- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

What Redwire (RDW)'s NASA Space Station Biotech Contract Could Mean for Shareholders

Reviewed by Simply Wall St

- On August 28, 2025, Redwire Corporation announced it was awarded a NASA indefinite-delivery/indefinite-quantity contract with a US$25 million ceiling over five years to provide biotechnology facilities, on-orbit operational support, and mission integration for the International Space Station, including an initial US$2.5 million task order for drug development with its PIL-BOX technology.

- This milestone highlights both NASA’s recognition of Redwire’s space biotechnology capabilities and the potential for ongoing contract opportunities that could broaden Redwire’s involvement in high-value microgravity science research.

- We'll explore how securing the NASA contract may support Redwire's push into in-space manufacturing and commercial research applications.

The latest GPUs need a type of rare earth metal called Terbium and there are only 29 companies in the world exploring or producing it. Find the list for free.

Redwire Investment Narrative Recap

For Redwire shareholders, the core investment case has always been about capturing leadership in the fast-evolving in-space manufacturing and research market, areas that depend on consistent contract flow and technological adoption. The new NASA IDIQ contract, with a US$25 million ceiling and initial US$2.5 million task order, is a visible endorsement of Redwire’s biotech offerings, but with task orders issued at NASA’s discretion, revenue timing and backlog security remain the most important short-term catalysts and risks. While this contract supports Redwire’s growth ambitions, the unpredictable cadence of government contract awards and execution means the impact on near-term earnings visibility may not be material, so revenue recognition volatility continues to overshadow the narrative for now.

One recent corporate milestone that ties directly into this news is the August 4, 2025 announcement of Redwire’s new SpaceMD subsidiary, focused on producing seed crystals for pharmaceuticals in microgravity, a move that strengthens the company’s commercial research credentials and creates fresh opportunities for proprietary IP with its PIL-BOX platform. As Redwire expands its presence on the International Space Station, these related ventures could act as critical revenue drivers and support longer-term differentiation if successful adoption occurs.

However, in contrast to the optimism around government awards, investors should not overlook the ongoing challenge of persistent volatility in US government contracting processes, which ...

Read the full narrative on Redwire (it's free!)

Redwire's narrative projects $887.3 million revenue and $73.2 million earnings by 2028. This requires 50.3% yearly revenue growth and a $322.7 million earnings increase from -$249.5 million.

Uncover how Redwire's forecasts yield a $18.06 fair value, a 102% upside to its current price.

Exploring Other Perspectives

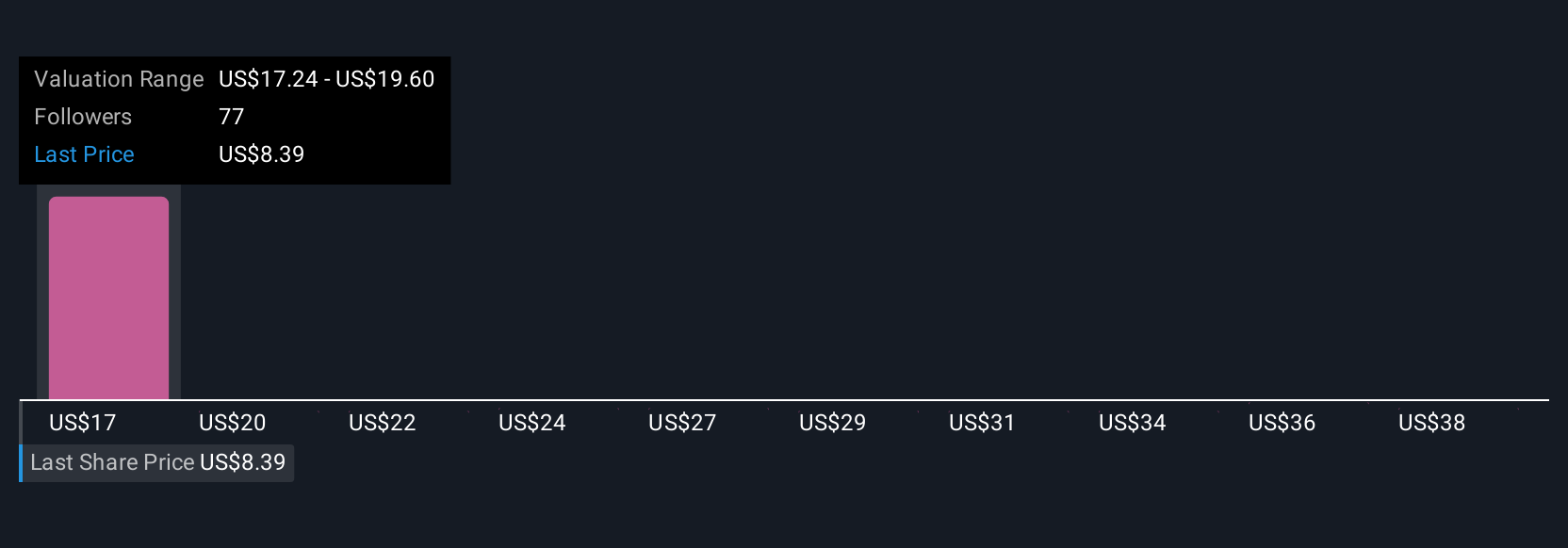

Ten independent fair value opinions from the Simply Wall St Community range from US$17.24 to US$40.80 per share. While many see opportunity in Redwire’s government partnerships, persistent unpredictability in contract timing continues to be top of mind for the wider market.

Explore 10 other fair value estimates on Redwire - why the stock might be worth just $17.24!

Build Your Own Redwire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Redwire research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Redwire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Redwire's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives