- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

RTX (NYSE:RTX) Partners With JetZero For Fuel-Efficient Aviation Systems Integration

Reviewed by Simply Wall St

RTX (NYSE:RTX) recently announced a partnership with JetZero to supply innovative systems for a more fuel-efficient aircraft, potentially impacting its stock performance. This collaboration, aiming for a 50% reduction in fuel consumption, may have influenced RTX's 9% price increase last quarter, alongside other accomplishments such as major defense contracts with Romania and the Netherlands, and a solid Q4 earnings report. Despite challenges from tech sell-offs and tariff uncertainties, RTX's strategic positioning in diverse sectors, including defense and emerging technologies, likely contributed to its resilience and positive shareholder returns. The broader market's decline of 1.9% contrasts with RTX's gains, illustrating the company's capacity to capitalize on burgeoning opportunities despite external headwinds. Overall, contrasting market conditions and RTX's robust operational performance have played crucial roles in shaping the company's total shareholder returns throughout this period.

Navigate through the intricacies of RTX with our comprehensive report here.

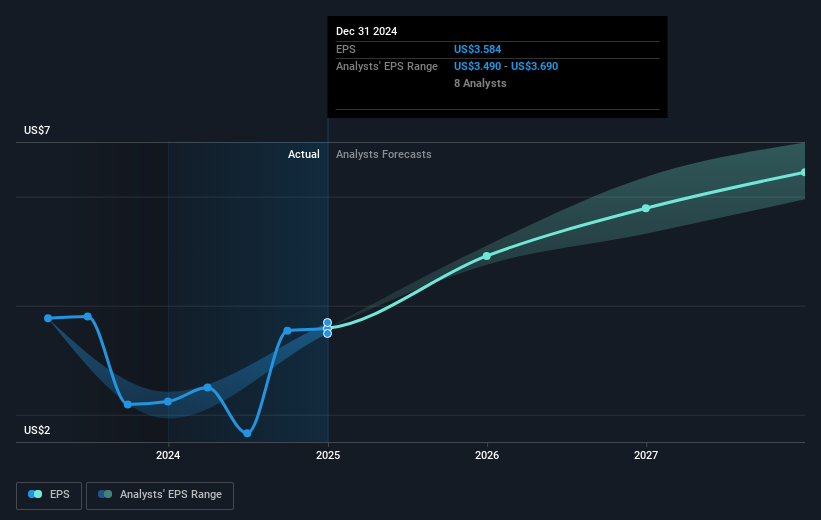

RTX Corporation's shares have delivered a total shareholder return of 131.61% over the last five years, highlighting its robust operational strategies and strong position in the Aerospace & Defense industry. Key drivers during this period include substantial earnings growth, which at 27% annually on average reflected its successful expansion efforts and technological advancements. Acknowledging the broader industry, RTX's return during the last year outperformed both the U.S. Aerospace & Defense industry's 21.9% return and the U.S. market's 14% return, underscoring its competitive edge.

Noteworthy events impacting its longer-term performance include significant strategic alliances, such as the collaboration with DARPA announced in March 2025 to develop ultra-wide bandgap semiconductors, enhancing electronic performance. In addition, comprehensive share buybacks, completing 112.26 million shares at approximately US$10.33 billion as of January 2025, likely boosted shareholder value. However, challenges arose with a US$200 million penalty due to a compliance investigation settled in August 2024, illustrating the complex regulatory landscape RTX navigates.

- Analyze RTX's fair value against its market price in our detailed valuation report—access it here.

- Discover the key vulnerabilities in RTX's business with our detailed risk assessment.

- Invested in RTX? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record average dividend payer.