- United States

- /

- Building

- /

- NYSE:OC

Discovering Pinnacle Financial Partners And Two Stocks Possibly Priced Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock markets begin a holiday-shortened week with significant gains, buoyed by investor optimism over potential Federal Reserve interest rate cuts, there is increased attention on identifying stocks that may be undervalued amidst this positive momentum. In such an environment, discerning investors often look for opportunities where market prices do not fully reflect a company's intrinsic value, making it essential to explore stocks like Pinnacle Financial Partners and others that might be priced below their estimated worth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Peraso (PRSO) | $0.8804 | $1.72 | 48.7% |

| Old National Bancorp (ONB) | $21.10 | $41.46 | 49.1% |

| Nicolet Bankshares (NIC) | $121.66 | $242.17 | 49.8% |

| MoneyHero (MNY) | $1.23 | $2.43 | 49.3% |

| Huntington Bancshares (HBAN) | $15.88 | $31.35 | 49.4% |

| First Busey (BUSE) | $23.21 | $45.34 | 48.8% |

| Fifth Third Bancorp (FITB) | $42.42 | $83.68 | 49.3% |

| CNB Financial (CCNE) | $25.02 | $48.83 | 48.8% |

| Circle Internet Group (CRCL) | $71.33 | $140.47 | 49.2% |

| Beacon Financial (BBT) | $24.93 | $48.66 | 48.8% |

Let's uncover some gems from our specialized screener.

Pinnacle Financial Partners (PNFP)

Overview: Pinnacle Financial Partners, Inc. is a bank holding company for Pinnacle Bank, offering a range of banking products and services to individuals, businesses, and professional entities in the United States with a market cap of $6.93 billion.

Operations: The company's revenue is primarily derived from its banking segment, which generated $1.89 billion.

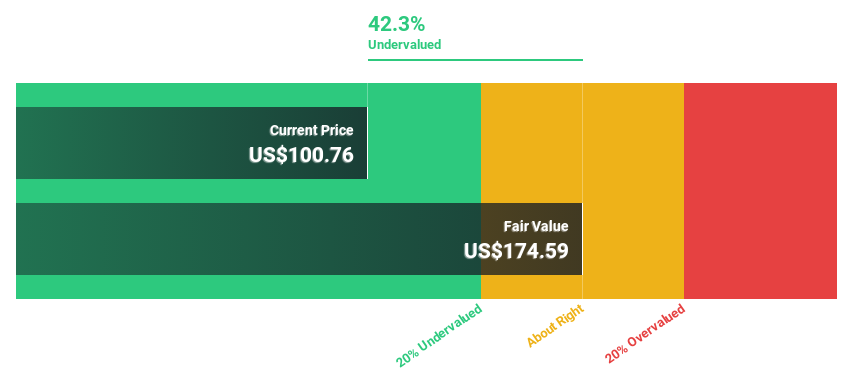

Estimated Discount To Fair Value: 38.4%

Pinnacle Financial Partners is trading at US$90.12, significantly below its estimated fair value of US$146.34, suggesting it may be undervalued based on cash flows. The company's earnings grew 50.7% over the past year and are expected to continue growing at 47.75% annually, outpacing both revenue growth forecasts and the broader U.S. market averages. Despite strong financial performance, recent buyback activity was negligible with no shares repurchased recently despite announcements earlier this year.

- The analysis detailed in our Pinnacle Financial Partners growth report hints at robust future financial performance.

- Navigate through the intricacies of Pinnacle Financial Partners with our comprehensive financial health report here.

Solstice Advanced Materials (SOLS)

Overview: Solstice Advanced Materials, Inc. is a specialty chemicals and advanced materials company operating in the United States and internationally with a market cap of $7.05 billion.

Operations: Solstice Advanced Materials generates revenue from two main segments: Electronic & Specialty Materials, contributing $1.09 billion, and Refrigerants & Applied Solutions, accounting for $2.73 billion.

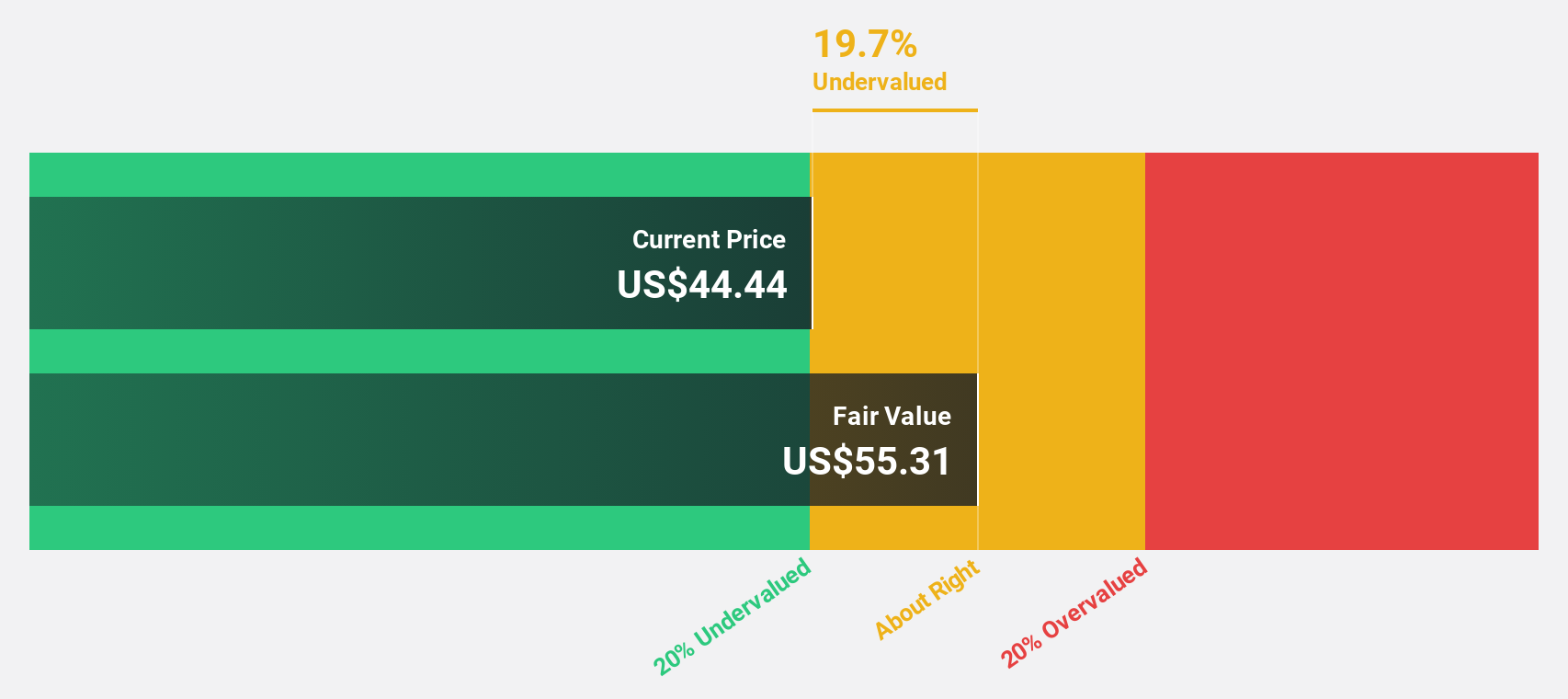

Estimated Discount To Fair Value: 19.7%

Solstice Advanced Materials is trading at US$44.44, below its estimated fair value of US$55.31, indicating potential undervaluation based on cash flows. Despite a significant forecasted earnings growth of 26.7% annually, revenue growth remains modest at 3.6% per year, trailing the broader U.S. market. Recent third-quarter results show a net loss of US$35 million compared to last year's profit, and while the company reaffirmed its full-year sales guidance, it faces challenges with declining profit margins and high share illiquidity.

- Insights from our recent growth report point to a promising forecast for Solstice Advanced Materials' business outlook.

- Click here to discover the nuances of Solstice Advanced Materials with our detailed financial health report.

Owens Corning (OC)

Overview: Owens Corning is a global provider of residential and commercial building products, with operations in the United States, Europe, the Asia Pacific, and other international markets; it has a market cap of $8.57 billion.

Operations: Owens Corning's revenue is primarily derived from its Roofing segment at $4.14 billion, Insulation at $3.54 billion, and Doors at $2.20 billion.

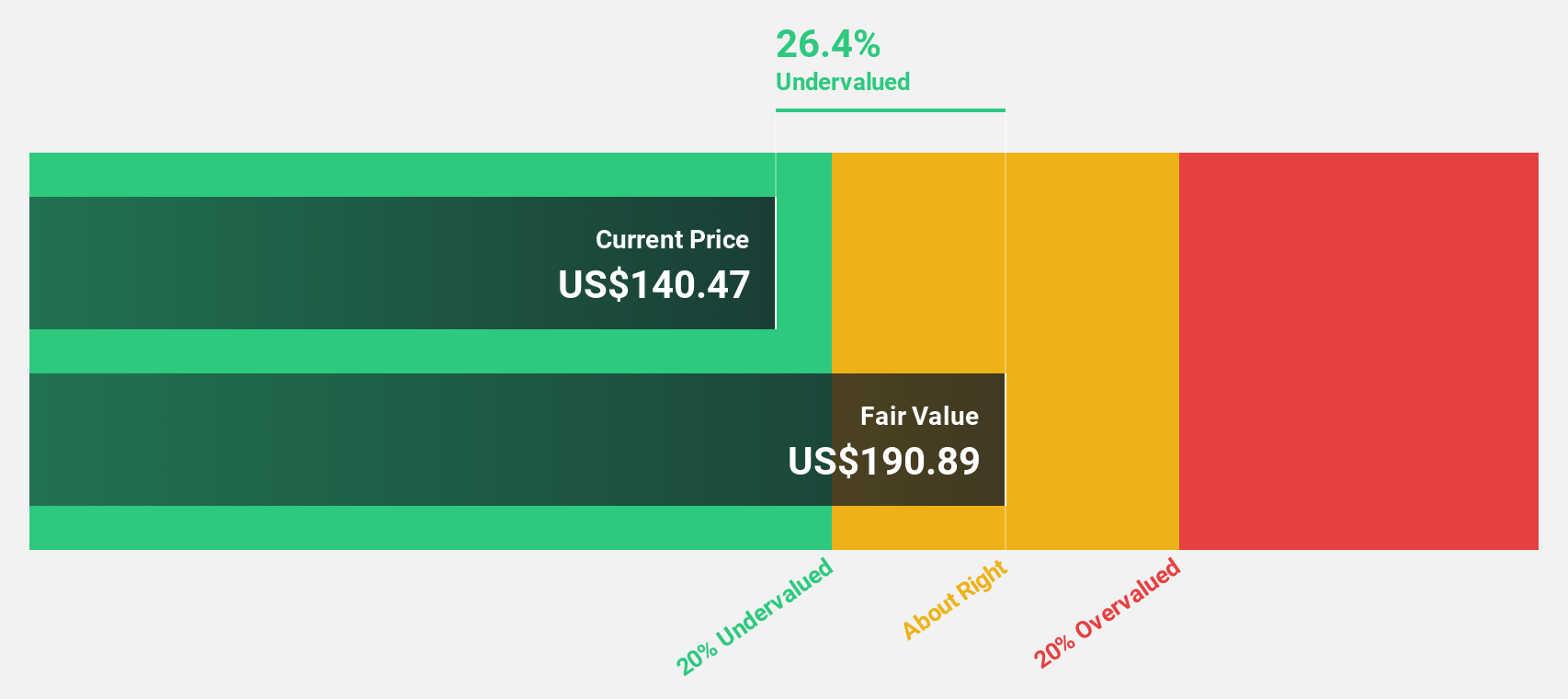

Estimated Discount To Fair Value: 19.2%

Owens Corning is trading at US$104.21, below its estimated fair value of US$129.02, highlighting potential undervaluation based on cash flows. Despite recent challenges with a goodwill impairment charge of US$780 million and a third-quarter net loss of US$494 million, the company is expected to become profitable within three years with high forecasted earnings growth. However, revenue is projected to decline by 4.1% annually over the next three years amidst high debt levels.

- According our earnings growth report, there's an indication that Owens Corning might be ready to expand.

- Unlock comprehensive insights into our analysis of Owens Corning stock in this financial health report.

Turning Ideas Into Actions

- Embark on your investment journey to our 213 Undervalued US Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OC

Owens Corning

Provides residential and commercial building products in the United States, Europe, the Asia Pacific, and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives