- United States

- /

- Aerospace & Defense

- /

- NYSE:NOC

Should Deutsche Bank’s Upgrade on Advanced Programs Prompt Action From Northrop Grumman (NOC) Investors?

Reviewed by Sasha Jovanovic

- Earlier this month, Deutsche Bank upgraded Northrop Grumman’s rating, expressing confidence in the company’s ability to generate strong free cash flow growth as major programs like the B-21 bomber and Sentinel weapons system advance.

- This analyst action highlights Northrop Grumman’s perceived resilience against rising industry competition and underscores the importance of ongoing investments in key defense projects.

- With the endorsement from Deutsche Bank reflecting improved sentiment, we’ll explore how analyst optimism around advanced programs may shift Northrop Grumman’s investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Northrop Grumman Investment Narrative Recap

To be a shareholder in Northrop Grumman, you must be confident in the long-term visibility provided by major U.S. defense contracts, especially the B-21 bomber and Sentinel programs, and in the company’s ability to deliver on these projects despite growing industry competition. Deutsche Bank’s recent upgrade underscores expectations for accelerating free cash flow as these programs mature, but it does not materially change the short-term catalyst, the progress of B-21 and Sentinel, nor the biggest risk, which remains the potential for program delays or budget changes.

Among Northrop’s recent announcements, the collaboration with Merlin to integrate autonomous technology into its Beacon ecosystem stands out. While not directly tied to the analyst upgrade, it aligns with the company’s push into advanced systems, complementing the focus on large hardware projects and potentially broadening the base for future revenue growth beyond marquee programs.

However, investors should remain aware that, despite renewed analyst optimism, significant revenue exposure to a handful of key government contracts means that even minor shifts in budget priorities or program timelines...

Read the full narrative on Northrop Grumman (it's free!)

Northrop Grumman's outlook projects $47.5 billion in revenue and $4.4 billion in earnings by 2028. This is based on a 5.5% annual revenue growth rate and a $0.5 billion increase in earnings from current earnings of $3.9 billion.

Uncover how Northrop Grumman's forecasts yield a $615.56 fair value, in line with its current price.

Exploring Other Perspectives

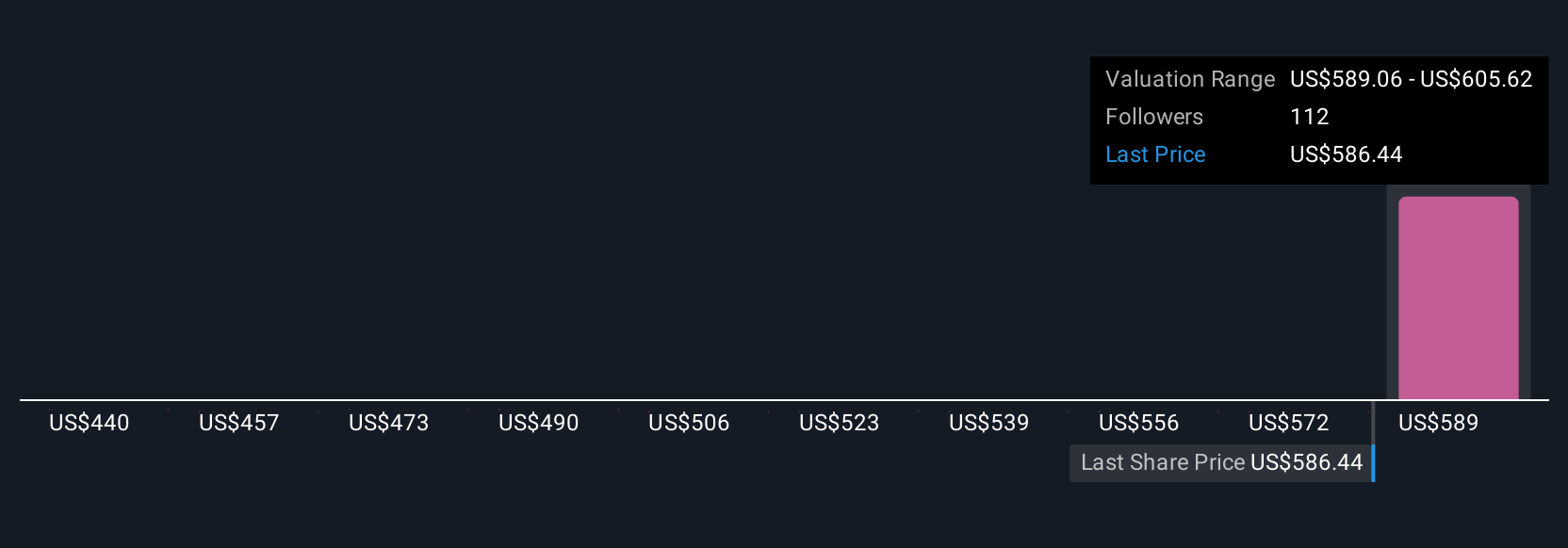

Simply Wall St Community members see Northrop Grumman’s fair value between US$450 and US$615.56, with five distinct forecasts. These differences stand out especially given the company’s exposure to major government contracts, which can create broad uncertainty about future performance.

Explore 5 other fair value estimates on Northrop Grumman - why the stock might be worth 28% less than the current price!

Build Your Own Northrop Grumman Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northrop Grumman research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northrop Grumman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northrop Grumman's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrop Grumman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOC

Northrop Grumman

Operates as an aerospace and defense technology company in the United States, the Asia/Pacific, Europe, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives