- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Will Redwire’s (RDW) Board and CFO Changes Reshape Its Governance and Strategic Priorities?

Reviewed by Sasha Jovanovic

- Redwire Corporation recently announced a major leadership transition, with CFO Jonathan Baliff retiring at the end of November and Chris Edmunds, the current Chief Accounting Officer, set to succeed him; in addition, General (RET) James McConville and Dorothy D. Hayes have joined the board as independent directors, while Jonathan Baliff and John S. Bolton stepped down.

- This board refresh and CFO succession plan introduces new governance perspectives and experience, signaling a possible shift in oversight and organizational priorities at Redwire.

- We’ll examine how these leadership changes and board appointments may impact Redwire’s investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Redwire Investment Narrative Recap

To own Redwire stock, you need to believe in its potential to capitalize on the increasing demand for space infrastructure and defense solutions, driven by public and private investment in space and aerospace technologies. The recent CFO succession and board appointments are not expected to materially alter the immediate catalyst for Redwire, winning large government and commercial contracts, but may boost governance oversight; however, the main short-term risk remains the volatility and unpredictability in U.S. government contracting, which can disrupt revenue recognition and forward visibility.

Among recent announcements, Redwire’s contract award with Axiom Space to provide solar array wings for a new commercial space station stands out. This development is especially relevant now, as it reinforces Redwire's position in the growing commercial space infrastructure market at a time when the company’s leadership is undergoing change.

In contrast, with all the focus on new leadership, investors should also be aware of ongoing revenue shifts that come with...

Read the full narrative on Redwire (it's free!)

Redwire's narrative projects $887.3 million revenue and $73.2 million earnings by 2028. This requires 50.3% yearly revenue growth and a $322.7 million increase in earnings from -$249.5 million.

Uncover how Redwire's forecasts yield a $18.06 fair value, a 107% upside to its current price.

Exploring Other Perspectives

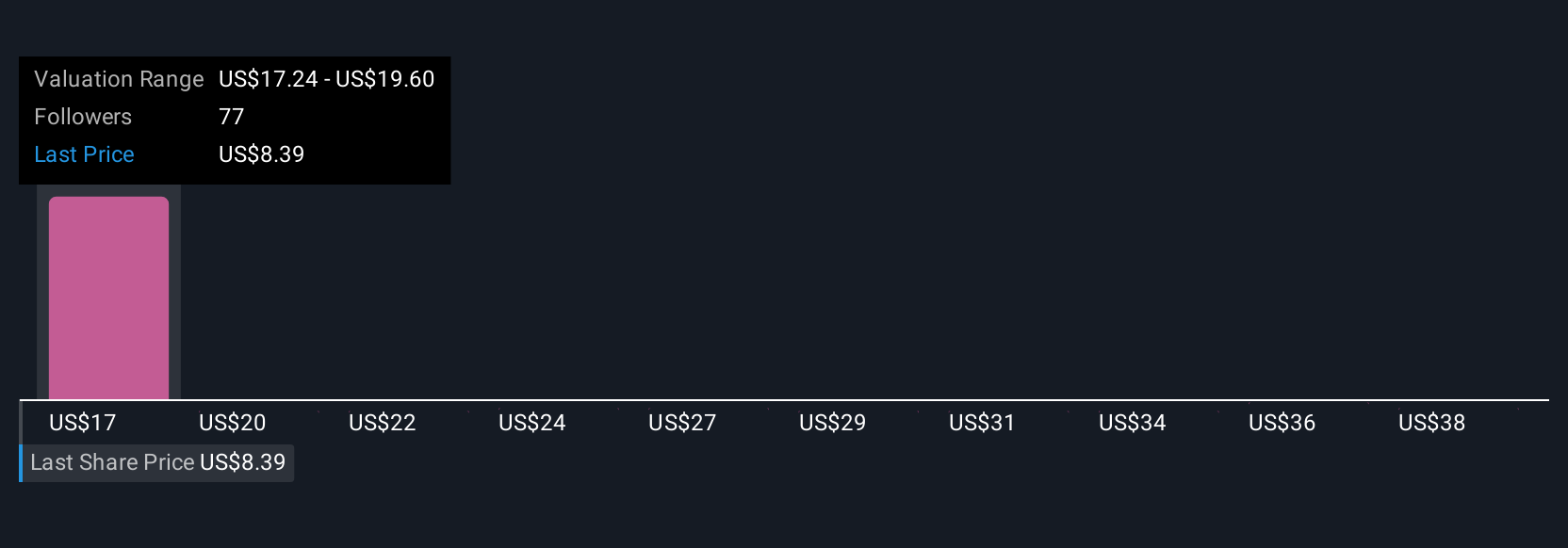

Ten individual perspectives in the Simply Wall St Community estimate Redwire’s fair value between US$17.24 and US$40.80 per share. While contract wins fuel optimism among some, ongoing risk from U.S. government budget unpredictability could weigh on outcomes, check out how your view compares.

Explore 10 other fair value estimates on Redwire - why the stock might be worth just $17.24!

Build Your Own Redwire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Redwire research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Redwire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Redwire's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives