- United States

- /

- Machinery

- /

- NYSE:REVG

Assessing REV Group (REVG) Valuation After Robust Earnings and Strong RV Sales Momentum

Reviewed by Kshitija Bhandaru

REV Group (REVG) has caught investor attention this week after delivering stronger-than-expected earnings, thanks in part to major product launches and higher sales at prominent RV industry shows. Market watchers are eyeing the ripple effects of these results, particularly as luxury RV numbers climb.

See our latest analysis for REV Group.

REV Group’s share price has seen notable swings lately, and after stellar product launches and strong show sales, momentum is still very much alive. With a year-to-date share price return of 71.6% and an impressive one-year total shareholder return of 95.2%, long-term investors have been well rewarded as optimism around growth potential remains high, even as the company keeps its full-year outlook guarded.

If impressive surges like this have you curious about what else is gaining traction, it could be the right moment to discover fast growing stocks with high insider ownership

But with shares trading below analyst price targets and brisk momentum in the rearview, the real question now is whether REV Group is still undervalued or if all that future growth has already been priced in.

Most Popular Narrative: 16.9% Undervalued

With the fair value estimate sitting nearly 17% above REV Group’s last closing price of $54.64, the consensus narrative signals further upside potential. This creates high expectations if execution continues to impress.

Continued operational investments, such as the Spartan Emergency Response facility expansion, enhance production capacity and efficiency. This positions REV Group to capitalize on sustained municipal demand for fire and emergency vehicles as aging fleets require replacement. These factors support long-term revenue growth and scale-driven margin improvements. An elevated focus on manufacturing throughput and process innovation enables REV Group to reduce lead times and cycle times, providing a competitive edge to capture consistent government and institutional orders. This is especially relevant as urbanization and municipal infrastructure investments support a steady increase in specialty vehicle demand, positively impacting both revenue visibility and net margins.

How does this bullish outlook come together? The narrative leans heavily on expectations for expanding markets, major operational gains, and a future profit multiple most companies only dream of. Which precise financial leaps are built into these projections? The only way to find out is to unpack the full story behind the numbers.

Result: Fair Value of $65.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and a narrower market focus could challenge REV Group’s growth if inflation and sector downturns persist longer than expected.

Find out about the key risks to this REV Group narrative.

Another View: Is the Market Multiple Sending a Different Signal?

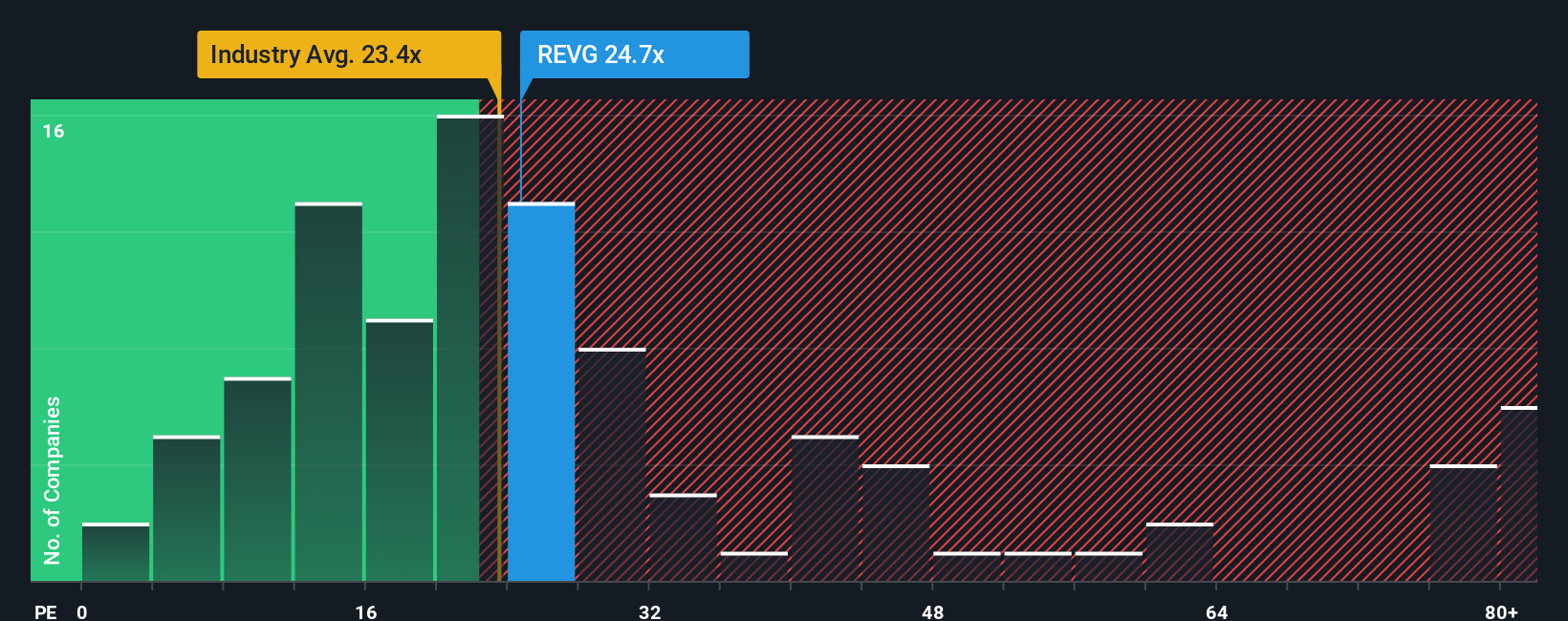

While analyst forecasts and fair value estimates point to REV Group being undervalued, the market’s favored yardstick tells a more cautious story. REV Group’s current price-to-earnings ratio sits at 24.7x, which is much higher than both its peer average (15.8x) and industry average (23.8x). Even so, it still trades below a fair ratio of 33.1x, meaning there is potential if sentiment shifts. Does this raise the risk that the market’s excitement may be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own REV Group Narrative

If you see the story differently or like to reach your own conclusions, you can build a personal analysis in just a few minutes. Do it your way

A great starting point for your REV Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You could be missing out on standout opportunities if you do not check the latest trends other investors are already acting on. The right tools help you spot up-and-coming winners before the crowd. Take the next step and broaden your investment universe today.

- Capture the income advantage by reviewing these 19 dividend stocks with yields > 3%, packed with reliable high-yield opportunities for long-term growth.

- Ride the wave of artificial intelligence by tapping into these 24 AI penny stocks, where innovation is reshaping entire industries.

- Spot value now by seizing these 898 undervalued stocks based on cash flows, which have the potential to outperform as market sentiment shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REVG

REV Group

Designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in North America and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives