- United States

- /

- Machinery

- /

- NYSE:TEX

Will Leadership Changes at Terex (TEX) Shape Its Global Strategy Amid Trade Tensions?

Reviewed by Sasha Jovanovic

- Terex Corporation recently announced the appointment of Srikanth Padmanabhan, former Cummins executive, to its Board of Directors, effective December 1, 2025.

- Padmanabhan’s extensive experience in global operations and manufacturing leadership brings additional expertise to Terex as it manages an increasingly complex international landscape.

- We'll explore how escalating US-China trade tensions and looming supply chain uncertainties may influence Terex's future business outlook and investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Terex Investment Narrative Recap

To back Terex as a shareholder today, you’d need confidence in ongoing global infrastructure investment fueling multi-year demand for its equipment, while staying mindful of cost and margin pressures from ongoing trade tensions. The recent appointment of Srikanth Padmanabhan to the Board signals an infusion of international manufacturing expertise, although it’s unlikely to materially shift the near-term balance of catalysts and risks, most notably, margin risks from rising tariffs and supply chain uncertainties remain most immediate.

Among recent company actions, Terex’s new refinancing agreement, cutting the term loan rate from SOFR + 2.00% to SOFR + 1.75%, is especially relevant, as it may help cushion the effect of potential cost increases from heightened trade friction by reducing interest expenses and preserving financial flexibility. While global demand and infrastructure spend remain catalysts, how successfully Terex manages external shocks and controls costs underlines the company’s outlook.

By contrast, investors should stay alert to the risk of unpredictable tariff-related inflation compressing margins, especially as...

Read the full narrative on Terex (it's free!)

Terex's narrative projects $6.1 billion in revenue and $525.7 million in earnings by 2028. This requires 6.0% yearly revenue growth and a $346.7 million increase in earnings from $179.0 million today.

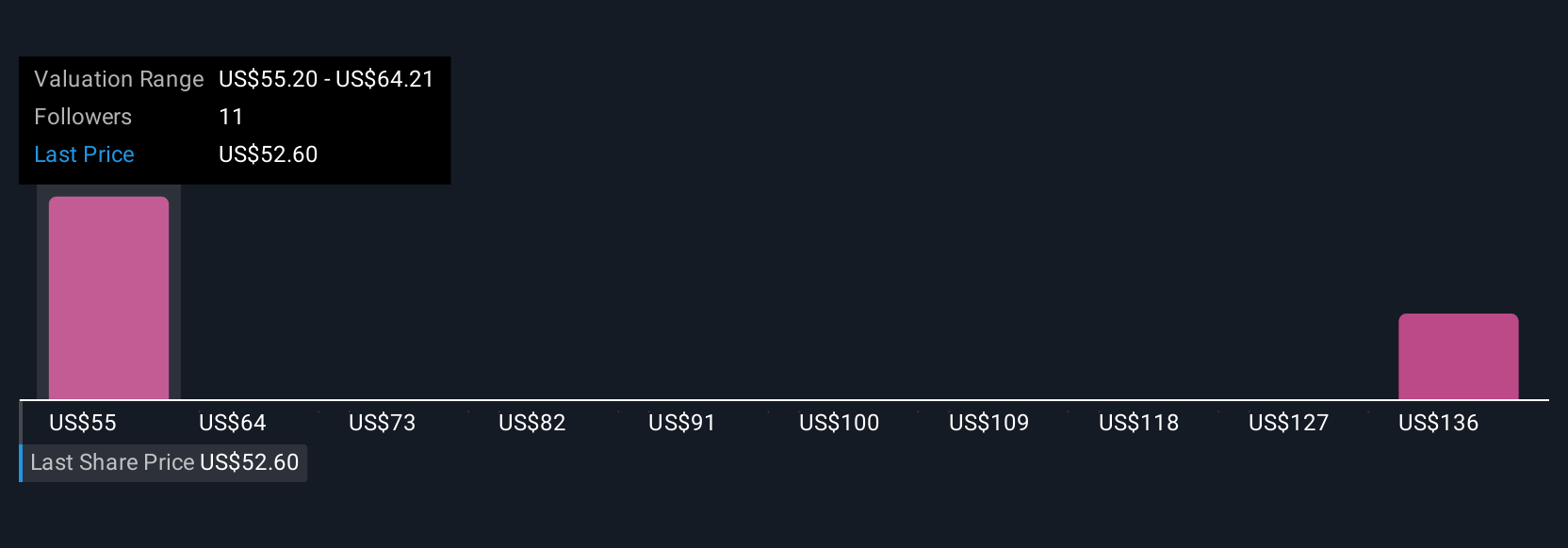

Uncover how Terex's forecasts yield a $55.20 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided four fair value estimates for Terex, ranging from US$51.89 to US$142.08 per share. While this showcases a broad spectrum of outlooks, margin compression risk from tariff-driven cost increases could shape future financial performance and underlines why opinions about value can vary this widely.

Explore 4 other fair value estimates on Terex - why the stock might be worth just $51.89!

Build Your Own Terex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Terex research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Terex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Terex's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEX

Terex

Provides materials processing machinery and mobile elevating work platform worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives