- United States

- /

- Construction

- /

- NYSE:TPC

US Growth Stocks With High Insider Ownership Seeing Up To 48% Revenue Growth

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with major indexes like the Dow Jones and S&P 500 facing potential weekly losses, investors are increasingly focusing on identifying resilient growth opportunities. In this environment, companies with high insider ownership can be particularly appealing due to their alignment of interests between management and shareholders, often resulting in strong revenue growth even amidst broader market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 25.4% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 27.6% |

| On Holding (NYSE:ONON) | 19.1% | 30.2% |

| Astera Labs (NasdaqGS:ALAB) | 15.7% | 61.3% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Enovix (NasdaqGS:ENVX) | 12.8% | 56.0% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 103.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.2% | 33.6% |

Let's review some notable picks from our screened stocks.

Liquidia (NasdaqCM:LQDA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liquidia Corporation is a biopharmaceutical company that develops, manufactures, and commercializes products for unmet patient needs in the United States, with a market cap of approximately $1.40 billion.

Operations: Liquidia generates its revenue primarily from its pharmaceuticals segment, which accounted for $15.61 million.

Insider Ownership: 10.7%

Revenue Growth Forecast: 48.6% p.a.

Liquidia is expected to see substantial revenue growth of 48.6% annually, outpacing the US market's 8.9%. Its earnings are projected to increase by 57.39% per year, with profitability anticipated within three years, marking above-average market growth. Currently trading at a significant discount (80.6%) below estimated fair value, no recent insider trading data is available for the past three months. Liquidia recently presented at the J.P. Morgan Healthcare Conference in January 2025.

- Dive into the specifics of Liquidia here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Liquidia is trading beyond its estimated value.

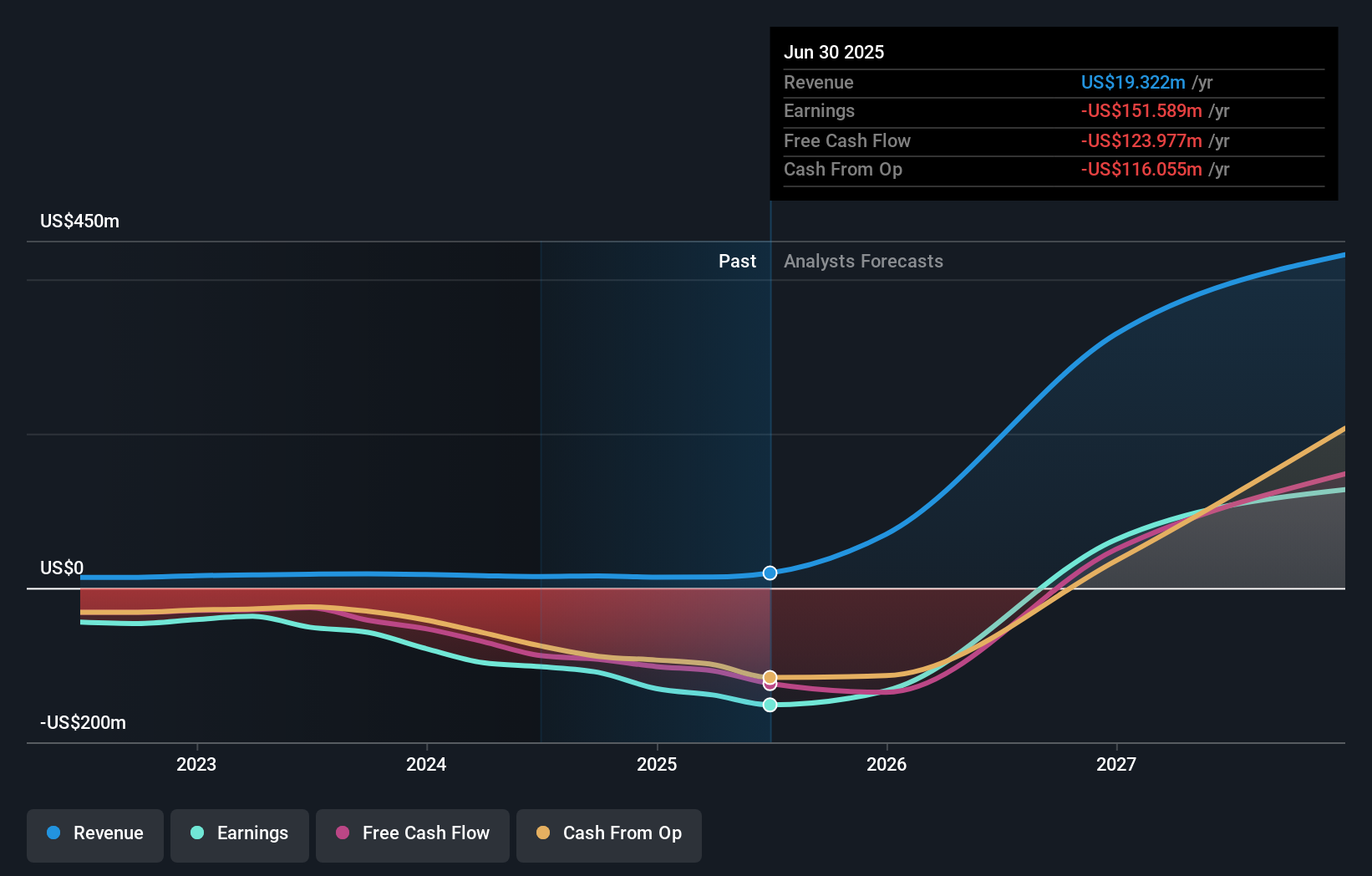

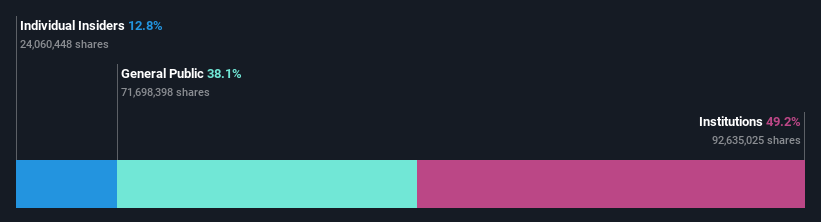

Enovix (NasdaqGS:ENVX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Enovix Corporation designs, develops, and manufactures lithium-ion batteries, with a market cap of approximately $2.11 billion.

Operations: Enovix Corporation's revenue segments are currently not specified in the provided text.

Insider Ownership: 12.8%

Revenue Growth Forecast: 44.4% p.a.

Enovix is poised for significant growth, with revenue expected to rise 44.4% annually, surpassing the US market average of 8.9%. The company aims to achieve profitability within three years, projecting robust earnings growth of 56% annually. Recent developments include a substantial order from a leading AI firm and advancements in their Malaysian manufacturing facility. Despite these positive indicators, Enovix's share price remains highly volatile and no recent insider trading data is available.

- Unlock comprehensive insights into our analysis of Enovix stock in this growth report.

- Our comprehensive valuation report raises the possibility that Enovix is priced higher than what may be justified by its financials.

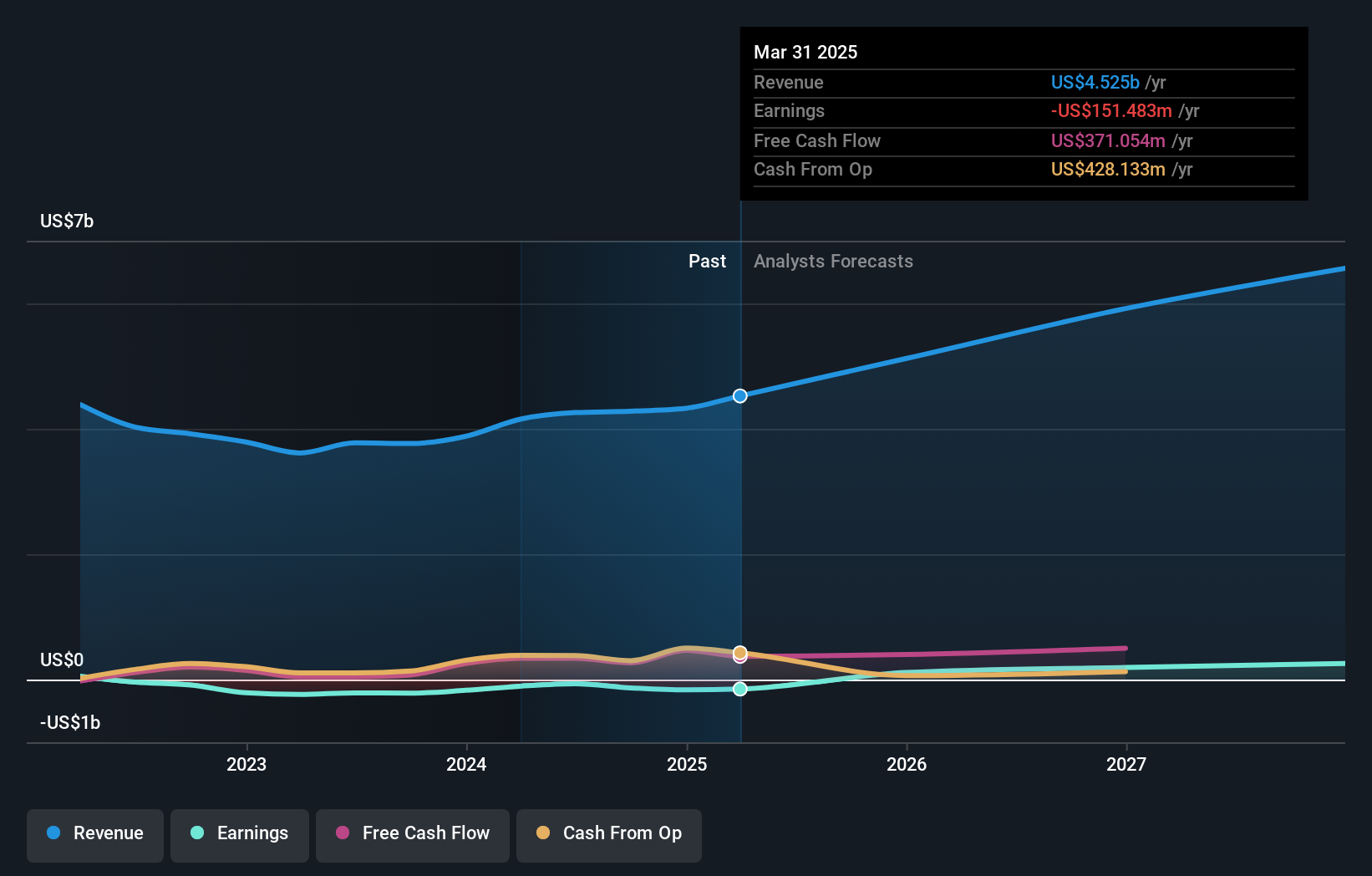

Tutor Perini (NYSE:TPC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tutor Perini Corporation is a construction company offering general contracting, construction management, and design-build services to private and public clients both in the United States and internationally, with a market cap of approximately $1.21 billion.

Operations: The company's revenue segments are comprised of Specialty Contractors at $615.19 million, Civil (Including Management Services) at $2.14 billion, and Building (Including Management Services) at $1.70 billion.

Insider Ownership: 16.2%

Revenue Growth Forecast: 12.7% p.a.

Tutor Perini is progressing with the $3.76 billion Manhattan Jail Project, enhancing its backlog and growth prospects. The company has improved its financial health by reducing debt by $430 million over the past year. Revenue is projected to grow at 12.7% annually, outpacing the US market average, with earnings expected to rise significantly. Despite trading below fair value estimates, no recent insider trading activity is reported following executive leadership changes.

- Navigate through the intricacies of Tutor Perini with our comprehensive analyst estimates report here.

- Our valuation report here indicates Tutor Perini may be undervalued.

Seize The Opportunity

- Click here to access our complete index of 197 Fast Growing US Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tutor Perini might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPC

Tutor Perini

A construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies in the United States and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives