- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:CARG

US Growth Companies With High Insider Ownership In November 2024

Reviewed by Simply Wall St

As U.S. markets reach new heights with the Dow Jones and S&P 500 hitting record levels, investor optimism is buoyed by recent political developments and monetary policy shifts. In this thriving environment, growth companies with high insider ownership are particularly appealing as they often signal strong confidence from those closest to the business, aligning well with current market dynamics that favor robust corporate governance and strategic foresight.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.5% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.6% | 26% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.3% |

| Coastal Financial (NasdaqGS:CCB) | 18.1% | 46.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Here we highlight a subset of our preferred stocks from the screener.

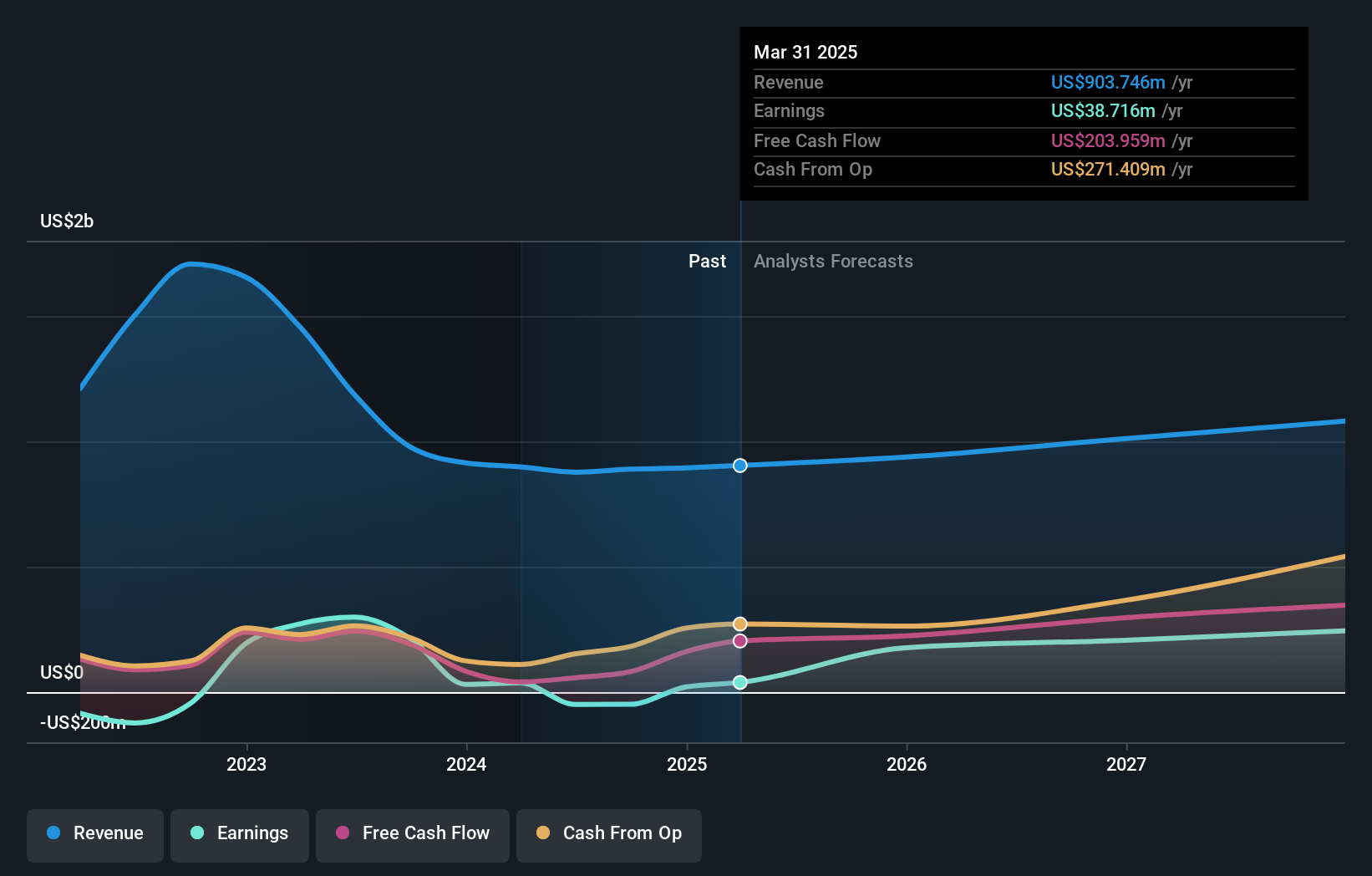

Credit Acceptance (NasdaqGS:CACC)

Simply Wall St Growth Rating: ★★★★★★

Overview: Credit Acceptance Corporation provides financing programs and related products and services in the United States, with a market cap of approximately $5.55 billion.

Operations: The company generates revenue of $846.10 million from offering dealers financing programs and related products and services in the United States.

Insider Ownership: 14.1%

Credit Acceptance Corporation shows strong growth potential with expected annual earnings growth of over 50% and revenue growth forecasted at 34.9%, outpacing the US market. However, insider selling has been significant recently, and profit margins decreased from last year. The company reported Q3 revenue of US$550.3 million, up from US$478.6 million a year ago, but net income for nine months fell to US$96 million compared to US$192.5 million previously.

- Click here and access our complete growth analysis report to understand the dynamics of Credit Acceptance.

- The analysis detailed in our Credit Acceptance valuation report hints at an inflated share price compared to its estimated value.

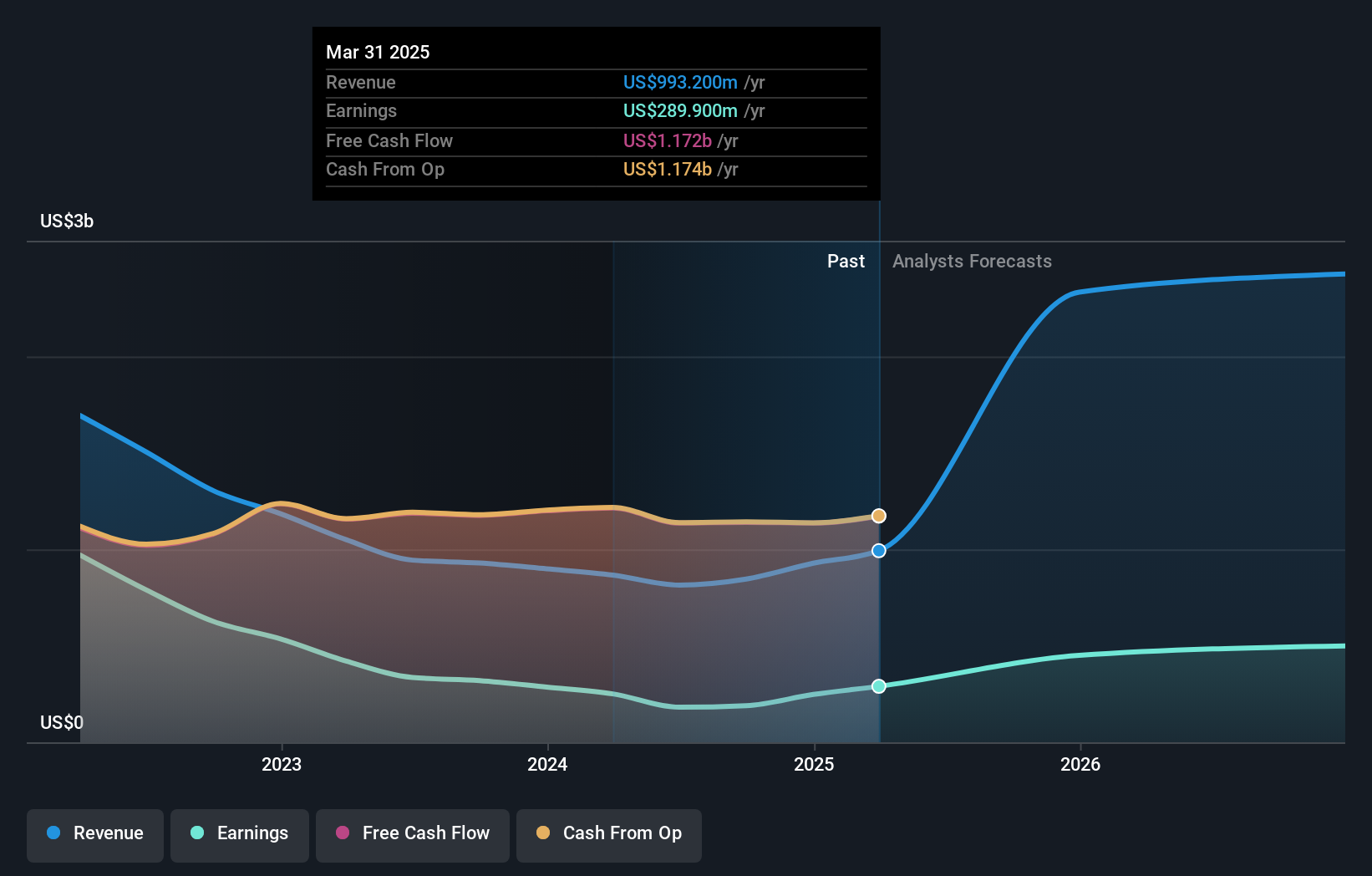

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles both in the United States and internationally, with a market cap of $3.40 billion.

Operations: The company's revenue is primarily derived from its U.S. Marketplace segment, which generated $686.26 million, and its Digital Wholesale segment, contributing $134.48 million.

Insider Ownership: 17%

CarGurus demonstrates growth potential with its expected annual earnings increase of 53.26% and revenue growth forecasted at 12.4%, surpassing the US market average. Recent Q3 results showed a rise in sales to US$204.02 million from US$177.91 million, though net income saw only slight improvement year-over-year. Despite significant insider selling recently, CarGurus announced a share repurchase program worth up to US$200 million, underlining confidence in its future prospects amidst evolving digital retail solutions expansion in Canada and the U.S.

- Get an in-depth perspective on CarGurus' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that CarGurus is priced higher than what may be justified by its financials.

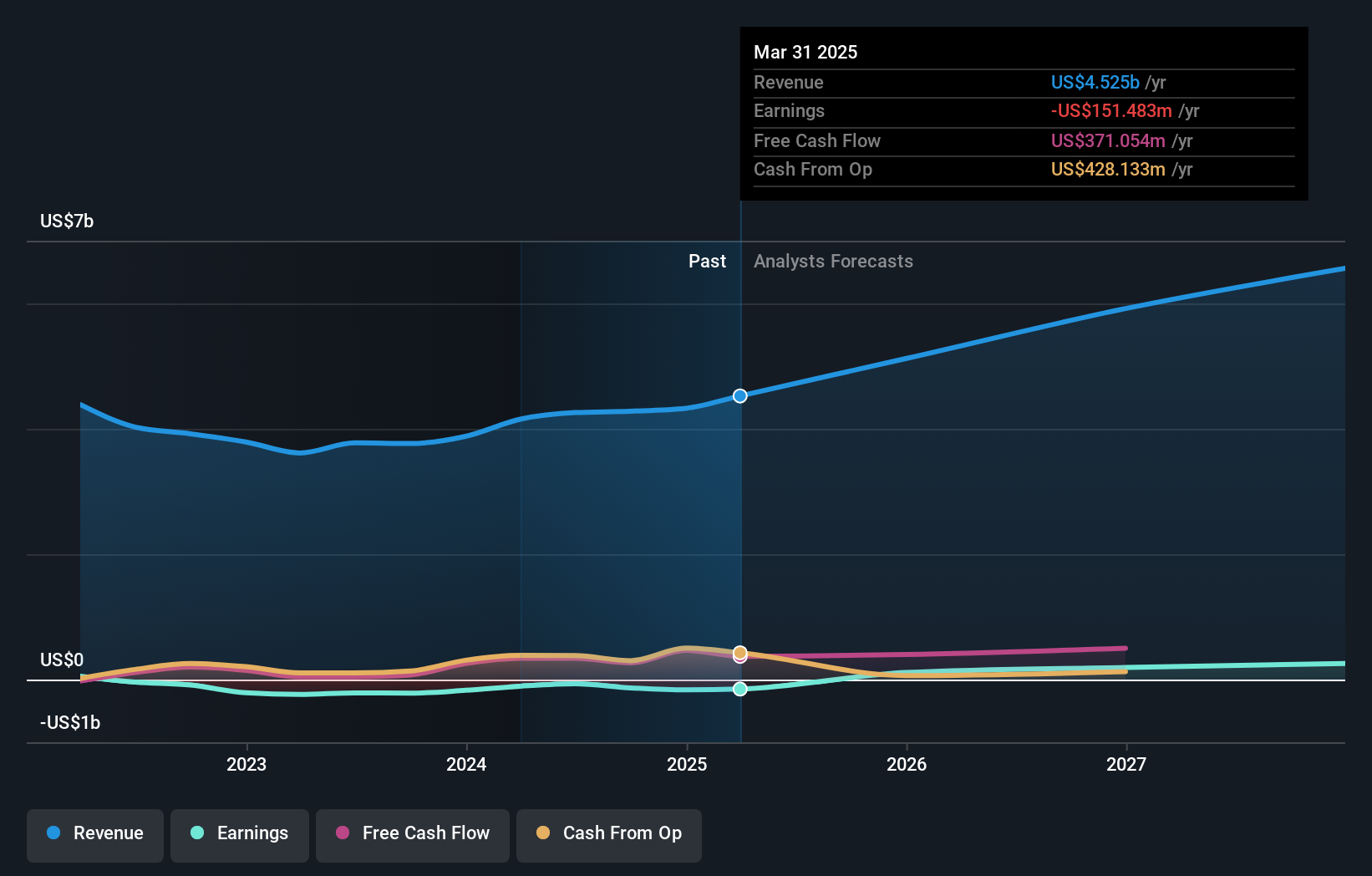

Tutor Perini (NYSE:TPC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tutor Perini Corporation is a construction company offering general contracting, construction management, and design-build services to private and public clients in the U.S. and internationally, with a market cap of approximately $1.59 billion.

Operations: Tutor Perini's revenue streams are derived from its diverse offerings in general contracting, construction management, and design-build services for both private sector clients and public agencies across domestic and international markets.

Insider Ownership: 16.5%

Tutor Perini's growth outlook is bolstered by substantial insider ownership and a robust project backlog, including significant contracts like the $1.66 billion Honolulu rail project and a $330.6 million Guam harbor repair initiative. Despite recent quarterly losses of US$100.86 million, the company is forecasted to achieve profitability within three years with earnings expected to grow 90.23% annually, signaling potential for value appreciation as it trades significantly below estimated fair value.

- Navigate through the intricacies of Tutor Perini with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Tutor Perini is priced lower than what may be justified by its financials.

Seize The Opportunity

- Unlock our comprehensive list of 194 Fast Growing US Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CARG

CarGurus

Operates an online automotive platform for buying and selling vehicles in the United States and internationally.

Flawless balance sheet with high growth potential.