- United States

- /

- Aerospace & Defense

- /

- NYSE:TDG

TransDigm Group (TDG): Assessing Valuation After Strong Earnings, 2026 Outlook Upgrade and Simmonds Precision Acquisition

Reviewed by Simply Wall St

TransDigm Group (TDG) just delivered a strong quarterly earnings report, with higher net sales, rising net income, and upbeat fiscal 2026 guidance that reinforces its growth story across commercial and defense aviation.

See our latest analysis for TransDigm Group.

Even after a strong quarter and the Simmonds Precision Products acquisition, TransDigm’s 1 year total shareholder return of 9.89 percent and powerful 3 year total shareholder return of 150.04 percent show momentum is still firmly in investors’ favor.

If TransDigm’s aerospace story has your attention, it could be a good time to explore other aerospace and defense stocks that might be riding similar long term tailwinds.

With earnings, guidance, and analyst targets all pointing higher, investors face a familiar dilemma: is TransDigm still trading below its long term potential, or is the market already pricing in years of future growth?

Most Popular Narrative Narrative: 18.1% Undervalued

With TransDigm last closing at $1,294.65 against a narrative fair value of about $1,581, the valuation view leans bullish and leans heavily on future compounding.

Analysts expect earnings to reach $2.5 billion (and earnings per share of $43.46) by about September 2028, up from $1.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.9 billion in earnings, and the most bearish expecting $2.3 billion.

Curious how this earnings ladder, rising margins, and a richer future multiple all add up to that target valuation? The full narrative lays out the playbook.

Result: Fair Value of $1,581.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained slower aftermarket growth, or interest costs climbing on TransDigm’s already leveraged balance sheet, could quickly challenge today’s upbeat valuation narrative.

Find out about the key risks to this TransDigm Group narrative.

Another Lens on Valuation

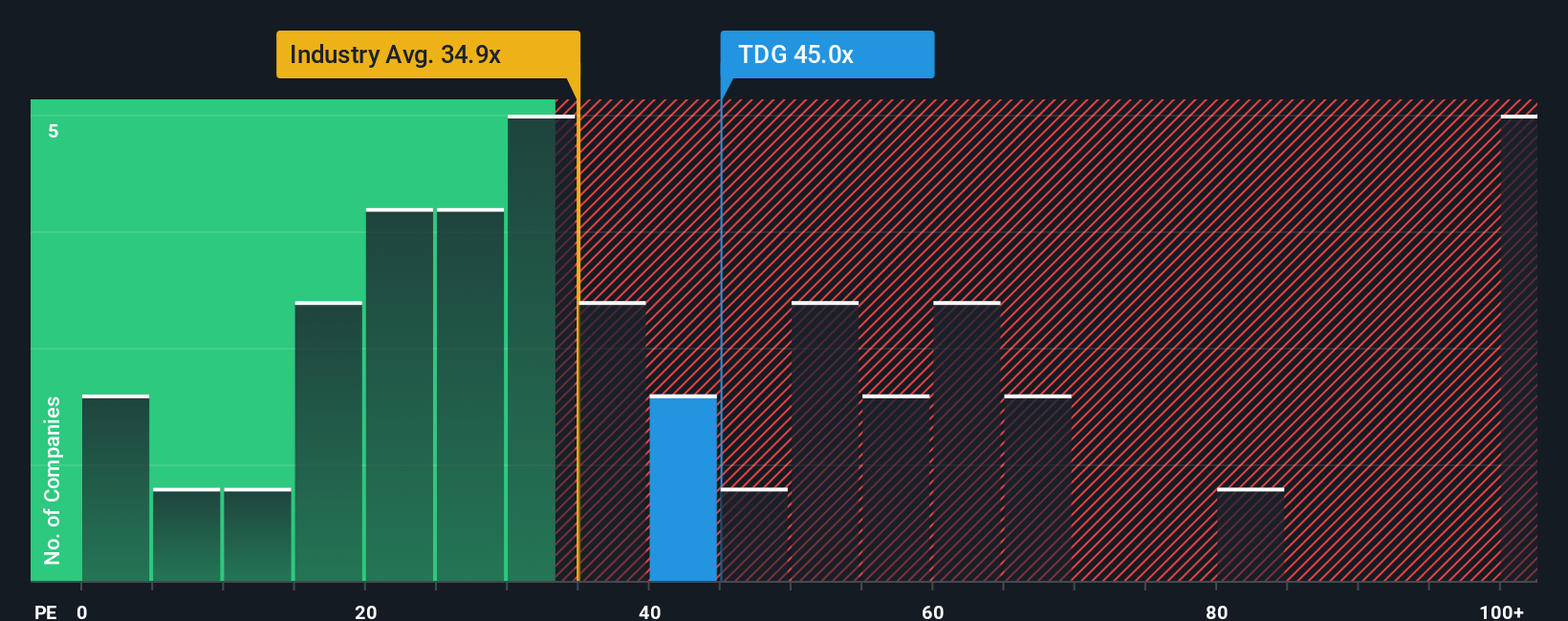

Those bullish narrative targets meet a tougher reality when you look at today’s earnings multiple. TransDigm trades on a P/E of 39.1 times, richer than the US Aerospace and Defense average at 37.8 times, peers at 31.9 times, and above a fair ratio of 33.1 times that the market could drift toward over time. If sentiment cools, how much room is there for the share price to rerate down even if earnings keep growing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransDigm Group Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view in minutes: Do it your way.

A great starting point for your TransDigm Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If TransDigm has sharpened your appetite for opportunity, do not stop here. Your next market winner could already be waiting inside a focused Simply Wall Street screener.

- Capture potential mispricings by running through these 901 undervalued stocks based on cash flows that still look cheap even after factoring in their future cash flows and growth prospects.

- Ride structural growth themes by zeroing in on these 26 AI penny stocks positioned at the heart of automation, data, and next generation software breakthroughs.

- Boost your income game by hunting for these 13 dividend stocks with yields > 3% that combine solid payouts with balance sheets built to support those yields through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TransDigm Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDG

TransDigm Group

Designs, produces, and supplies aircraft components in the United States and internationally.

Acceptable track record with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)