- United States

- /

- Building

- /

- NYSE:OC

What Do Recent Market Slides Mean for Owens Corning’s True Value in 2025?

Reviewed by Bailey Pemberton

If you’ve spent any time looking at Owens Corning stock lately, you might be wondering whether now’s the right moment to buy, hold, or simply watch from the sidelines. With a share price closing at $126.96, it’s easy to get caught up in the swirl of recent market moves. Over the last week, the stock has ticked up by 0.4%, but zoom out and you’ll see a sharp dip of 13.1% in the past month and a hefty slide of 25.0% year-to-date. That might sound bleak, but take a step back. Owens Corning is still up 55.0% over three years and an impressive 93.0% over five. Those are some serious long-term gains.

What’s causing all this volatility? Some recent shifts in industry outlook, changing expectations for the construction sector, and broader market turbulence have each played a role in investors’ mood swings. Yet, here’s where things get really interesting: when it comes to valuation, Owens Corning absolutely stands out. Across six major undervaluation checks, the company scores a flawless 6. That means it’s potentially undervalued in every metric that counts, something you don’t often see, even among market favorites.

Of course, knowing the score is just the start. The real question is, how do experts actually measure value, and which approaches hold up best when markets are this unpredictable? Let’s break down the main ways analysts size up a stock’s worth. Stick around, because we’ll finish with a smarter, even more insightful framework for thinking about value that you won’t want to miss.

Approach 1: Owens Corning Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular tool that analysts use to estimate a company's intrinsic value by forecasting its future cash flows and then discounting those amounts back to today's dollars. In the case of Owens Corning, this method takes into account an array of projected free cash flows over the next decade to capture the company's earning power and growth potential.

Currently, Owens Corning generates free cash flow of approximately $963 million. Analyst consensus predicts this figure will rise to about $1.28 billion by 2027. Further projections, extrapolated beyond analysts’ formal estimates, suggest free cash flow could reach roughly $2.06 billion in a decade. These calculations are all in US dollars, providing a straightforward basis for valuation.

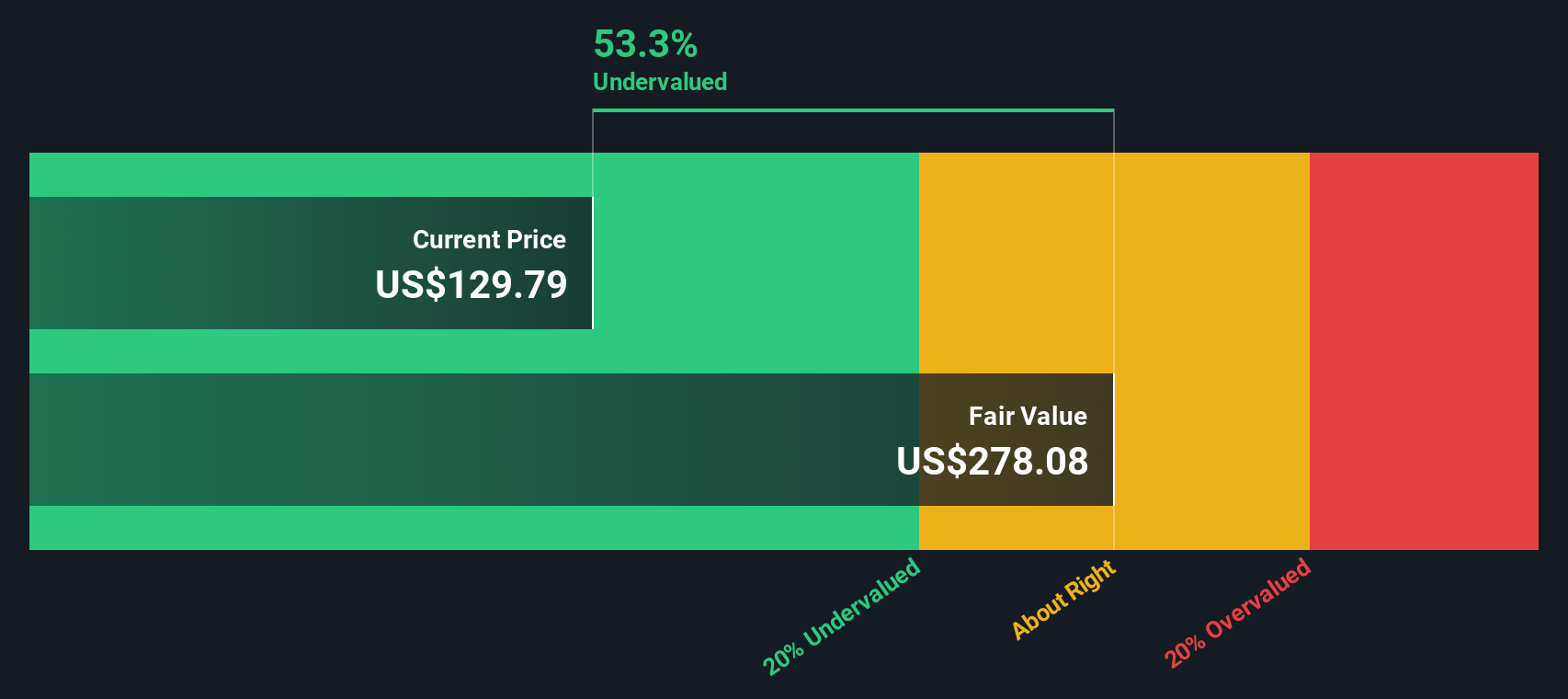

The DCF model estimates Owens Corning's fair intrinsic value at $274.59 per share, which is substantially higher than the recent closing price of $126.96. This means the stock is considered about 53.8% undervalued using DCF analysis, signaling an attractive margin of safety for long-term investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Owens Corning is undervalued by 53.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Owens Corning Price vs Earnings (P/E)

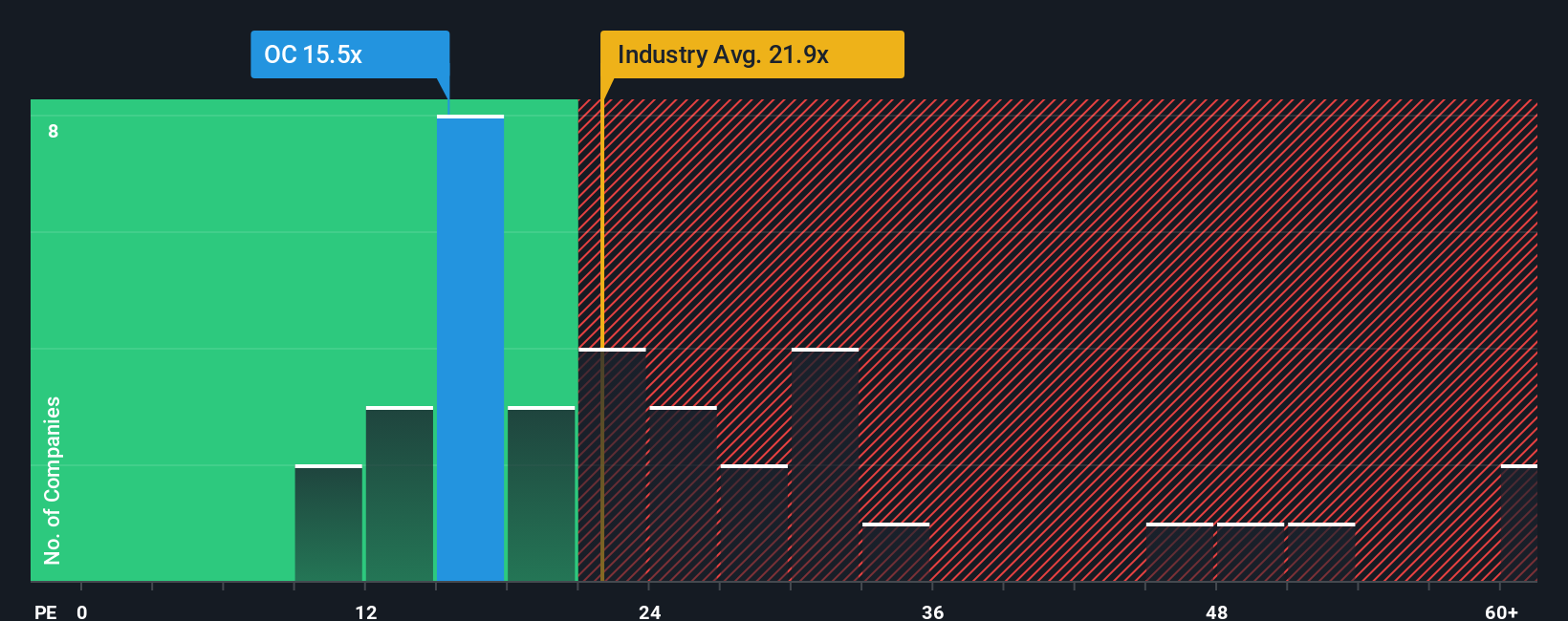

For profitable companies like Owens Corning, the price-to-earnings (P/E) ratio is a logical and widely trusted benchmark for valuation. It shows how much investors are currently willing to pay per dollar of earnings, which makes it easy to compare companies of different sizes. A company with steadily rising profits typically commands a higher P/E, while slower growth or increased risk tends to lower what the market considers “fair.”

Right now, Owens Corning trades at a P/E of 15.1x. For context, the building industry average P/E sits at 20.3x, and the average across its main peers is even higher at 24.4x. At first glance, Owens Corning looks cheap relative to both its industry and peers.

But there is a more tailored way to judge value with the "Fair Ratio." This proprietary Simply Wall St metric estimates the most appropriate multiple for Owens Corning by factoring in its earnings growth, risk, profit margins, size, and broader industry outlook. Unlike blunt industry averages or simple peer comparisons, the Fair Ratio is specifically modeled for how much the market should reasonably pay for Owens Corning.

For Owens Corning, the Fair Ratio is 35.7x, which is more than double its current P/E of 15.1x. Because the actual multiple is far below this fair value benchmark, it appears the stock may be meaningfully undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Owens Corning Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects your view of a company's future, such as how revenue, earnings, or profit margins could grow, to a specific financial forecast and a fair value estimate. This creates a clear story that explains why you think a stock is worth more or less than the market price.

Narratives are simple and accessible tools featured on Simply Wall St's Community page and trusted by millions of investors. They help you quickly see how different outlooks can lead to different investment decisions. By linking a story—explaining why the business will do well or face challenges—to key financial assumptions and an up-to-date fair value, Narratives empower you to decide when to buy, hold, or sell. These Narratives automatically update if new data or news affects the outlook.

For example, looking at Owens Corning, one Narrative points to a bullish $210 price target based on strong demand for sustainable products and solid profit margins, while a more cautious Narrative projects a $157 target, reflecting concerns about competition and industry headwinds. With Narratives, you can compare these real investor perspectives and use the data to shape your own conclusions more confidently.

Do you think there's more to the story for Owens Corning? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OC

Owens Corning

Provides residential and commercial building products in the United States, Europe, the Asia Pacific, and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion