- United States

- /

- Construction

- /

- NYSE:PWR

Quanta Services (PWR): Revenue Growth Beats Market Average, Reinforcing Bullish Narrative

Reviewed by Simply Wall St

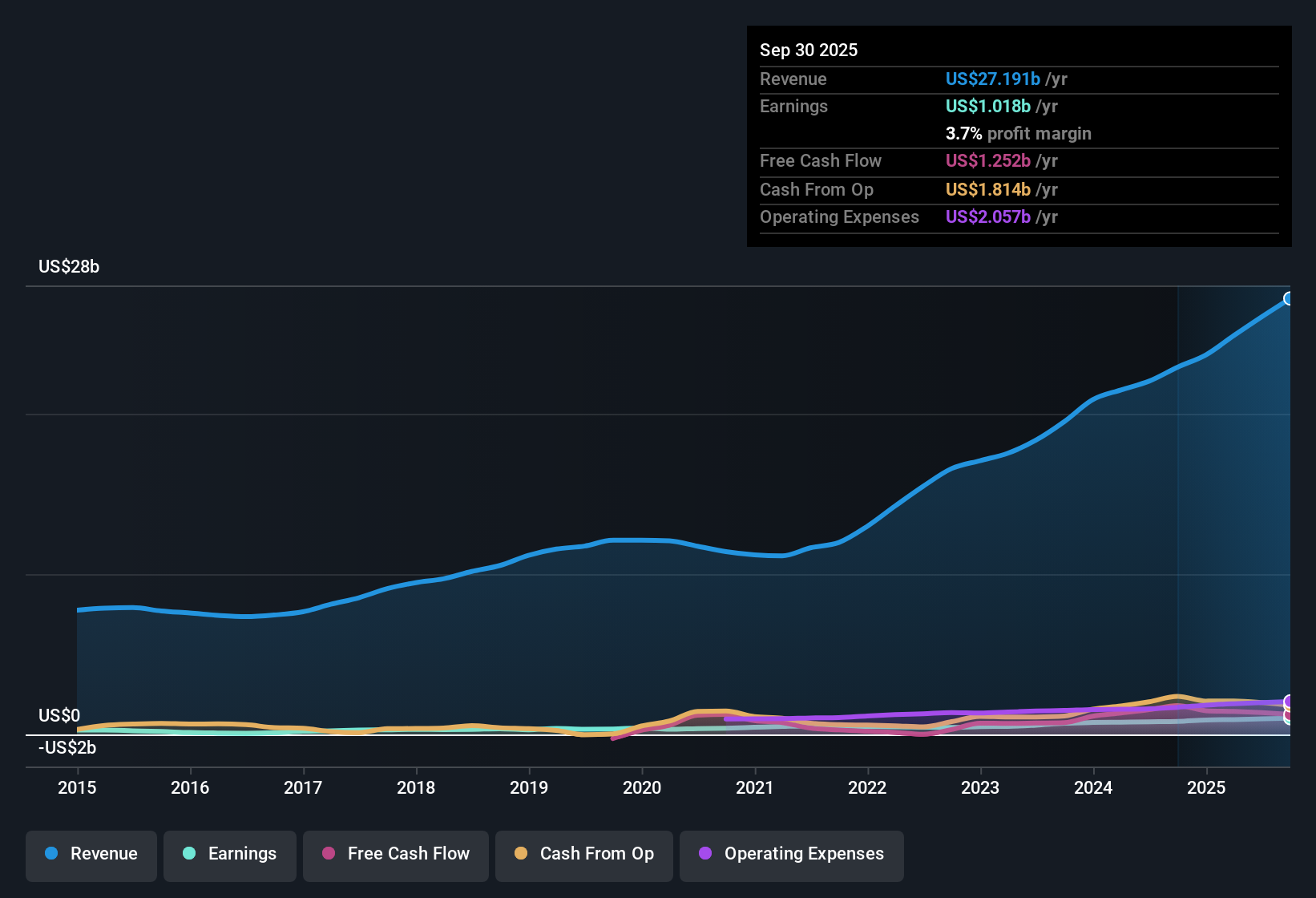

Quanta Services (PWR) posted a robust year, with revenue set to grow at 11.1% per year and net profit margin improving slightly to 3.7% from last year's 3.6%. Over the past five years, the company's earnings have expanded by 18.1% annually, including a standout 23% jump in the most recent year, outpacing US market averages at every turn. As the forecast points to continued earnings growth of 17.8% per year, investors see persistent growth and margin progress as key drivers in the story heading into the next quarter.

See our full analysis for Quanta Services.Now, let’s see how these latest results stack up against the prevailing market narratives. Some assumptions could be confirmed, while others might need to be reconsidered.

See what the community is saying about Quanta Services

Analysts Project 12.9% Annual Revenue Growth

- Looking ahead, analysts forecast Quanta Services’s revenue to grow at 12.9% per year over the next three years, surpassing both its recent 11.1% pace and the broader US market’s forecast of 10.3%.

- According to the analysts' consensus view, the growth expectation is supported by a surge in multi-year utility and renewables project pipelines and expanding high-value contracts, which together improve the company’s earnings predictability and backlog stability.

- Consistent backlog conversion and long-term project visibility, driven by rising demand for power grid upgrades and renewable integration, give management confidence in maintaining above-market top-line growth.

- Strategic acquisitions and service diversification enable cross-selling to high-growth markets, helping Quanta extend its advantage despite cyclical risk tied to broader energy and data infrastructure trends.

See how Wall Street analysts explain Quanta’s above-market growth and resilience in their narrative. 📊 Read the full Quanta Services Consensus Narrative.

Margin Expansion Targets 4.6% by 2026

- Profit margin is projected to climb from 3.7% today to 4.6% within three years, building on modest prior gains even as labor and project complexity intensify.

- The analysts' consensus view highlights that margin expansion is underpinned by Quanta’s ability to secure longer-term, higher-value contracts and operational execution expertise, but also faces challenges from labor markets and complex project execution.

- Expanding renewables EPC services and investments like Dynamic Systems are expected to offer synergistic margin improvements and exposure to faster growing segments.

- Persistent skilled labor shortages and larger, more politically sensitive projects could pressure margins if cost inflation outpaces contract terms or if regulatory hurdles delay revenue recognition.

Valuation Premium: 69.6x PE Versus Industry 35.4x

- Quanta Services trades at a PE ratio of 69.6x, which is nearly double the US construction industry average of 35.4x and well above its peer average of 38.9x.

- The analysts' consensus view notes that while robust earnings and revenue growth forecasts help justify some of this premium, the current share price of $453.83 stands both above the $435.29 analyst target and well beyond the DCF fair value of $372.72, magnifying the risk that a shift in sector momentum or execution challenges could trigger a repricing.

- Bulls point to superior growth and backlog quality as rationale for the premium, but bears warn that elevated multiples leave less room for error as industry and regulatory dynamics remain volatile.

- To align with the $435.29 analyst target by 2028, EPS would need to reach $11.56 and the PE ratio fall to 47.6x. Even this ratio would outpace industry norms and depends on flawless execution of current growth plans.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Quanta Services on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the data another way? Take just a few minutes to craft your own take and share your angle. Do it your way

A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Quanta Services’ impressive growth, its high valuation and reliance on outperforming stretched earnings targets leave it vulnerable if execution or industry dynamics shift.

If you want to spot better value for your portfolio, seek out opportunities among these 848 undervalued stocks based on cash flows that may offer greater upside with less pricing risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Quanta Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PWR

Quanta Services

Offers infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline, and energy industries in the United States, Canada, Australia, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)