- United States

- /

- Trade Distributors

- /

- NYSE:VRTV

Here's Why We Think Veritiv (NYSE:VRTV) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Veritiv (NYSE:VRTV). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Veritiv

Veritiv's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Veritiv's EPS went from US$7.70 to US$23.97 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

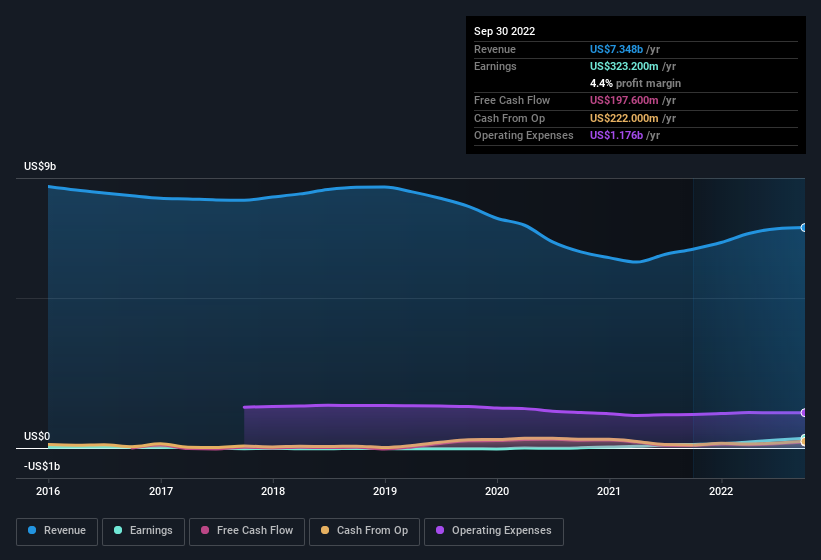

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Veritiv is growing revenues, and EBIT margins improved by 2.8 percentage points to 5.6%, over the last year. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Veritiv's balance sheet strength, before getting too excited.

Are Veritiv Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The first bit of good news is that no Veritiv insiders reported share sales in the last twelve months. But the important part is that Independent Chairman Stephen Macadam spent US$202k buying stock, at an average price of US$127. It seems at least one insider thinks that the company is doing well - and they are backing that view with cash.

Along with the insider buying, another encouraging sign for Veritiv is that insiders, as a group, have a considerable shareholding. With a whopping US$80m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Sal Abbate is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between US$1.0b and US$3.2b, like Veritiv, the median CEO pay is around US$5.6m.

Veritiv offered total compensation worth US$5.0m to its CEO in the year to December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Veritiv Deserve A Spot On Your Watchlist?

Veritiv's earnings per share have been soaring, with growth rates sky high. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Veritiv deserves timely attention. It is worth noting though that we have found 3 warning signs for Veritiv (1 can't be ignored!) that you need to take into consideration.

The good news is that Veritiv is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VRTV

Veritiv

Veritiv Corporation operates as a business-to-business provider of value-added packaging products and services, facility solutions, and print based products and services in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives