The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Owens Corning (NYSE:OC). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Owens Corning

Owens Corning's Improving Profits

Owens Corning has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Owens Corning's EPS skyrocketed from US$10.67 to US$14.65, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 37%.

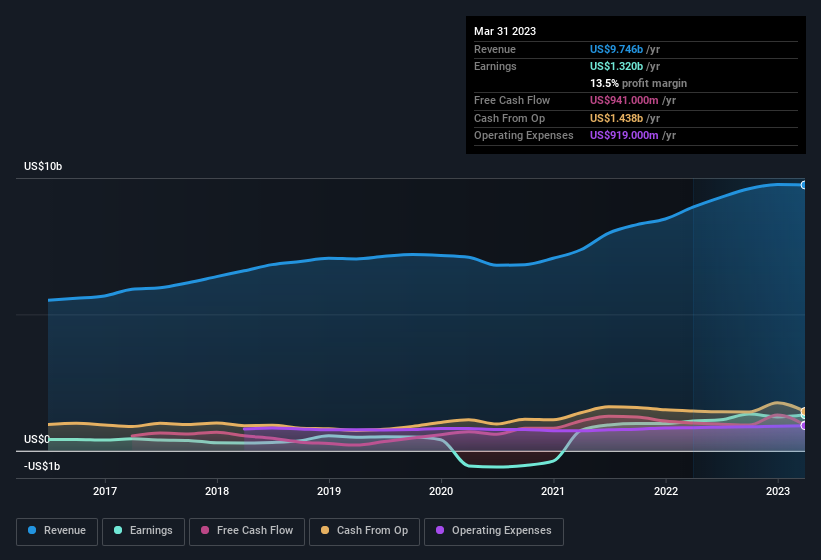

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Owens Corning remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 9.2% to US$9.7b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Owens Corning's future EPS 100% free.

Are Owens Corning Insiders Aligned With All Shareholders?

Since Owens Corning has a market capitalisation of US$9.5b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. As a matter of fact, their holding is valued at US$47m. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.5%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Owens Corning Deserve A Spot On Your Watchlist?

For growth investors, Owens Corning's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Owens Corning's continuing strength. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. Before you take the next step you should know about the 3 warning signs for Owens Corning (1 is a bit concerning!) that we have uncovered.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OC

Owens Corning

Provides residential and commercial building products in the United States, Europe, the Asia Pacific, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives