- United States

- /

- Building

- /

- NYSE:WMS

Reaffirmed Guidance and Surging Water-Quality Growth Might Change The Case For Investing In Advanced Drainage Systems (WMS)

Reviewed by Sasha Jovanovic

- In recent months, Brown Brothers Harriman highlighted Advanced Drainage Systems as a key positive contributor to its mid-cap fund after the company delivered better-than-expected sales and earnings, while Barclays reaffirmed a positive analyst stance and the firm reiterated its fiscal 2026 guidance.

- The business is seeing double-digit organic growth in areas such as water quality and stormwater capture solutions, even as short interest inches higher and insider selling picks up, pointing to a complex mix of confidence and caution around its outlook.

- Next, we’ll examine how this reaffirmed guidance and strong water-quality growth influence Advanced Drainage Systems’ existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Advanced Drainage Systems Investment Narrative Recap

To own Advanced Drainage Systems, you need to believe in long term demand for water management and higher value water quality solutions, supported by disciplined execution even when construction markets are uneven. The reaffirmed fiscal 2026 guidance and stronger than expected recent earnings support that thesis in the near term, while the biggest current risk remains a prolonged slowdown in construction and infrastructure spending. The recent uptick in short interest and insider selling does not appear to materially change that core risk.

The most relevant recent announcement here is ADS’s second quarter fiscal 2026 update, where revenue grew 9% to US$850.4 million and management reiterated full year guidance. That performance, alongside double digit organic growth in water quality and stormwater capture, ties directly into the key catalyst of rising regulatory and infrastructure focus on water quality and resilient drainage solutions, even as the share price already trades on a premium earnings multiple to the building industry and peers.

Yet behind the strong water quality growth and reaffirmed guidance, investors should still be aware of the risk that a prolonged period of weak construction and infrastructure demand could...

Read the full narrative on Advanced Drainage Systems (it's free!)

Advanced Drainage Systems' narrative projects $3.3 billion revenue and $558.3 million earnings by 2028. This requires 4.3% yearly revenue growth and about a $125.6 million earnings increase from $432.7 million today.

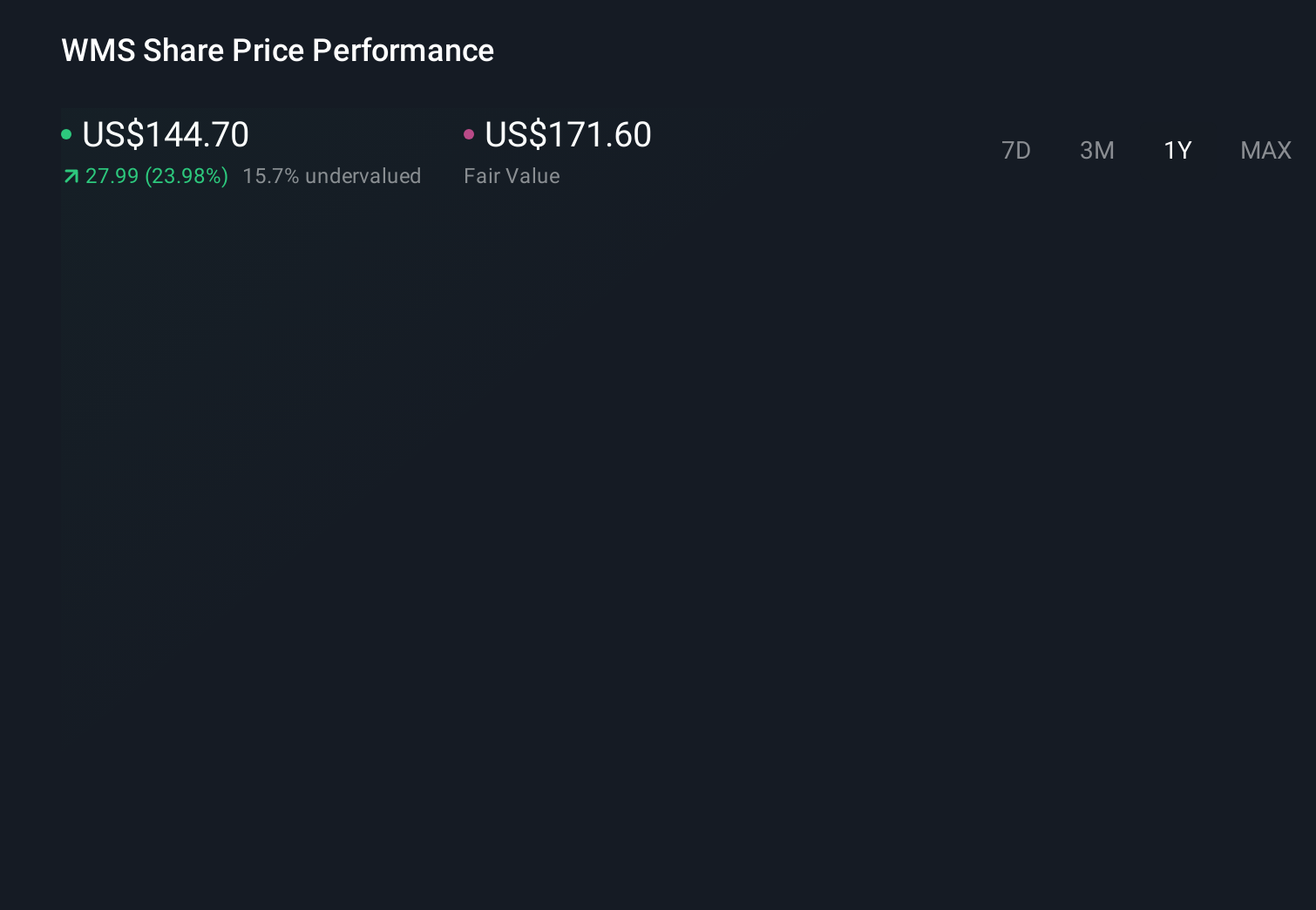

Uncover how Advanced Drainage Systems' forecasts yield a $171.10 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Four fair value views from the Simply Wall St Community span roughly US$93 to US$171 per share, highlighting how differently investors can assess ADS. Set against reaffirmed 2026 guidance and strong water quality growth, this spread invites you to weigh contrasting assumptions about how resilient those end markets really are.

Explore 4 other fair value estimates on Advanced Drainage Systems - why the stock might be worth as much as 14% more than the current price!

Build Your Own Advanced Drainage Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advanced Drainage Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Advanced Drainage Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advanced Drainage Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMS

Advanced Drainage Systems

Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)