- United States

- /

- Machinery

- /

- NYSE:PLOW

Discovering Hidden Opportunities In US Stocks

Reviewed by Simply Wall St

As the U.S. stock market shows resilience with the Dow Jones, S&P 500, and Nasdaq Composite all inching higher amid positive inflation data and progress in China-U.S. trade talks, investors are keenly observing opportunities within small-cap stocks that could benefit from these broader economic trends. In this landscape of cautious optimism, identifying a good stock often involves looking beyond the obvious to find companies with strong fundamentals and growth potential that may not yet be reflected in their current valuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Tompkins Financial (TMP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tompkins Financial Corporation is a financial holding company offering services in commercial and consumer banking, leasing, trust and investment management, financial planning, wealth management, and insurance with a market cap of $899.27 million.

Operations: Tompkins Financial generates revenue primarily from its banking segment, contributing $237.57 million, followed by insurance services at $40.94 million and wealth management at $20.66 million.

With total assets of US$8.2 billion and equity at US$741.4 million, Tompkins Financial stands out with its impressive earnings growth of 956.5% over the past year, far surpassing the industry average of 5.4%. The bank's deposits amount to US$6.8 billion against loans of US$6 billion, securing a net interest margin of 2.8%. However, it has an insufficient bad loan allowance at 1.2% and a low allowance for bad loans at 86%. Trading at about 47% below its estimated fair value suggests potential undervaluation in the market context.

- Navigate through the intricacies of Tompkins Financial with our comprehensive health report here.

Examine Tompkins Financial's past performance report to understand how it has performed in the past.

AdvanSix (ASIX)

Simply Wall St Value Rating: ★★★★★☆

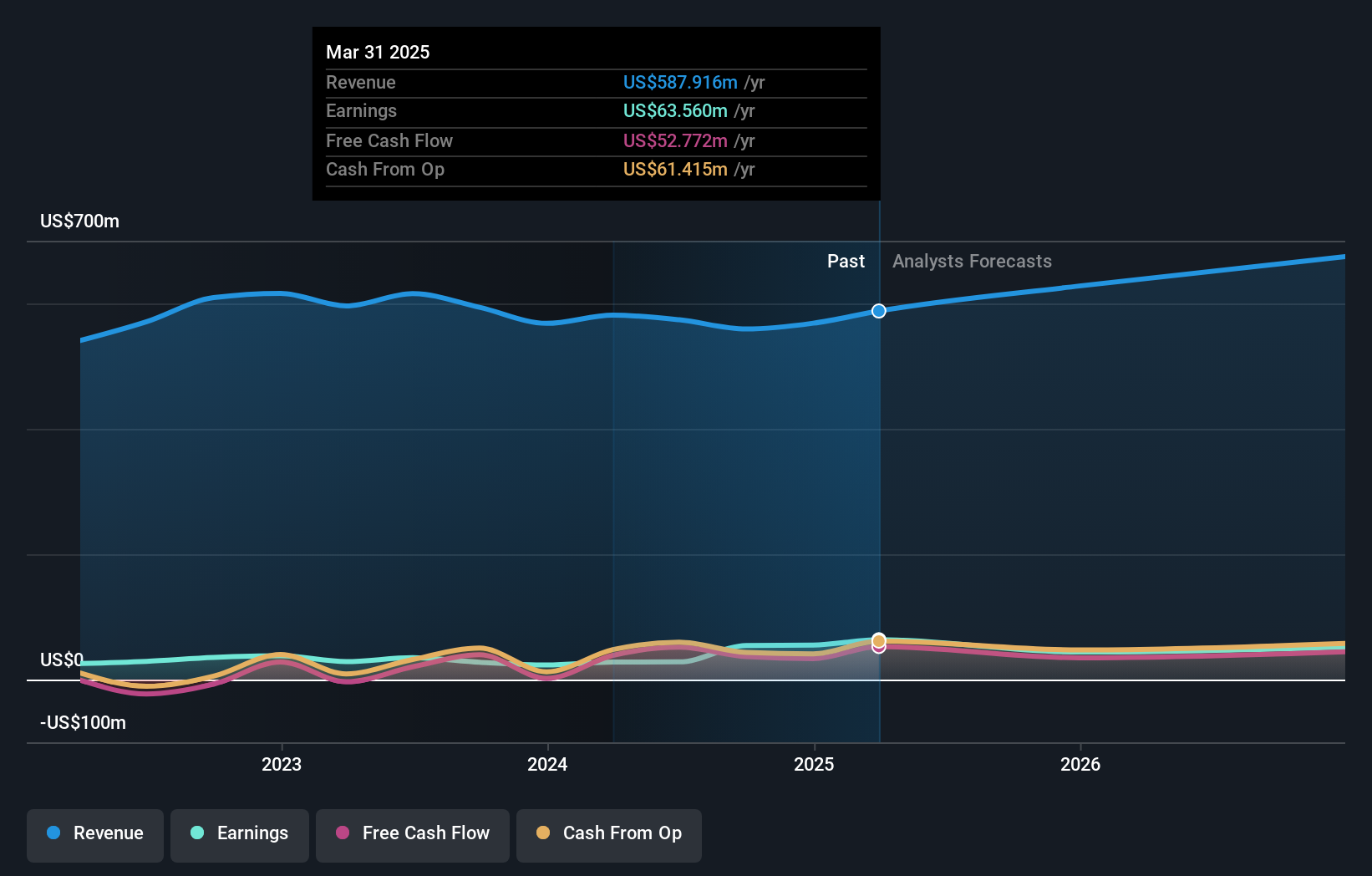

Overview: AdvanSix Inc. is a company involved in the manufacture and sale of polymer resins both domestically and internationally, with a market capitalization of approximately $654.77 million.

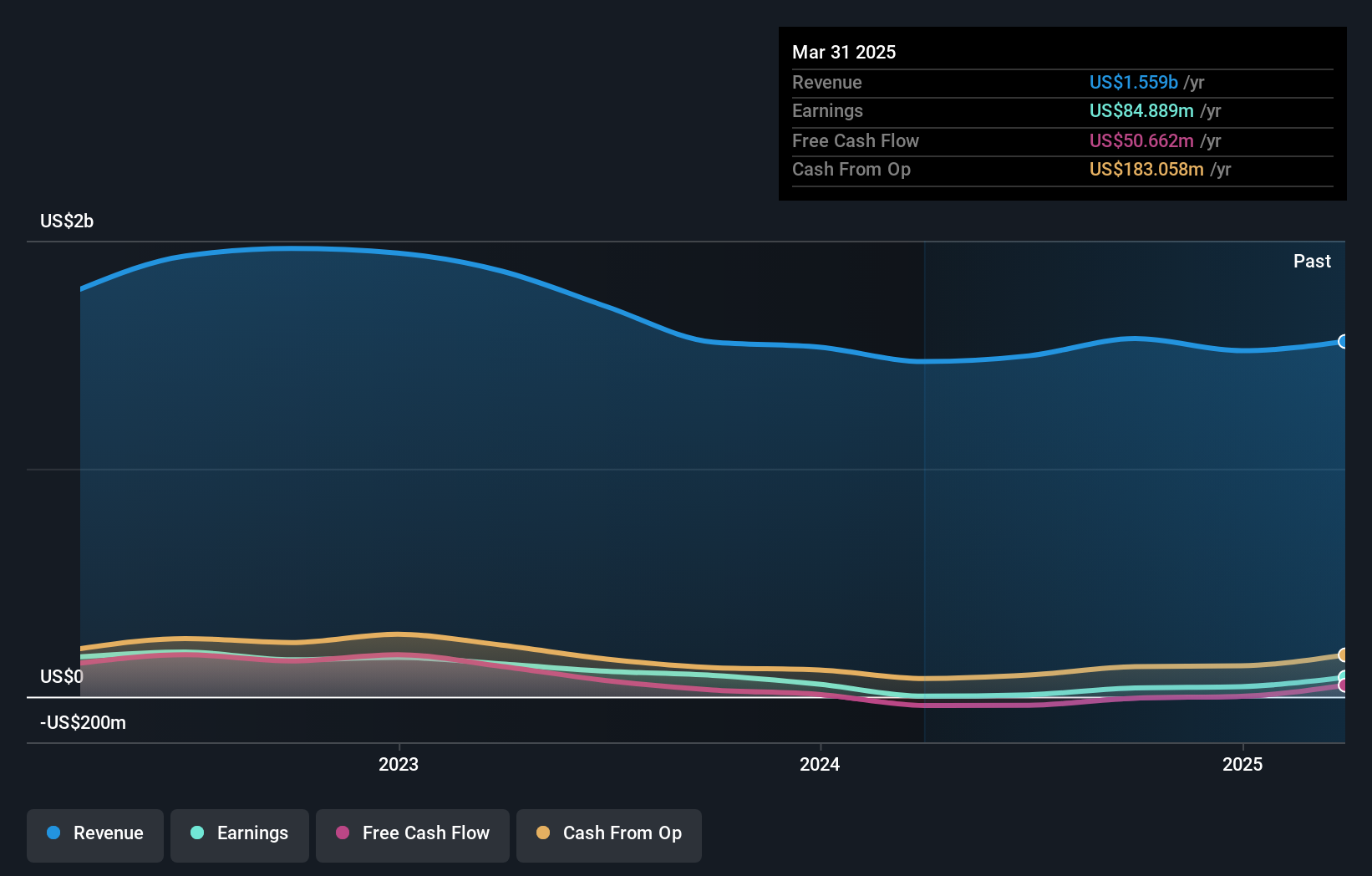

Operations: AdvanSix generates revenue primarily through its chemical manufacturing segment, which reported $1.56 billion.

AdvanSix, a nimble player in the chemicals sector, has shown impressive resilience with a remarkable 3634.7% earnings growth over the past year, significantly outpacing its industry peers. Its net debt to equity ratio stands at a satisfactory 26%, reflecting prudent financial management. The company's recent capacity expansion in ammonium sulfate production and carbon capture tax credits are set to bolster future earnings stability and cash flow. However, challenges such as rising raw material costs and global nylon market oversupply could pose hurdles. Currently trading at 34.4% below estimated fair value, AdvanSix offers potential upside for investors considering its strategic initiatives and robust financial health.

Douglas Dynamics (PLOW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Douglas Dynamics, Inc. is a North American manufacturer and upfitter specializing in commercial work truck attachments and equipment, with a market cap of $660.77 million.

Operations: The company's revenue is primarily derived from two segments: Work Truck Solutions ($319.29 million) and Work Truck Attachments ($268.63 million).

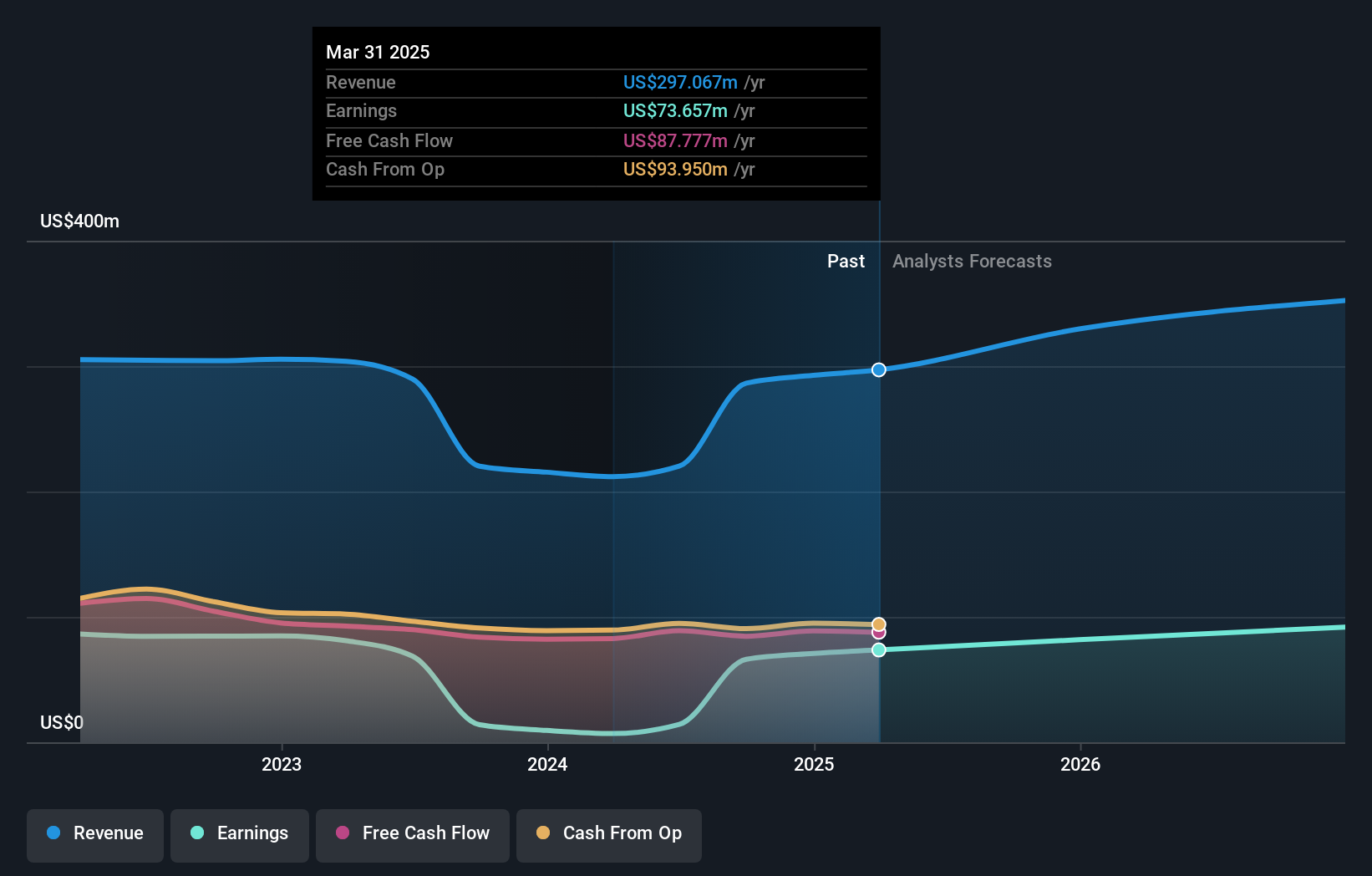

Douglas Dynamics, a key player in the commercial truck equipment sector, has seen its earnings surge by 127% over the past year, outpacing industry growth. The company's net debt to equity ratio stands at a high 66.7%, though interest payments are well-covered with EBIT at four times the required amount. Despite significant insider selling recently, Douglas Dynamics trades at 13% below its estimated fair value and has reduced its debt from 94% to 70% in five years. Recent leadership changes and strategic focus on municipal markets suggest potential for steady revenue despite challenges like variable snowfall impacting demand.

Taking Advantage

- Click through to start exploring the rest of the 278 US Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLOW

Douglas Dynamics

Operates as a manufacturer and upfitter of commercial work truck attachments and equipment in North America.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives