- United States

- /

- Machinery

- /

- NYSE:XYL

Xylem (NYSE:XYL) Declares US$0.40 Q2 Dividend Payable June 2025

Reviewed by Simply Wall St

Xylem (NYSE:XYL) recently affirmed a second-quarter dividend of $0.40 per share and raised its earnings guidance for the full year. Coupled with the announcement of increased revenue and earnings in the first quarter, these positive developments appear to add weight to the broader market's upward trend, as the company experienced a stock price increase of 14% over the last month. This movement aligns with a general market upswing, as major indices like the S&P 500 and Nasdaq have also seen gains. The company's performance reflects a timely alignment with investor optimism and a favorable market environment.

Buy, Hold or Sell Xylem? View our complete analysis and fair value estimate and you decide.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

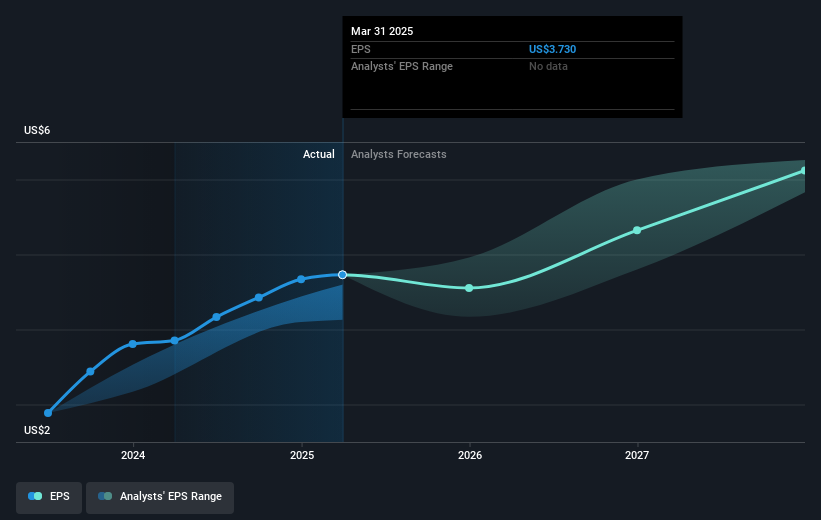

The recent upswing in Xylem's stock price by 14% reflects a positive response to their affirmed dividend of US$0.40 per share and revised earnings guidance, potentially strengthening investor confidence. This news supports the narrative that the company’s strategic initiatives, including operating model simplification and Evoqua integration, are set to bolster customer agility and margin expansion. However, analysts' forecasts show revenue growth at an annual rate of 4.6% with earnings expected to reach US$1.3 billion by 2028, supporting a longer-term view where structural efforts may foster resilience despite economic pressures.

Over the past five years, Xylem’s total shareholder return was 114.46%, providing a solid basis for longer-term performance evaluation compared to shorter-term market trends. Within the last year, the company has underperformed the US Machinery industry, which returned 2.9%, suggesting room for improvement as market conditions evolve. The current share price of US$120.45 still presents a discount relative to the consensus analyst price target of US$138.66, indicating potential for upward movement if the projected growth and synergy rationales are realized.

The increase in dividends and earnings guidance combined with strategic restructuring initiatives implies potential revenue and margin improvements. Xylem's adaptability through pricing actions and supply chain resilience indicates potential to navigate economic fluctuations such as tariffs, FX impacts, and demand volatility. If successful, these factors could drive the share value closer to analyst targets. Nonetheless, achieving a PE ratio of 32.2x by 2028 remains contingent on sustained earnings and revenue expansion, offering investors a perspective to align market expectations with company performance forecasts.

Assess Xylem's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYL

Xylem

Engages in the design, manufacture, and servicing of engineered products and solutions for utility, industrial, and residential and commercial building services settings worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives