- United States

- /

- Building

- /

- NYSEAM:TGEN

Tecogen (TGEN) Is Up 5.7% After Clearing All Debt Early Will Its Financial Flexibility Pay Off?

Reviewed by Simply Wall St

- On September 2, 2025, Tecogen's Audit Committee approved the full prepayment of two promissory notes totaling US$1 million plus accrued interest to director John N. Hatsopoulos, settling the company's debt ahead of schedule.

- This early repayment eliminated all outstanding company debt and saved Tecogen approximately US$46,159 in future interest expenses that would have otherwise accrued through to maturity.

- We'll explore how the complete elimination of debt could shape Tecogen's investment narrative moving forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Tecogen's Investment Narrative?

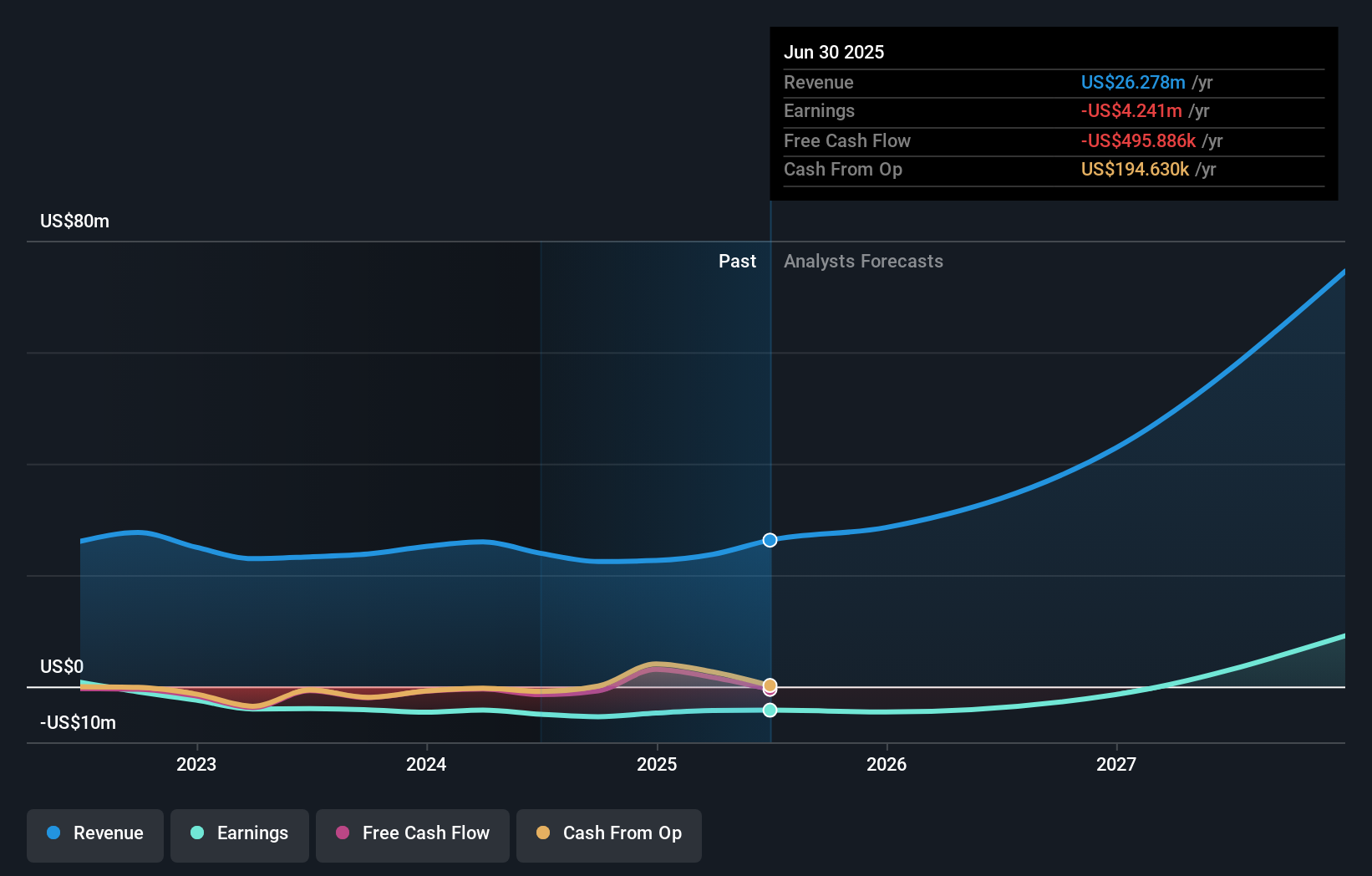

For Tecogen, the investment story still revolves around turning rising revenue into sustainable profits, while managing risk as an unprofitable, high-growth company. The complete elimination of debt this month, following the early repayment of US$1 million in promissory notes, strengthens the balance sheet and reduces future interest costs. This could improve flexibility and lower financial risk, which may help with short-term catalysts like new contract wins and partnerships, especially as the business targets high growth in its core cooling and cogeneration technology solutions. Still, material risks remain: the company trades at a high price-to-sales multiple and has a volatile share price, plus the upcoming lock-up expiry in October could increase selling pressure. Whether the sharp revenue growth will translate into profits fast enough, with no remaining debt, is now more central than before.

Yet the risk of increased share sales remains as the lock-up expiry approaches, investors should be aware. Our valuation report unveils the possibility Tecogen's shares may be trading at a premium.Exploring Other Perspectives

Explore 3 other fair value estimates on Tecogen - why the stock might be worth over 2x more than the current price!

Build Your Own Tecogen Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tecogen research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Tecogen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tecogen's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tecogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:TGEN

Tecogen

Designs, manufactures, markets, and maintains cogeneration products for multi-family residential, commercial, recreational, and industrial use in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)