- United States

- /

- Industrials

- /

- NYSE:MMM

Optimistic Investors Push 3M Company (NYSE:MMM) Shares Up 26% But Growth Is Lacking

The 3M Company (NYSE:MMM) share price has done very well over the last month, posting an excellent gain of 26%. The last 30 days bring the annual gain to a very sharp 32%.

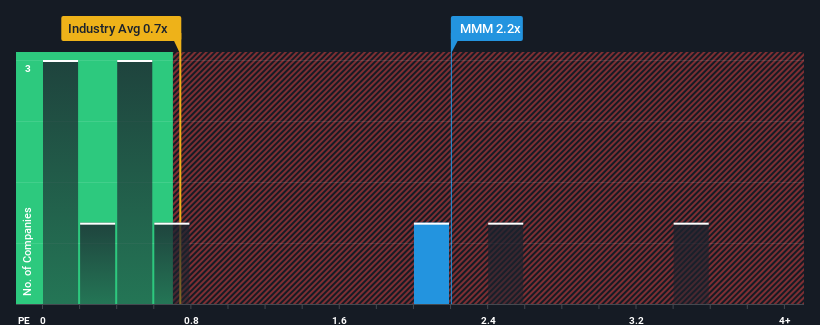

Following the firm bounce in price, given close to half the companies operating in the United States' Industrials industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider 3M as a stock to potentially avoid with its 2.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for 3M

How 3M Has Been Performing

With revenue growth that's superior to most other companies of late, 3M has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on 3M.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, 3M would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. Still, lamentably revenue has fallen 6.1% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 7.3% each year during the coming three years according to the analysts following the company. That's not great when the rest of the industry is expected to grow by 3.9% per annum.

With this in mind, we find it intriguing that 3M's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Final Word

The large bounce in 3M's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that 3M currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 3 warning signs we've spotted with 3M.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade 3M, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if 3M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MMM

3M

Provides diversified technology services in the Americas, the Asia Pacific, Europe, the Middle East, Africa, and internationally.

Good value low.

Similar Companies

Market Insights

Community Narratives