- United States

- /

- Electrical

- /

- NYSE:SMR

NuScale Power (SMR): Assessing Valuation After Record-Setting SMR Deal with ENTRA1 and Tennessee Valley Authority

Reviewed by Simply Wall St

If you’ve been eyeing NuScale Power (NYSE:SMR), recent headlines probably caught your attention. The company’s technology just landed at the heart of a landmark deal between ENTRA1 Energy and the Tennessee Valley Authority, aiming to deploy up to 6 gigawatts of small modular reactor (SMR) capacity. This is the largest such commitment in American history. For investors, this is a rare moment of validation, as NuScale’s nuclear reactors are being tapped to supply carbon-free power across a seven-state region. It marks a bold move to address surging energy needs from sectors like AI, data centers, and semiconductor manufacturing.

NuScale has seen its share price swing sharply as this story unfolded, with an initial surge on the news reflecting optimism about its role in meeting new demand, followed by a rapid pullback as investors weighed the risks and the company’s current financial position. Recent momentum caps off a dramatic year, with the stock up nearly 95% since January and delivering over 3% return in the past year, even as annual revenue remains modest and the company continues to post losses. This pattern of volatility highlights just how sensitive NuScale’s valuation is to both big-picture energy developments and the pace of real-world project execution.

Now that excitement has faded and the dust is settling, is NuScale Power trading at a discount to its potential, or are markets already factoring in future growth?

Most Popular Narrative: 18.4% Undervalued

The most widely followed narrative suggests NuScale Power is undervalued by nearly a fifth compared to its estimated fair value. This outlook highlights ambitious expectations for both future growth and profitability improvements as the company scales up commercial deployment of its small modular reactors.

"With an NRC-approved SMR technology and the commitment of over $2 billion towards its development and licensing, NuScale is uniquely positioned for immediate commercial deployment compared to competitors focused solely on demonstration plans. This potentially accelerates revenue growth once commercial operations commence."

Curious what makes this valuation so optimistic? The analysts behind this view are betting big on a unique mix of rapid revenue expansion, much-improved profit margins, and an eye-popping future earnings multiple rarely seen outside high-growth tech. Wondering just how aggressive these underlying numbers get? If the market’s current skepticism is misplaced, the real story can be found in the fine print that drives this bold fair value estimate.

Result: Fair Value of $42.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing hurdles in securing funding and potential delays with long-term agreements could easily disrupt NuScale’s optimistic growth projections.

Find out about the key risks to this NuScale Power narrative.Another View: Not Everyone Sees This as a Bargain

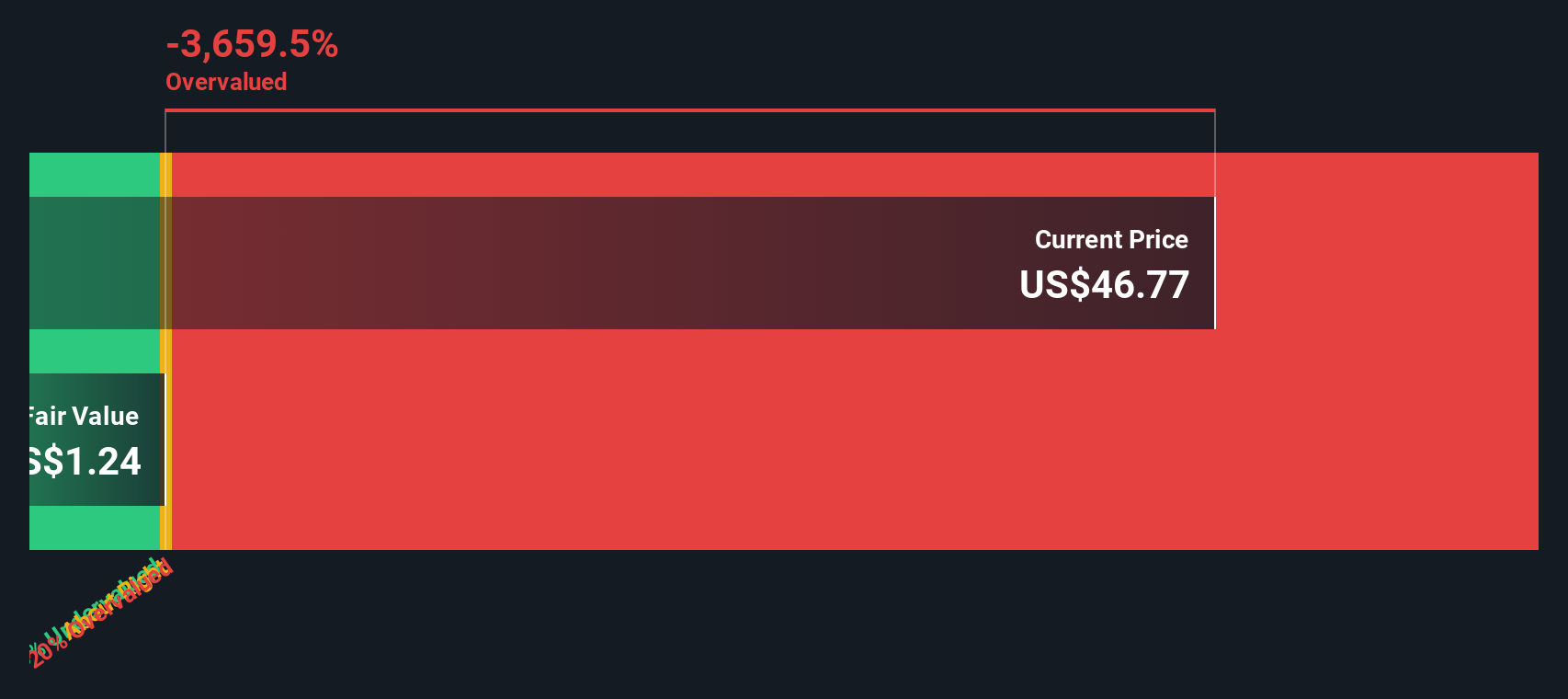

While the previous approach points to value, our DCF model tells a very different story. It suggests NuScale could actually be overvalued at current prices. Which assessment will prove right as events unfold?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NuScale Power Narrative

If you think there’s more to the story, or want to dig into the numbers on your own terms, you can craft your own view in just a few minutes. Do it your way

A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Make smarter investment decisions by uncovering stocks that fit your goals with these powerful screeners from Simply Wall Street.

- Target stocks trading at compelling prices by searching for undervalued stocks based on cash flows, which are poised for growth and hidden potential.

- Jump on the next wave of innovation by tracking companies driving breakthroughs in medicine and technology with healthcare AI stocks.

- Boost your portfolio’s income stream by finding dividend stocks with yields > 3% offering consistent, attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:SMR

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026