- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

A Look At Automatic Data Processing (ADP) Valuation After Fortune Recognition And New NER Pulse Hiring Data

Reviewed by Simply Wall St

Why ADP Is Back on Investors’ Radar

Automatic Data Processing (ADP) is drawing fresh attention after two developments: its 20th consecutive appearance on Fortune’s World’s Most Admired Companies list and new NER Pulse data on recent U.S. private hiring.

See our latest analysis for Automatic Data Processing.

At a share price of US$256.99, ADP has seen a 1 day share price return of 0.74%, while the 90 day share price return of an 8.72% decline and the 1 year total shareholder return of an 11.36% decline suggest momentum has been fading. At the same time, the Fortune recognition, steady dividend declaration and fresh NER Pulse hiring data keep the company in focus for investors with a longer view, anchored by a 3 year total shareholder return of 20.41% and a 5 year total shareholder return of 72.09%.

If ADP has you thinking about payroll and HR platforms more broadly, it could be a good moment to see how other tech names are shaping up through high growth tech and AI stocks.

With ADP trading at US$256.99 and sitting at a discount to both analyst targets and some intrinsic value estimates, the key question is whether there is still upside available or if the market is already pricing in future growth.

Price-to-Earnings of 25.1x: Is It Justified?

On a P/E of 25.1x at a last close of US$256.99, ADP sits slightly above the broader US Professional Services industry but roughly in line with its closest peers. This keeps the current price in a relatively tight valuation band.

The P/E multiple compares the share price to earnings per share. For a company like ADP that is profitable and established, it is a quick way for investors to relate the price they pay to the earnings the business is currently generating.

ADP is described as expensive versus the industry average P/E of 24.2x, so the market is paying a premium for each dollar of earnings. However, that premium is small compared to the peer group average P/E of 25.2x and is reported as being below an estimated fair P/E of 30.2x that this analysis suggests the market could move toward if sentiment and assumptions stay supportive.

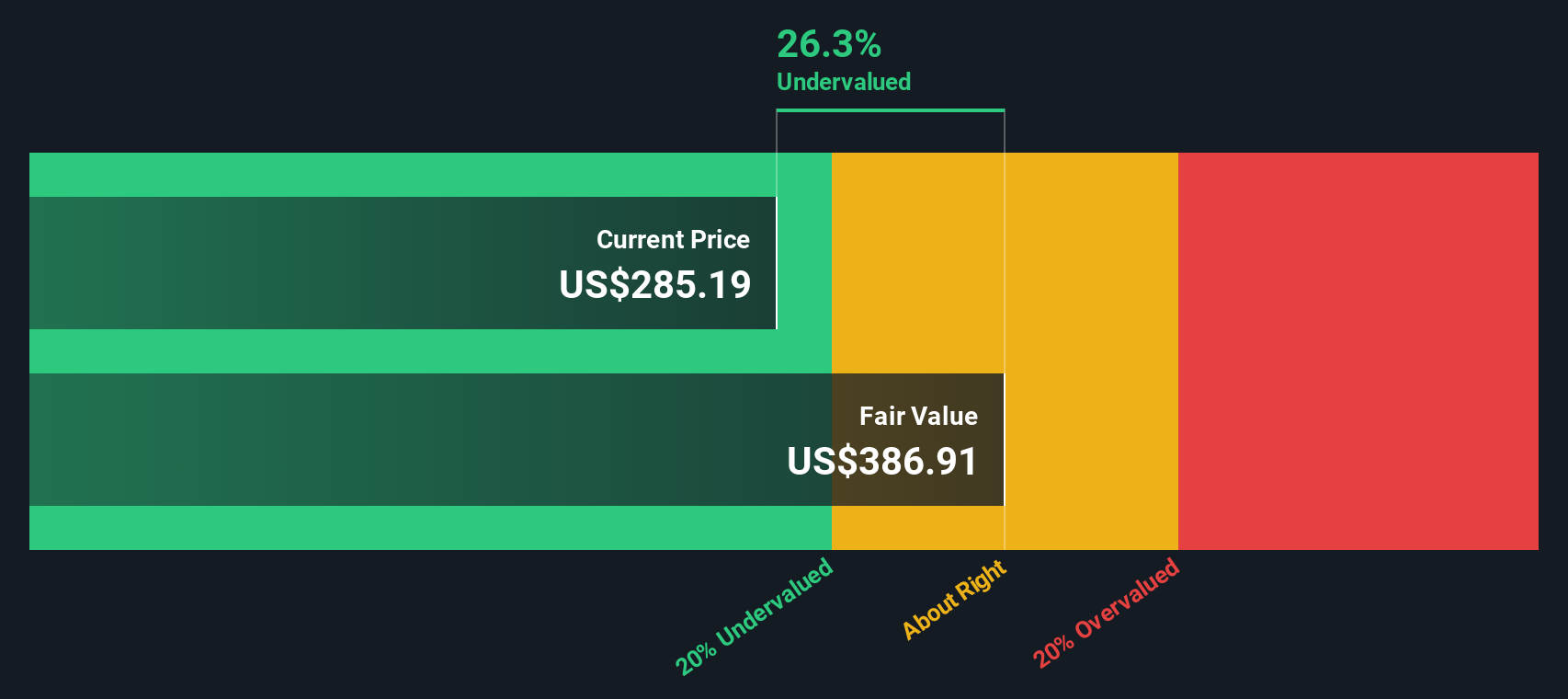

Against this backdrop, ADP also screens as good value on a discounted cash flow basis, with this DCF model putting future cash flow value at US$330.83 per share versus the current US$256.99. On that measure, the shares are indicated as trading about 22.3% below that internal fair value estimate.

Explore the SWS fair ratio for Automatic Data Processing

Result: Price-to-Earnings of 25.1x (ABOUT RIGHT)

However, short term share price pressure, including the 11.36% 1 year total shareholder return decline, and any slowdown in annual revenue or net income growth, could challenge this valuation story.

Find out about the key risks to this Automatic Data Processing narrative.

Another View: Our DCF Model Paints a Different Picture

If the current P/E of 25.1x makes ADP look only slightly expensive versus the industry, our DCF model comes in with a stronger opinion. Based on those cash flow assumptions, an estimated value of US$330.83 per share compared with US$256.99 indicates the stock screens as undervalued. This raises the question of which signal you consider more important.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Automatic Data Processing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Automatic Data Processing Narrative

If you see the numbers differently or prefer to piece together your own view from the data, you can build a custom narrative in minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Automatic Data Processing.

Looking for more investment ideas?

If ADP has sharpened your focus, do not stop here. The Screener can surface other stocks that fit your style before the market moves on.

- Spot potential growth stories early by checking out these 3534 penny stocks with strong financials that pair smaller size with stronger financial foundations.

- Ride the AI trend more deliberately by scanning these 23 AI penny stocks that bring artificial intelligence into real world products and services.

- Hunt for price gaps by filtering these 881 undervalued stocks based on cash flows where cash flow expectations and current market pricing appear out of sync.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Nova Ljubljanska Banka d.d. future looks bright with a profit margin change of 38%

Viohalco S.A. (VIO.AT): Greece's Leading Integrated Metals Processor

M&A machine with a relentless focus on operational excellence

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

with the recent increase in Yttrium over the course of 2025 and it's now apparent value perceived by the market, Rainbow Rare Earths states this would add approx. 30M USD (@Ex rate 0.75USD - 1GBP of 0.75)/22.5M GBP to EBITDA per annum. Therefore I adjust my fair value price to MORE than previous - how much more? Who cares... I'm simply allowing for 40% of this figure to fall to the bottom line in my estimation of fair value. I now now estimate the fair value of >£1.20 - that's all I need to know.