- United States

- /

- Machinery

- /

- NYSE:OTIS

The Bull Case For Otis Worldwide (OTIS) Could Change Following European Launch of Arise Elevator Modernization Solutions

Reviewed by Sasha Jovanovic

- In September 2025, Otis Worldwide announced the launch of its Arise™ MOD Prime and MOD Plus elevator modernization solutions in key European markets to tackle the challenge of aging elevator infrastructure with enhanced safety, energy efficiency, and digital connectivity.

- This initiative enables building owners to customize the scope and pace of upgrades, potentially broadening adoption and supporting increased demand for Otis’s modernization services in Europe.

- We'll examine how these modernization solutions, emphasizing flexibility for building owners, may influence Otis Worldwide's investment narrative going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Otis Worldwide Investment Narrative Recap

To be an Otis Worldwide shareholder, you need to believe in the company’s ability to turn Europe’s aging elevator infrastructure into a predictable stream of high-margin modernization and service revenue, while offsetting weak new equipment sales, especially in China and commercial real estate markets. The launch of the Arise™ MOD Prime and MOD Plus solutions in Europe supports the modernization growth story, but is not expected to materially shift the main short-term catalyst: ongoing momentum in modernization order conversion and recurring service revenue. Persistent headwinds in new installations and price pressure, especially from China, remain the core risk.

Of recent announcements, Wolfe Research’s recent upgrade to Outperform stands out in this context. It draws attention to the bullish side of Otis’s plan to bolster recurring revenue by expanding modernization offerings like Arise™, despite analyst caution and macro pressures lingering over new equipment demand.

But while modernization and service growth may fuel optimism, investors should also factor in continuing exposure to prolonged weakness in...

Read the full narrative on Otis Worldwide (it's free!)

Otis Worldwide's outlook anticipates $16.4 billion in revenue and $1.9 billion in earnings by 2028. This is based on a projected 5.0% annual revenue growth rate and a $0.4 billion earnings increase from the current $1.5 billion.

Uncover how Otis Worldwide's forecasts yield a $100.23 fair value, a 12% upside to its current price.

Exploring Other Perspectives

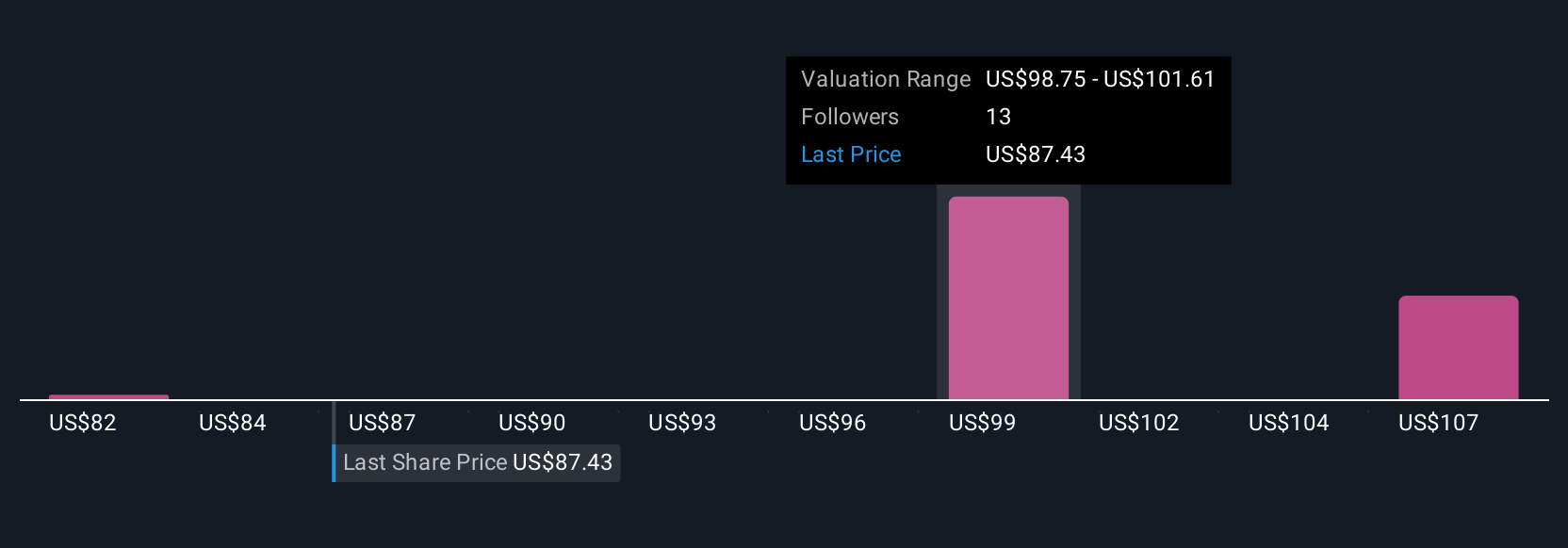

Four members of the Simply Wall St Community estimate fair value between US$81.56 and US$109.62 per share. With modernization forming the main catalyst, this spread highlights how opinions on Otis’s earnings potential and risks can widely differ, explore several perspectives before forming your own view.

Explore 4 other fair value estimates on Otis Worldwide - why the stock might be worth as much as 23% more than the current price!

Build Your Own Otis Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Otis Worldwide research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Otis Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Otis Worldwide's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OTIS

Otis Worldwide

Engages in manufacturing, installation, and servicing of elevators and escalators in the United States, China, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives