- United States

- /

- Building

- /

- NYSE:WMS

Advanced Drainage Systems (WMS): Reassessing Valuation After Guidance Reaffirmation and Earnings Beat

Reviewed by Simply Wall St

Advanced Drainage Systems (WMS) is back on investors radar after a recent fund commentary highlighted its better than expected sales and earnings, as well as a reaffirmed fiscal 2026 outlook despite choppy construction markets.

See our latest analysis for Advanced Drainage Systems.

The latest fund commentary seems to have reminded the market what is working under the hood, with the share price now at $149.6 and a strong year to date share price return of 30.85 percent feeding into a solid 5 year total shareholder return of 101.14 percent. This suggests momentum is still broadly intact even if the 1 year total shareholder return of 15.9 percent has cooled a little.

If you are weighing how this kind of steady compounding might compare across the market, it could be a good time to explore stable growth stocks screener (None results).

With earnings beating expectations, fiscal 2026 guidance intact, and the share price still sitting below analyst targets, are investors being offered an underappreciated compounder, or is the market already pricing in years of future growth?

Most Popular Narrative: 12.6% Undervalued

With Advanced Drainage Systems last closing at $149.60 against a narrative fair value of about $171.10, the story leans toward upside if assumptions hold.

Continuous expansion of the Allied Products and Infiltrator segments, both of which command higher margins and are growing faster than the core Pipe business, is shifting product mix toward higher profitability. This is resulting in improved EBITDA margins and long-term earnings power.

Want to understand why a steady, mid single digit growth outlook still backs a premium earnings multiple? The narrative leans heavily on margin expansion and mix shift. Curious how these moving parts combine into that higher fair value target? Dive in to see which forecasts really drive the valuation.

Result: Fair Value of $171.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unravel if construction demand remains weak for an extended period, or if resin and other input costs spike and squeeze margins.

Find out about the key risks to this Advanced Drainage Systems narrative.

Another View: Valuation Looks Stretched on Earnings

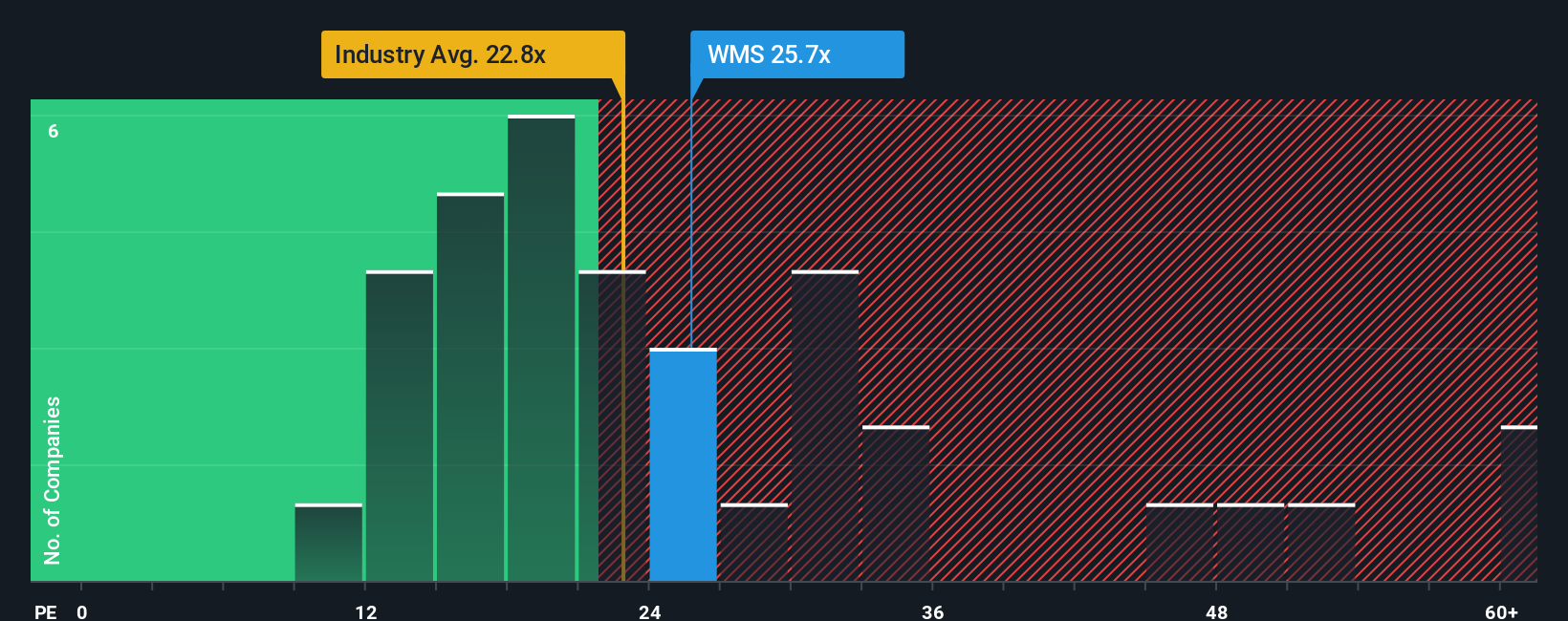

That 12.6 percent upside from the narrative fair value contrasts sharply with how the stock screens on earnings, where Advanced Drainage Systems trades at about 25.4 times profit versus a fair ratio of 25.3 times and roughly 19 times for the wider US Building industry and 18 times for peers. On this lens, the shares look expensive rather than cheap, raising the question of whether investors are already paying upfront for years of mix driven margin gains.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advanced Drainage Systems Narrative

If you see the story differently or would rather follow your own due diligence, you can quickly build a personalized view in just minutes with Do it your way.

A great starting point for your Advanced Drainage Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in your next opportunity by scanning focused stock ideas that match your style, so you are not reacting after markets move.

- Target high-upside potential with these 3606 penny stocks with strong financials that already show robust balance sheets and improving fundamentals rather than just speculative hype.

- Position ahead of the next productivity boom by using these 25 AI penny stocks to zero in on companies commercializing real world artificial intelligence solutions.

- Lock in value first by filtering for these 909 undervalued stocks based on cash flows where cash flow based pricing still lags behind intrinsic worth, before broader sentiment catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMS

Advanced Drainage Systems

Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026