- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Revenues Tell The Story For Redwire Corporation (NYSE:RDW) As Its Stock Soars 60%

Redwire Corporation (NYSE:RDW) shares have continued their recent momentum with a 60% gain in the last month alone. This latest share price bounce rounds out a remarkable 703% gain over the last twelve months.

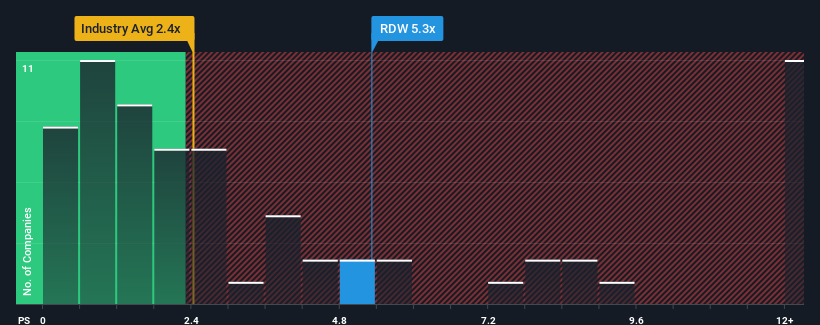

After such a large jump in price, you could be forgiven for thinking Redwire is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.3x, considering almost half the companies in the United States' Aerospace & Defense industry have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Redwire

What Does Redwire's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Redwire has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Redwire.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Redwire's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. The strong recent performance means it was also able to grow revenue by 142% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 32% per year over the next three years. That's shaping up to be materially higher than the 8.3% per year growth forecast for the broader industry.

In light of this, it's understandable that Redwire's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Redwire's P/S?

The strong share price surge has lead to Redwire's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Redwire's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Redwire that you need to be mindful of.

If these risks are making you reconsider your opinion on Redwire, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives