- United States

- /

- Electrical

- /

- NYSEAM:KULR

US Growth Companies With High Insider Ownership In January 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed trading environment following a series of strong gains, investors are paying close attention to corporate earnings and policy changes under the new administration. In this context, growth companies with high insider ownership can be appealing as they often signal confidence from those closest to the business, potentially aligning with investor interests in times of market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| MoneyLion (NYSE:ML) | 20.3% | 92.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.1% | 66.2% |

| Similarweb (NYSE:SMWB) | 25.4% | 126.3% |

Let's dive into some prime choices out of the screener.

Westrock Coffee (NasdaqGM:WEST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Westrock Coffee Company, LLC is an integrated provider of coffee, tea, flavors, extracts, and ingredients solutions operating both in the United States and internationally with a market cap of approximately $614.11 million.

Operations: The company's revenue segments include Beverage Solutions, generating $660.44 million, and Sustainable Sourcing & Traceability, contributing $184.58 million.

Insider Ownership: 13.4%

Westrock Coffee shows potential for growth with revenue expected to rise by 15.8% annually, outpacing the US market's 9%. Despite recent financial challenges, including a Q3 net loss of US$14.26 million, the company is forecasted to achieve profitability within three years. Insider confidence is evident as substantial shares have been bought recently. The addition of Ken Parent to the board may bolster strategic initiatives and operational leadership.

- Unlock comprehensive insights into our analysis of Westrock Coffee stock in this growth report.

- Our comprehensive valuation report raises the possibility that Westrock Coffee is priced lower than what may be justified by its financials.

KULR Technology Group (NYSEAM:KULR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KULR Technology Group, Inc., operating through its subsidiary KULR Technology Corporation, specializes in developing and commercializing thermal management technologies for electronics and batteries in the United States, with a market cap of $513.83 million.

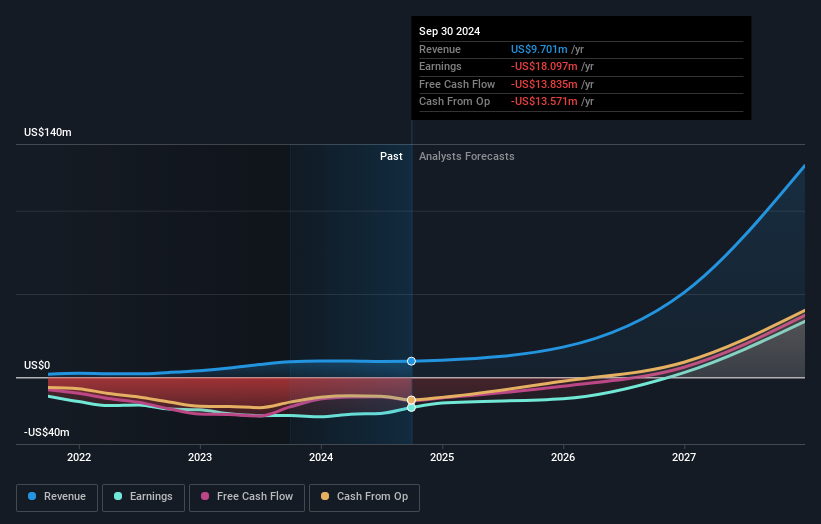

Operations: KULR Technology Group's revenue segment includes Superconductor Products & Systems, generating $9.70 million.

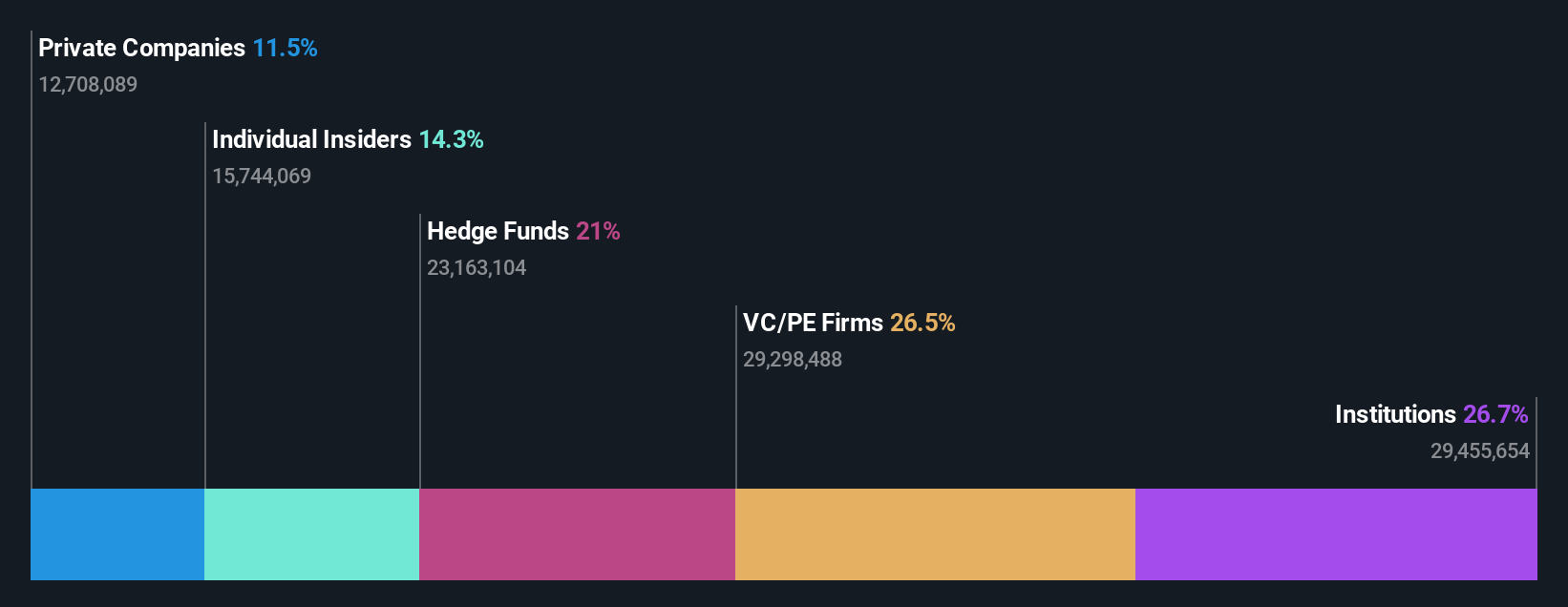

Insider Ownership: 17.6%

KULR Technology Group is positioned for significant growth, with revenue expected to increase by 68.5% annually, surpassing the US market's average. Recent strategic alliances, such as the collaboration with Scripps Research Institute and a multi-million-dollar licensing agreement in Japan, highlight its innovative capabilities in energy solutions. Despite past shareholder dilution and financial volatility, KULR's advancements in aerospace and defense sectors underscore its potential to become profitable within three years.

- Delve into the full analysis future growth report here for a deeper understanding of KULR Technology Group.

- Our valuation report unveils the possibility KULR Technology Group's shares may be trading at a premium.

Loar Holdings (NYSE:LOAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Loar Holdings Inc. designs, manufactures, and markets aerospace and defense components for aircraft and systems both in the United States and internationally, with a market cap of $7.71 billion.

Operations: The company's revenue segment includes Aerospace & Defense, generating $378.81 million.

Insider Ownership: 22.4%

Loar Holdings is poised for growth with revenue forecasted to rise by 15.2% annually, outpacing the US market. Despite recent insider selling and financial challenges, such as interest payments not being well covered by earnings, the company's earnings are expected to grow significantly at 51.9% per year. Recent equity offerings totaling $488.75 million and revised guidance for increased net sales underscore its strategic expansion efforts following acquisitions like Applied Avionics.

- Navigate through the intricacies of Loar Holdings with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Loar Holdings' share price might be too optimistic.

Turning Ideas Into Actions

- Investigate our full lineup of 204 Fast Growing US Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if KULR Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:KULR

KULR Technology Group

Through its subsidiary, KULR Technology Corporation, develops and commercializes thermal management technologies for electronics, batteries, and other components applications in the United States.

High growth potential low.