- United States

- /

- Machinery

- /

- NYSE:TWI

Titan International (NYSE:TWI) shareholder returns have been enviable, earning 371% in 3 years

Titan International, Inc. (NYSE:TWI) shareholders might be concerned after seeing the share price drop 11% in the last quarter. But that doesn't displace its brilliant performance over three years. Indeed, the share price is up a whopping 369% in that time. Arguably, the recent fall is to be expected after such a strong rise. The share price action could signify that the business itself is dramatically improved, in that time.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Our analysis indicates that TWI is potentially undervalued!

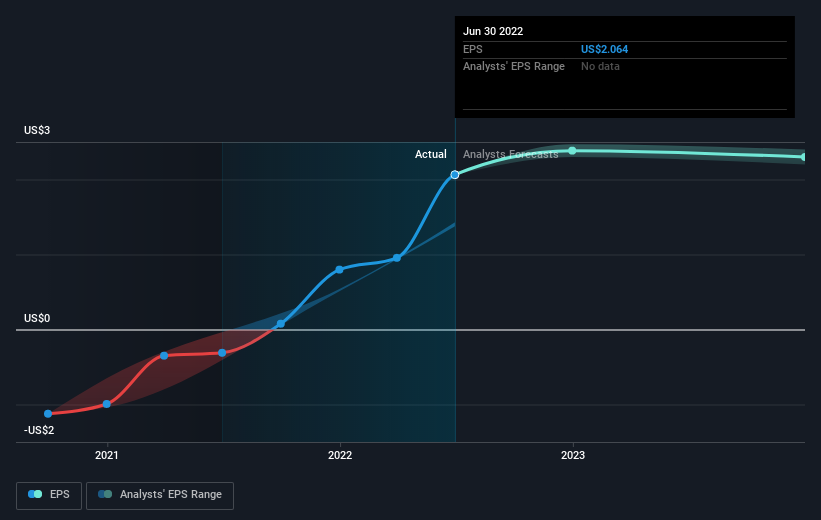

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Titan International became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Titan International has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Titan International's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Titan International's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Titan International's TSR of 371% over the last 3 years is better than the share price return.

A Different Perspective

It's nice to see that Titan International shareholders have received a total shareholder return of 88% over the last year. That's better than the annualised return of 7% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Titan International has 2 warning signs (and 1 which is significant) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Titan International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TWI

Titan International

Manufactures and sells wheels, tires, and undercarriage systems and components for off-highway vehicles in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives