- United States

- /

- Trade Distributors

- /

- NYSE:URI

United Rentals (URI) Valuation Spotlight After Record Q2 Sales, Guidance Boost, and Buyback Expansion

Reviewed by Simply Wall St

United Rentals (URI) just delivered its second-quarter results, and there’s plenty for investors to consider. The company posted record revenue, outpacing Wall Street’s sales forecasts, even though earnings came in a bit shy of expectations. Alongside these numbers, management raised its full-year outlook and increased this year’s share buyback target by $400 million. These moves signal confidence in ongoing demand and a clear intent to reward shareholders.

This latest set of results is part of a broader wave of momentum for United Rentals. Over the past year, the stock is up 26%, with most of the gains concentrated in recent months as construction and industrial markets have stayed resilient. Three-year and five-year returns are even stronger, reflecting both cyclical growth and what appears to be steady long-term execution. The company’s ongoing focus on project pipelines and technology-driven enhancements appears to have resonated with investors who are betting on further upside.

With the stock trading near all-time highs and management projecting even more growth ahead, investors may be considering whether this represents a new opportunity to buy in, or if the market has already priced in all expectations for future momentum.

Most Popular Narrative: 4% Overvalued

According to community narrative, United Rentals is currently seen as modestly overvalued compared to analyst fair value estimates, based on anticipated growth and profit drivers.

The company is expanding its Specialty business through new cold starts, which grew 22% year-over-year and 15% pro forma. This growth is anticipated to positively impact both revenue and net margins as the business becomes a larger share of total sales.

Curious what is powering this premium price? The narrative centers on ambitious growth goals, robust profit targets, and a projected future multiple that is uncommon in equipment rentals. What is the detailed roadmap behind this bold valuation? Explore further to uncover the exact financial forecasts that support this calculation.

Result: Fair Value of $894.56 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, large project slowdowns or margin pressure from rising costs could quickly challenge the growth thesis behind United Rentals’ premium valuation.

Find out about the key risks to this United Rentals narrative.Another View: Discounted Cash Flow Perspective

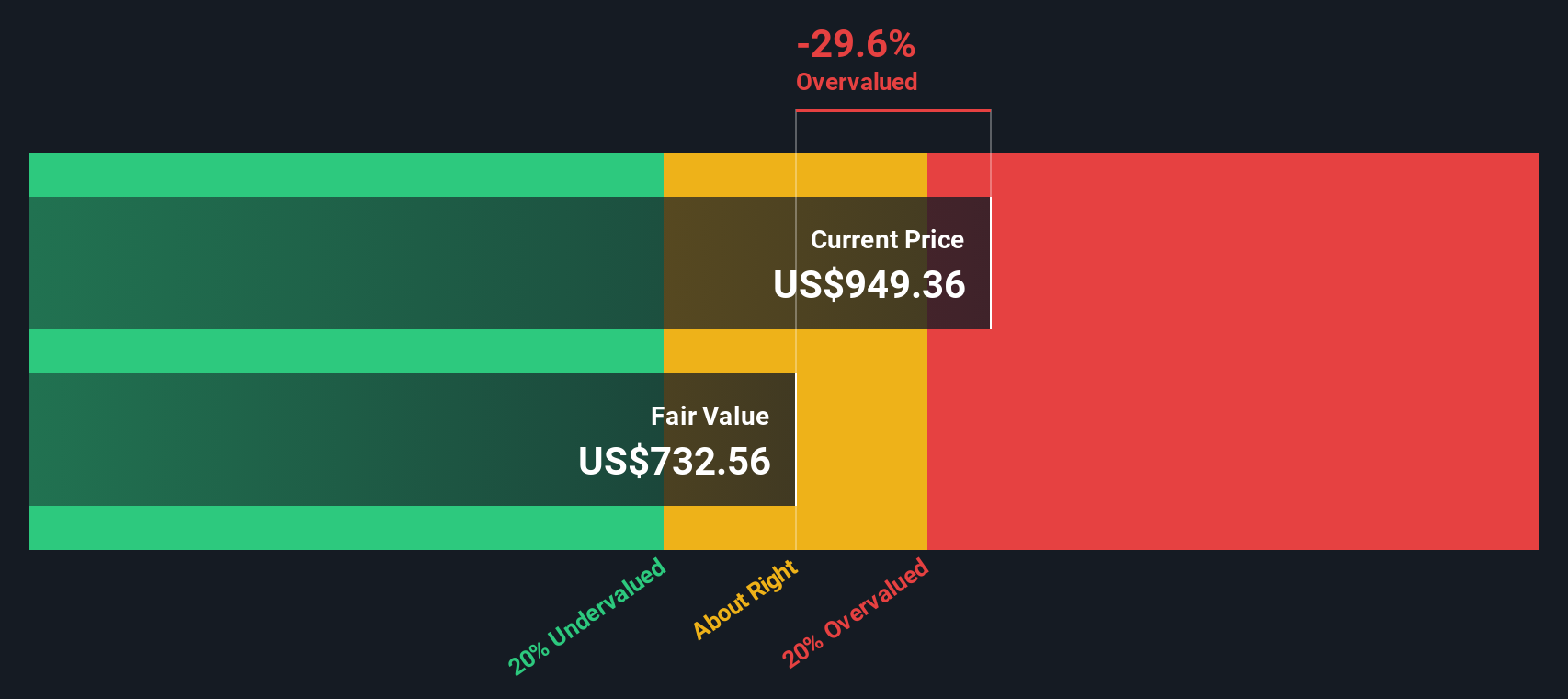

Looking at United Rentals from the perspective of our DCF model offers a different angle. This approach suggests that the current market price may be overly optimistic when compared to the company’s long-term cash flow outlook. How much confidence should investors place in these projections compared to the broader optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own United Rentals Narrative

If you would rather dig into the numbers yourself and shape your own perspective, you can easily build your own analysis in just a few minutes, or simply do it your way.

A great starting point for your United Rentals research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for Your Next Big Investing Move?

There are countless market opportunities waiting just beyond United Rentals. With Simply Wall Street’s powerful screeners, you can confidently uncover stocks that match your goals. Take action now and explore new possibilities that could make a real difference to your portfolio.

- Unlock reliable income streams by tapping into high-yield opportunities with dividend stocks with yields > 3%.

- Accelerate your portfolio’s growth by finding up-and-coming companies with strong balance sheets using penny stocks with strong financials.

- Strengthen your position in the tech revolution by investing in tomorrow’s leaders, starting with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:URI

United Rentals

Through its subsidiaries, operates as an equipment rental company.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives