- United States

- /

- Trade Distributors

- /

- NYSE:URI

Is Bullish Sector Sentiment Reshaping the Investment Thesis for United Rentals (URI)?

Reviewed by Simply Wall St

- In recent days, United Rentals has attracted attention as market sentiment turned positive following analyst upgrades and supportive forecasts for growth in the U.S. non-residential construction sector. These developments were underpinned by commentary pointing to favorable market conditions and United Rentals’ strong market positioning in the equipment rental industry.

- An important insight is that analysts expect United Rentals to benefit from ongoing policy shifts and a rebound in construction activity, placing the company in a favorable position relative to its sector peers.

- To assess the full impact of improving sector sentiment, we'll explore how these factors influence United Rentals' investment narrative and outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

United Rentals Investment Narrative Recap

To be a shareholder in United Rentals, it's essential to believe in the sustained growth of U.S. non-residential construction and the company's ability to maintain its strong market position as policy shifts and construction activity rebound. The recent analyst upgrades and sector optimism may provide short-term momentum, but do not materially address the biggest current risk: United Rentals' significant capital expenditures, which could pressure free cash flow should macroeconomic conditions deteriorate unexpectedly.

Among recent announcements, United Rentals' increased share repurchase activity, 580,672 shares bought back for US$418.78 million in the past quarter, stands out as the most relevant, as it demonstrates confidence in the company’s financial foundation and may support earnings per share growth if sector trends remain favorable. However, this catalyst is only as effective as the company’s ability to manage its balance sheet should large project demand or macro conditions shift.

By contrast, investors should also be aware that heavy capital commitments could limit flexibility if economic conditions change ...

Read the full narrative on United Rentals (it's free!)

United Rentals' narrative projects $18.8 billion revenue and $3.5 billion earnings by 2028. This requires 6.1% yearly revenue growth and a $1.0 billion earnings increase from $2.5 billion today.

Uncover how United Rentals' forecasts yield a $924.70 fair value, in line with its current price.

Exploring Other Perspectives

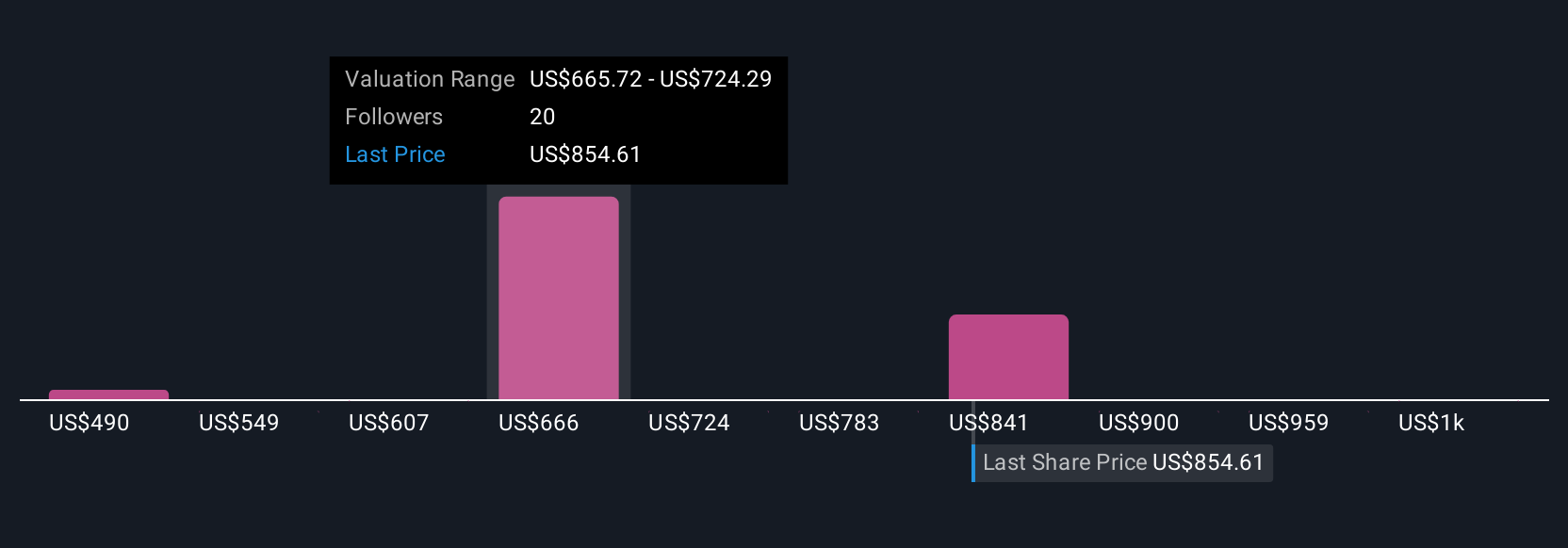

Seven Simply Wall St Community members set fair values for United Rentals ranging from US$490 to US$1,075. Earnings growth expectations remain steady under analyst consensus, but opinions differ widely, explore these diverse viewpoints to compare how market optimism and risk shape valuation thinking.

Explore 7 other fair value estimates on United Rentals - why the stock might be worth as much as 14% more than the current price!

Build Your Own United Rentals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Rentals research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free United Rentals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Rentals' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:URI

United Rentals

Through its subsidiaries, operates as an equipment rental company.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives