- United States

- /

- Building

- /

- NYSE:MOD

Modine (MOD) Valuation Check After Fresh Buy Ratings Highlight Data Center Cooling Growth Potential

Reviewed by Simply Wall St

Modine Manufacturing (MOD) is back on investors radar after fresh Buy ratings from D.A. Davidson and UBS, both pointing to the company’s growing role in data center cooling and its potential for long term revenue expansion.

See our latest analysis for Modine Manufacturing.

The latest pullback, including a 1 day share price return of minus 15.3 percent, comes after a strong run. Year to date share price gains are still above 20 percent and a remarkable multi year total shareholder return above 1,000 percent suggests momentum is pausing rather than breaking.

If Modine’s data center story has you thinking bigger about infrastructure plays, it might be worth exploring aerospace and defense stocks as another pocket of the market where mission critical technology can compound over time.

With shares still up strongly over three and five years but trading at a roughly 30 percent discount to analyst targets, is Modine quietly undervalued here, or is the market already baking in years of data center growth?

Most Popular Narrative Narrative: 23.6% Undervalued

Compared to Modine Manufacturing’s last close of $139.88, the most followed narrative pegs fair value near $183, implying notable upside if its growth plan holds.

The accelerating build-out of data centers and the need for next-generation cooling solutions are driving extraordinary demand for Modine's products, with management forecasting the potential to double data center revenues from approximately $1 billion in fiscal 2026 to $2 billion by fiscal 2028. This structural demand from digital infrastructure is set to materially boost revenue growth and deliver significant operating leverage over time.

Want to see how a fast rising data center revenue stream, fatter profit margins and a premium future earnings multiple combine into that valuation call? The full narrative unpacks the exact growth path, profitability lift and implied earnings power that have to line up for Modine to reach that price.

Result: Fair Value of $183 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Modine’s aggressive data center buildout and concentrated North American exposure could backfire if customer demand slows, which could leave excess capacity and pressured margins.

Find out about the key risks to this Modine Manufacturing narrative.

Another Take On Valuation

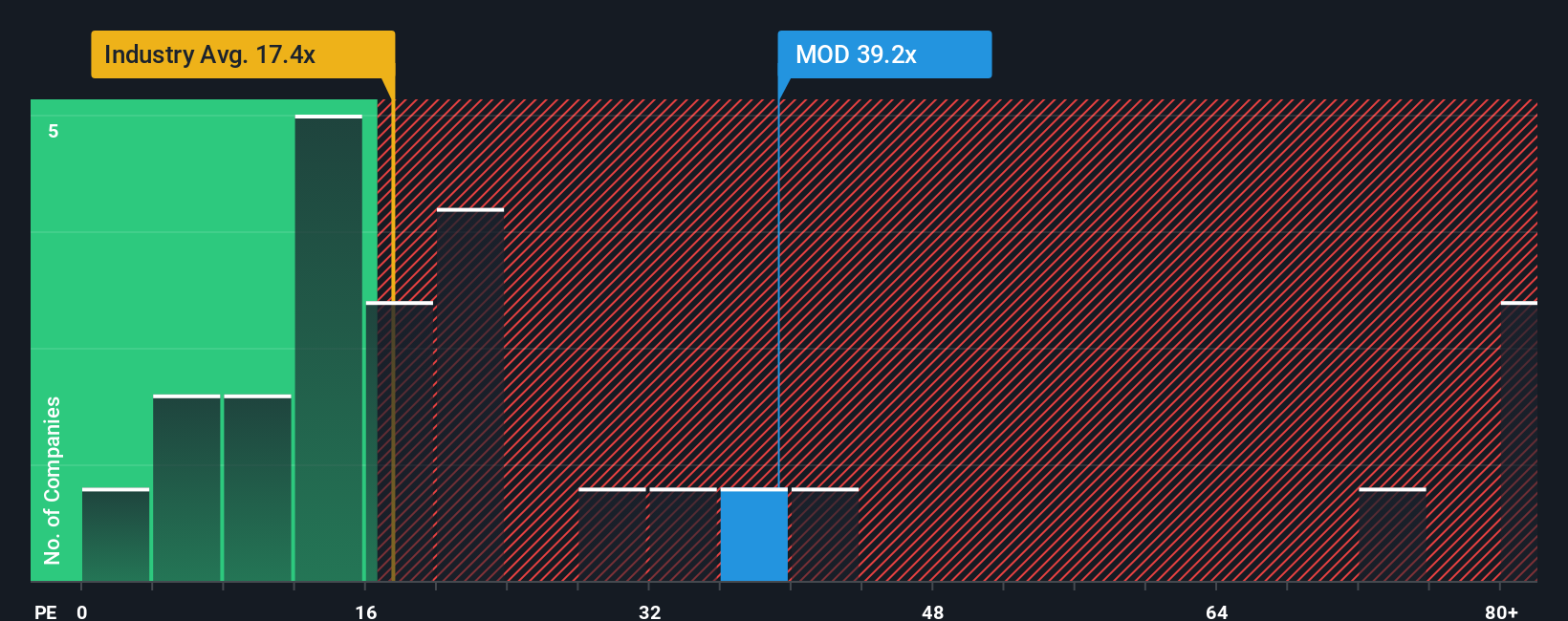

Those upside narratives clash with a simple earnings lens. Modine trades on a 39.6 times P E ratio, almost double the US Building industry at 20.2 times and well above peers at 26.7 times, even if our fair ratio suggests room for that gap to narrow over time.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Modine Manufacturing Narrative

If this perspective does not quite fit your view or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your Modine Manufacturing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single opportunity. Use the Simply Wall St Screener to uncover fresh, data backed ideas that others might overlook until it is too late.

- Capture potential mispricings early by scanning these 901 undervalued stocks based on cash flows that may offer strong upside relative to their cash flow outlook.

- Ride structural growth trends by focusing on these 26 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Boost your income potential by targeting these 13 dividend stocks with yields > 3% that can help support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOD

Modine Manufacturing

Designs, engineers, tests, manufactures, and sells mission-critical thermal solutions in the United States, Canada, Italy, Hungary, the United Kingdom, China, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)