing's forecasts yield a $320.25 fair value, a 9% upside to its current price.

Exploring Other Perspectives

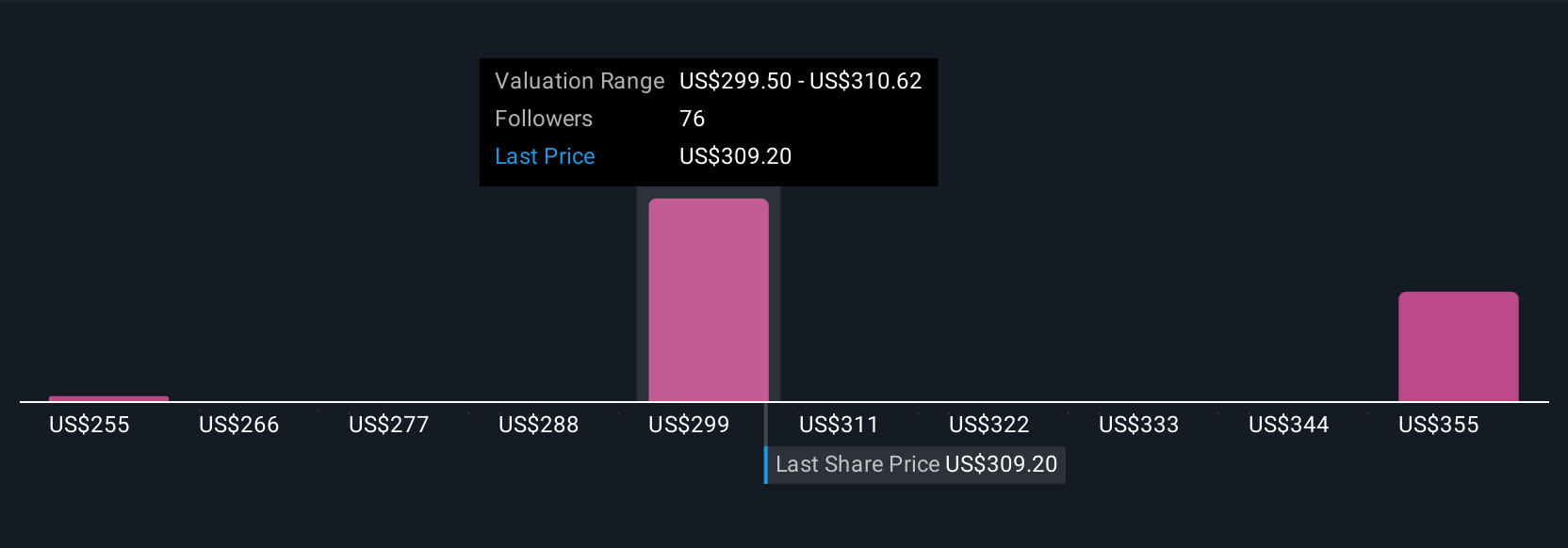

Simply Wall St Community members offered eight fair value estimates ranging from US$235 to US$386 per share, reflecting a wide spread in growth and risk expectations. While the new AI initiatives may underpin ADP’s efforts to defend market share, the impact of strong SaaS-native rivals remains a real factor that could influence future returns, so it pays to consider alternative views.

Explore 8 other fair value estimates on Automatic Data Processing - why the stock might be worth as much as 32% more than the current price!

Build Your Own Automatic Data Processing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Automatic Data Processing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Automatic Data Processing's overall financial health at a glance.

No Opportunity In Automatic Data Processing?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Titan Cement International S.A. (TITC.AT): Greece's Leading Cement and Building Materials Producer

QDay is coming - 01 Quantum hold the key

Salesforce's Market Dominance and AI Pivot Will Drive Earnings Re-acceleration

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!