- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

RTX (NYSE:RTX): Exploring Valuation After Recent Share Price Volatility and Long-Term Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for RTX.

RTX’s share price has experienced some volatility lately, but zooming out reveals strong momentum. The company has posted a 35.94% share price return year-to-date and a total shareholder return of nearly 188% over five years. This combination of short-term fluctuations and robust long-term gains suggests the market continues to recognize RTX’s growth potential while reassessing risks as new data emerges.

Curious what else is driving the sector? Now could be the perfect time to spot companies shaping the future of aerospace and defense via our See the full list for free.

With the stock up nearly 36% year-to-date but still trading at a 10% discount to analyst targets, investors now face a key question: Is there still an attractive entry point, or has the market already factored in future growth?

Most Popular Narrative: 5.3% Undervalued

RTX’s last closing price sits below the narrative’s fair value estimate, hinting at a window of upside potential according to the latest widely followed perspective.

Robust and growing backlog, highlighted by a 1.86 quarter book-to-bill ratio, $236 billion backlog (up 15% year-over-year), and major new international contracts (e.g., EU, MENA, Asia-Pacific) indicate RTX is well positioned to benefit from sustained increases in global defense spending and heightened geopolitical tensions. This sets up strong visibility for future revenue growth.

Curious what drives this optimistic price target? The magic number depends on how fast revenues, margins, and future profits can grow, plus one bold, forward-looking multiple. Ready to see which assumptions analysts are betting on? Dive deeper to unlock the exact financial forecasts shaping this valuation.

Result: Fair Value of $166.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued tariff pressures or setbacks with jet engine reliability could challenge RTX’s margin and earnings growth narrative in the coming quarters.

Find out about the key risks to this RTX narrative.

Another View: Market Multiples Paint a Different Picture

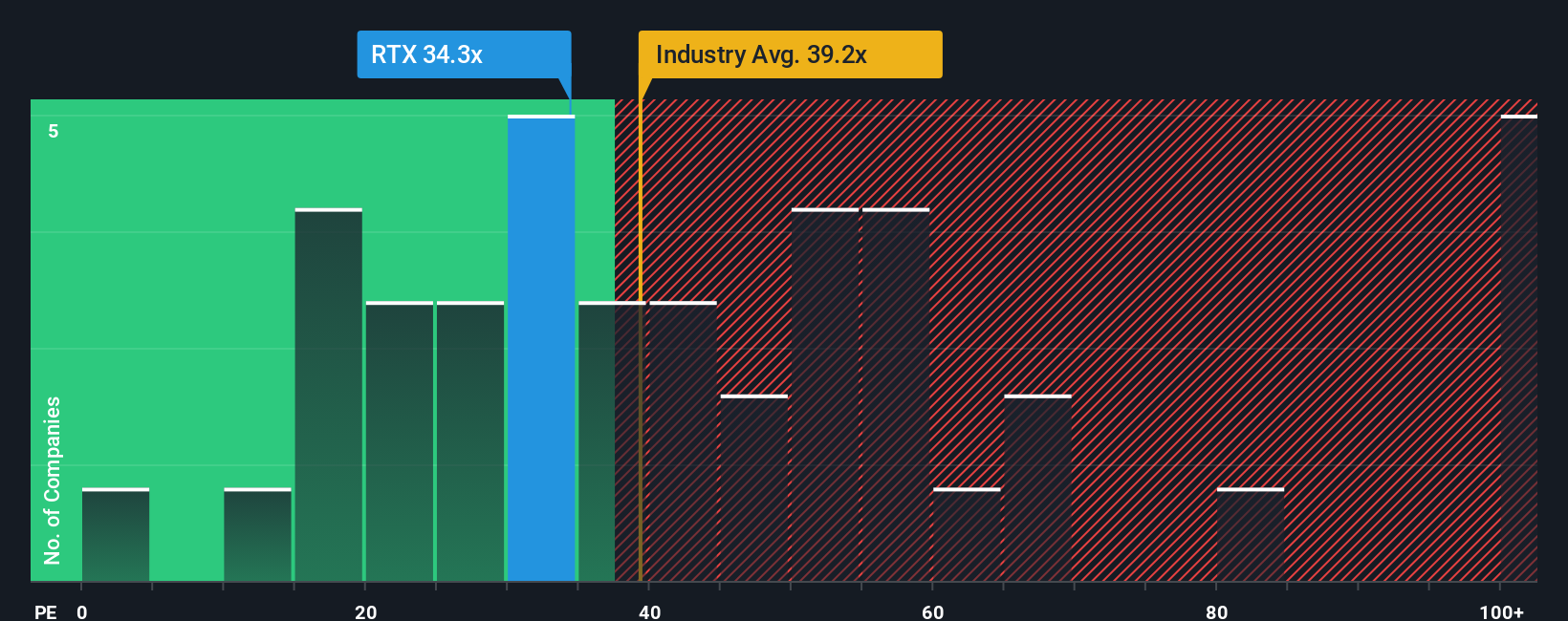

Looking through the lens of market multiples, RTX currently trades at a price-to-earnings ratio of 34.3x, which is above its peer average of 28.3x and just above its own fair ratio of 33.6x. While it is still cheaper than the broader Aerospace & Defense industry average of 39.2x, this gap suggests investors are paying a bit of a premium for RTX compared to similar companies. Is the premium justified, or is the risk of repricing on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RTX Narrative

If you want to dig deeper and challenge these narratives, you can easily build your own data-driven story in just a few minutes. Do it your way

A great starting point for your RTX research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. The smartest investors always keep fresh ideas on their radar. The Simply Wall Street Screener makes it easy to spot market gems before everyone else jumps on board.

- Maximize potential gains by targeting these 900 undervalued stocks based on cash flows based on real cash flow metrics and solid fundamentals.

- Supercharge your portfolio and tap into the future of medicine by checking out these 32 healthcare AI stocks making breakthroughs in healthcare technology.

- Bank on reliable income with these 19 dividend stocks with yields > 3% offering yields above 3% for steady, long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives