- United States

- /

- Machinery

- /

- NYSE:OSK

Is There Now an Opportunity in Oshkosh After Recent US Army Vehicle Contract?

Reviewed by Bailey Pemberton

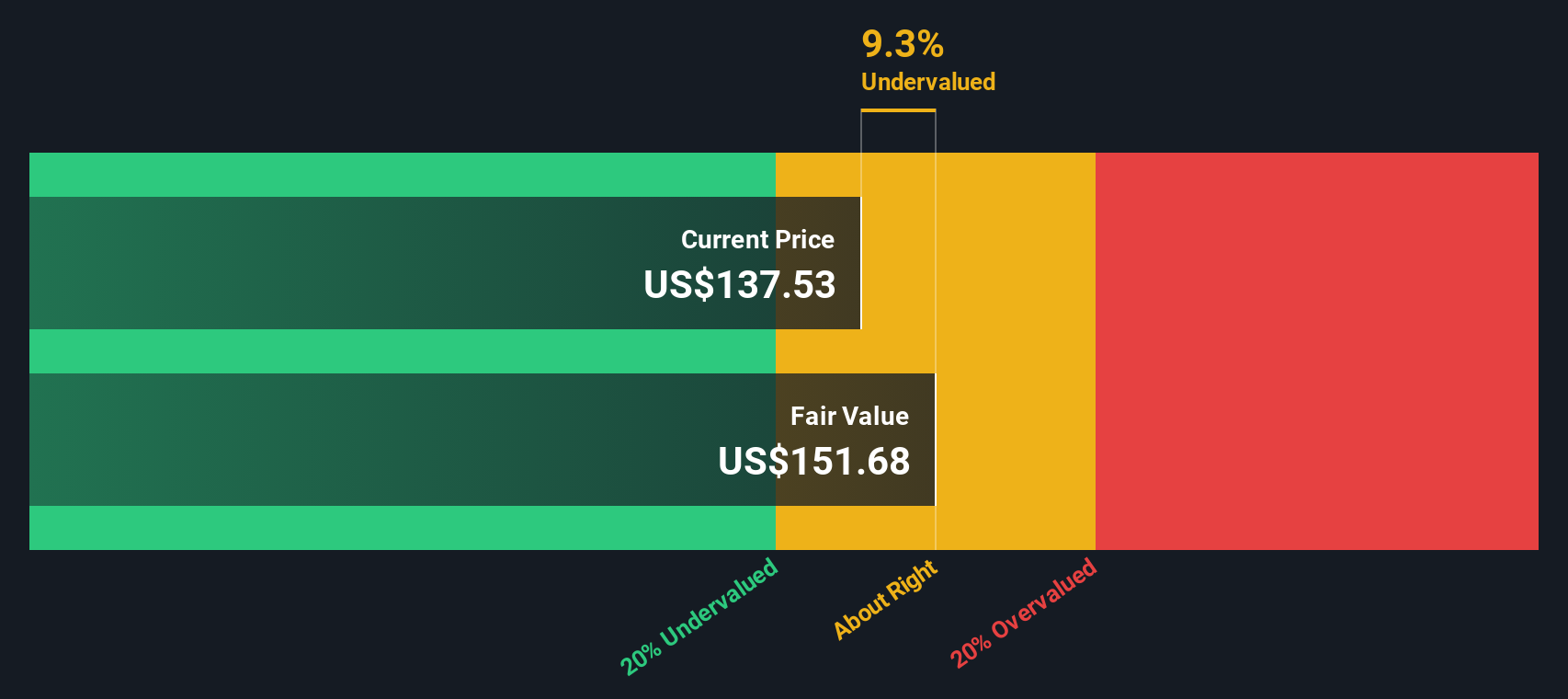

Thinking about what to do with Oshkosh stock right now? If the recent rollercoaster in share prices has you second-guessing your next move, you’re definitely not alone. Over the last seven days, the stock is down 5.5%, and it’s slipped 9.3% in the past month. But zoom out a little, and Oshkosh has actually rewarded patient investors, climbing an impressive 32.8% year-to-date and gaining more than 73% over the last three years. Recent sector-wide volatility, influenced by shifting market expectations and larger macroeconomic trends, has likely weighed on short-term sentiment. Still, longer trends hint at enduring strength and possible growth ahead.

What really stands out right now is Oshkosh’s valuation score: a perfect 6 out of 6. In other words, under all six key valuation checks, the company currently looks undervalued. That means there’s good reason to look beyond this quarter’s swings and see if the stock deserves a spot in your portfolio for the long haul. Let’s walk through each of these valuation methods to see what’s driving this top score. After breaking down the standard approaches, we’ll consider a deeper way to look at what Oshkosh is really worth.

Approach 1: Oshkosh Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to their present value. This approach essentially asks, "What is the value of all the cash Oshkosh will generate in the future, expressed in today’s dollars?"

For Oshkosh, the analysis starts with its most recent Free Cash Flow (FCF) of $515.3 million. Over the next several years, analysts project sustained FCF growth, with estimates reaching $697.9 million by 2026 and $736.5 million by 2027. While analyst projections extend five years, further growth in FCF, approaching $977.0 million by 2035, is extrapolated to deliver a clearer long-term outlook.

Taking these projected figures together, the DCF model produces an intrinsic fair value of $212.82 per share. This number is about 41.6% higher than the current market price, indicating a significant discount. In simple terms, Oshkosh stock appears to be quite undervalued when considering what the business should be worth based on its future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Oshkosh is undervalued by 41.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

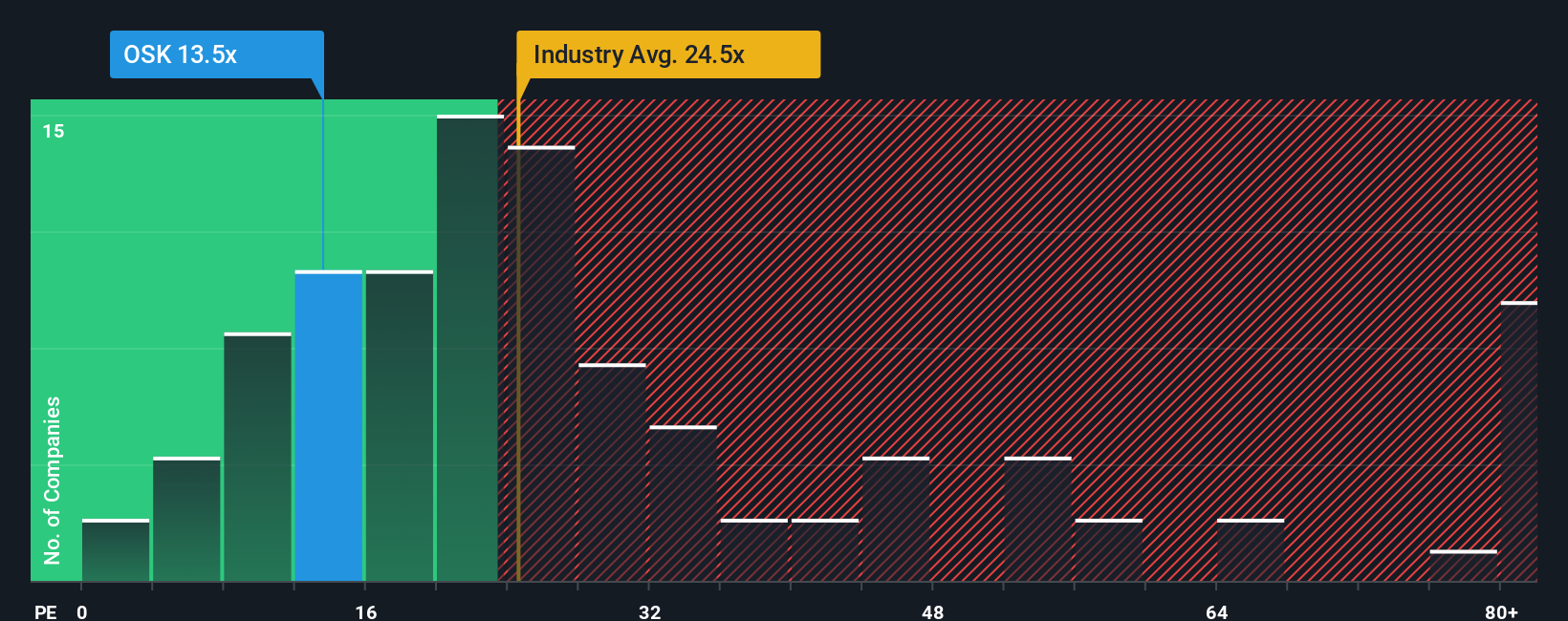

Approach 2: Oshkosh Price vs Earnings (PE)

When valuing profitable companies like Oshkosh, the Price-to-Earnings (PE) ratio is often the go-to metric. The PE ratio helps investors understand how much the market is willing to pay for each dollar of a company’s earnings. This makes it especially useful when earnings are reliable and consistent.

It is important to remember that what counts as a “normal” PE ratio is not fixed. Factors such as expected future growth, perceived risks, industry conditions, market cap, and profit margins all play a role in determining whether a particular PE is justified. Faster-growing, lower-risk companies usually command higher PE multiples, while slower-growing or more volatile firms tend to have lower ones.

Oshkosh currently trades at a PE ratio of 12.2x. That is well below the machinery industry average of 23.4x and its peer group average of 19.4x, hinting that the market may be unduly cautious about the stock’s prospects. However, Simply Wall St’s proprietary Fair Ratio, which incorporates all the relevant factors specific to Oshkosh and not just peers or the broad industry, suggests a fair PE of 26.6x. This metric looks beyond basic comparisons and blends in company-specific growth, risks, profit margins, and market cap to deliver a more tailored valuation benchmark.

Given Oshkosh’s PE ratio is less than half its Fair Ratio, the stock appears notably undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Oshkosh Narrative

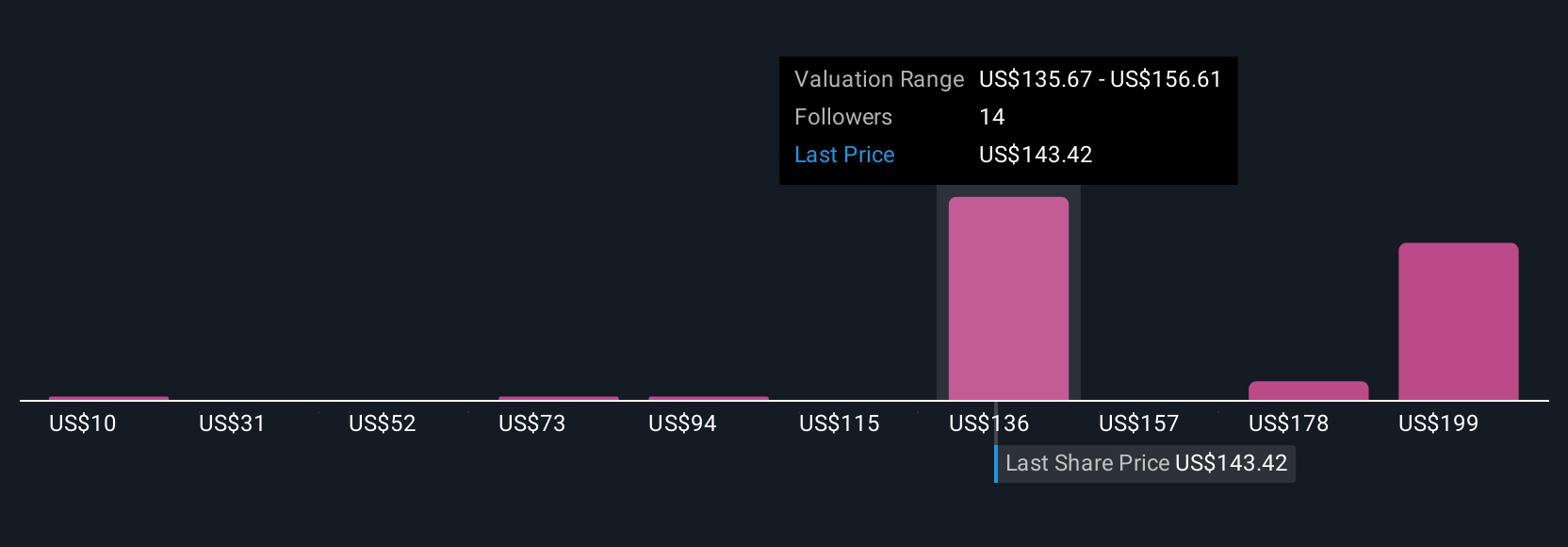

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful concept: it is your own story about where a company is heading, built around your view of future revenues, profits, and margins, which then flows through to an estimated fair value. Narratives make investing more accessible by letting you express how you see Oshkosh growing, not just as numbers, but as a story that connects business drivers, forecasts, and valuation.

Narratives are available on Simply Wall St’s Community page, where millions of investors share and compare their perspectives, making it easy for you to participate or learn from others. Each Narrative links the company’s most important business trends (like infrastructure expansion and electric mobility for Oshkosh) to a financial forecast and then to a fair value, so you can quickly decide if the stock looks undervalued or overvalued compared to the current price. In addition, Narratives are dynamic and update automatically as new information, such as earnings or news, comes in, so your analysis stays current and relevant.

For example, regarding Oshkosh, some investors may use the most optimistic Narrative, projecting an aggressive price target of $188.00 fueled by robust earnings growth and new market expansion. The most cautious Narrative sets a fair value as low as $119.00, highlighting risks from government contract dependence and margin pressures. This shows how Narratives help you find a valuation that truly matches your own outlook.

Do you think there's more to the story for Oshkosh? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSK

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives