- United States

- /

- Machinery

- /

- NYSE:MWA

Mueller Water Products' (NYSE:MWA) 11% YoY earnings expansion surpassed the shareholder returns over the past three years

Low-cost index funds make it easy to achieve average market returns. But if you invest in individual stocks, some are likely to underperform. That's what has happened with the Mueller Water Products, Inc. (NYSE:MWA) share price. It's up 24% over three years, but that is below the market return. Zooming in, the stock is actually down 16% in the last year.

The past week has proven to be lucrative for Mueller Water Products investors, so let's see if fundamentals drove the company's three-year performance.

Check out our latest analysis for Mueller Water Products

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

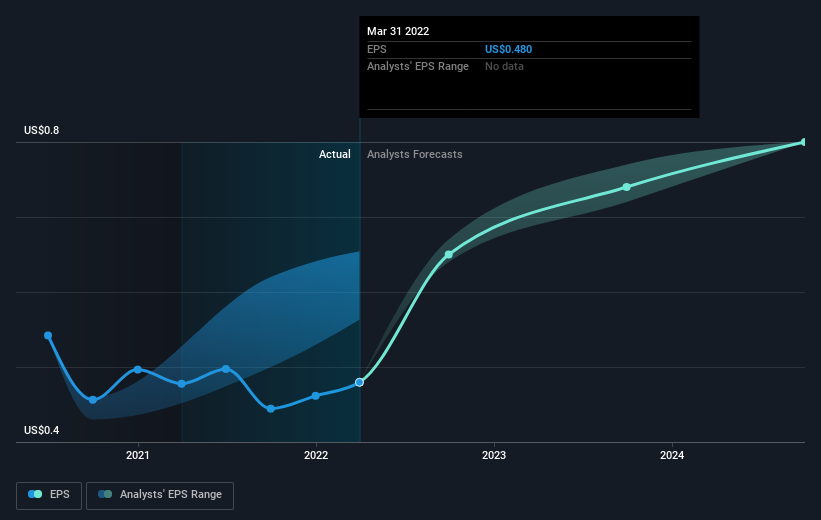

During three years of share price growth, Mueller Water Products achieved compound earnings per share growth of 36% per year. This EPS growth is higher than the 7% average annual increase in the share price. So it seems investors have become more cautious about the company, over time.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Mueller Water Products has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Mueller Water Products the TSR over the last 3 years was 31%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While it's never nice to take a loss, Mueller Water Products shareholders can take comfort that , including dividends,their trailing twelve month loss of 15% wasn't as bad as the market loss of around 18%. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand Mueller Water Products better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Mueller Water Products you should know about.

We will like Mueller Water Products better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MWA

Mueller Water Products

Manufactures and markets products and services for the transmission, distribution, and measurement of water used by municipalities, and the residential and non-residential construction industries in the United States, Israel, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives