- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

Lockheed Martin Rises After Pentagon Missile Push Is Valuation Now Attractive in 2025

Reviewed by Bailey Pemberton

Thinking about Lockheed Martin these days? You are not alone, and there is a lot to consider. Over the past month, the stock has jumped 5.5%, regaining ground after a tough year that left it down more than 16%. In the broader picture, long-term investors have still seen strong gains, with the stock up 23% over three years and an impressive 56% over five years. Clearly, there is a history of resilience here, even if recent bumps have made some investors pause.

Several headlines have reminded the market about Lockheed’s role on the world stage. Turkey, for instance, has been eyeing a major purchase of Lockheed fighter jets, and the U.S. Pentagon is encouraging suppliers like Lockheed Martin to seriously ramp up missile production, responding to global tensions. These sorts of global defense contracts and military supply chain pushes can be game changers for stocks like this, especially in an industry where demand depends so heavily on geopolitics and government policy.

So, is Lockheed Martin’s stock a bargain right now? By the numbers, the company currently scores a 4 out of 6 on classic valuation checks, suggesting it might be undervalued in two thirds of major categories factored in. That makes for a compelling setup, but as with any investment, it pays to really dig into what those valuation signals mean. Next, we will break down these approaches, and later, there is a smarter, more nuanced perspective that takes things even further.

Why Lockheed Martin is lagging behind its peers

Approach 1: Lockheed Martin Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to today’s dollars. This approach aims to capture what Lockheed Martin’s future income streams are really worth in present terms.

Currently, Lockheed Martin generates an annual Free Cash Flow (FCF) of $3.3 Billion. According to analyst consensus and further projections, that figure is expected to grow steadily over the next decade. By 2029, projected FCF could reach $7.4 Billion, with estimates for the next ten years showing continued growth based on both analyst forecasts for the near term and data-driven extrapolations after that point.

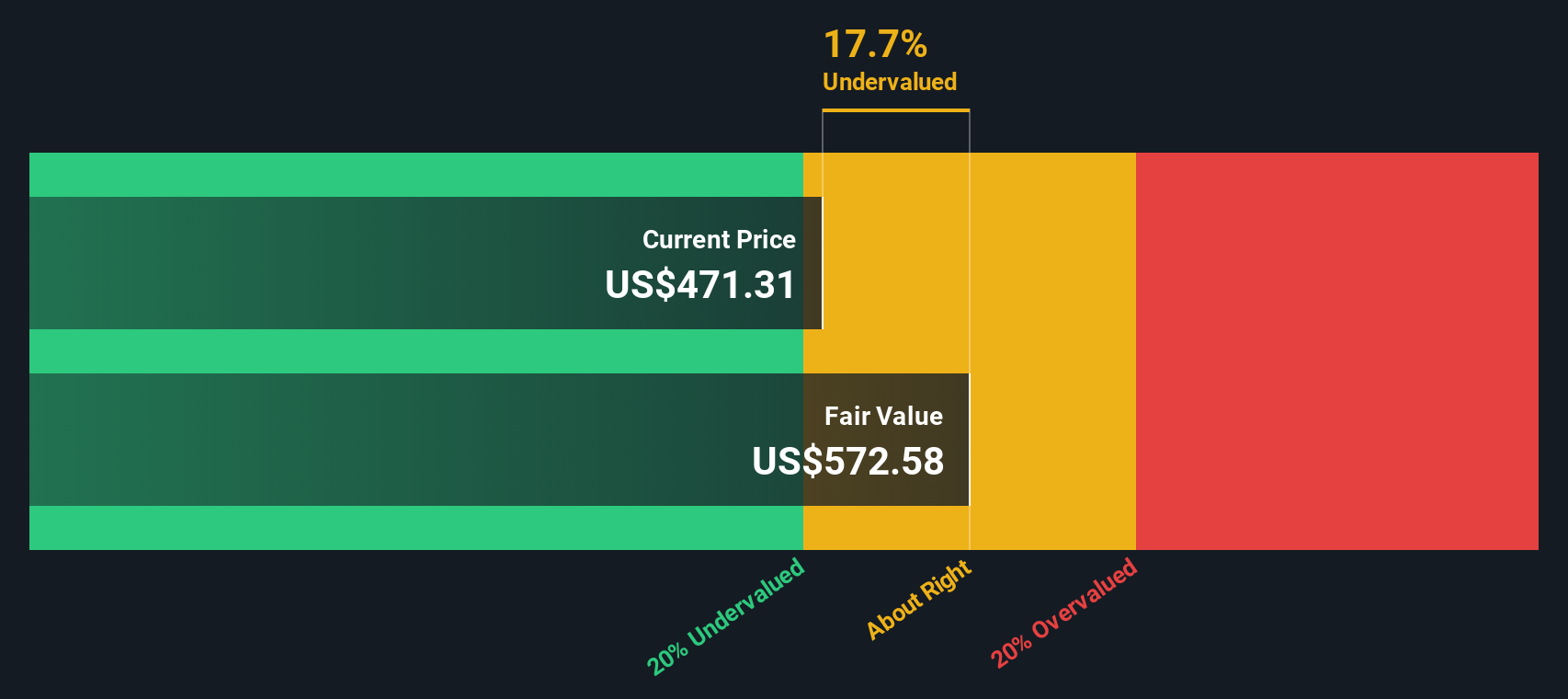

Using these cash flow projections, the DCF model calculates an estimated fair value for Lockheed Martin stock of $567.76 per share. Compared to its current market price, this suggests the shares are trading at a 12.0% discount. In other words, based on expected future cash flows, the stock appears undervalued by a meaningful margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lockheed Martin is undervalued by 12.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Lockheed Martin Price vs Earnings (PE)

For established, profitable companies like Lockheed Martin, the Price-to-Earnings (PE) ratio is a tried-and-true valuation metric. The PE ratio helps investors understand how much they are paying for each dollar of a company’s earnings. Higher growth prospects or lower risk usually justify a higher PE multiple.

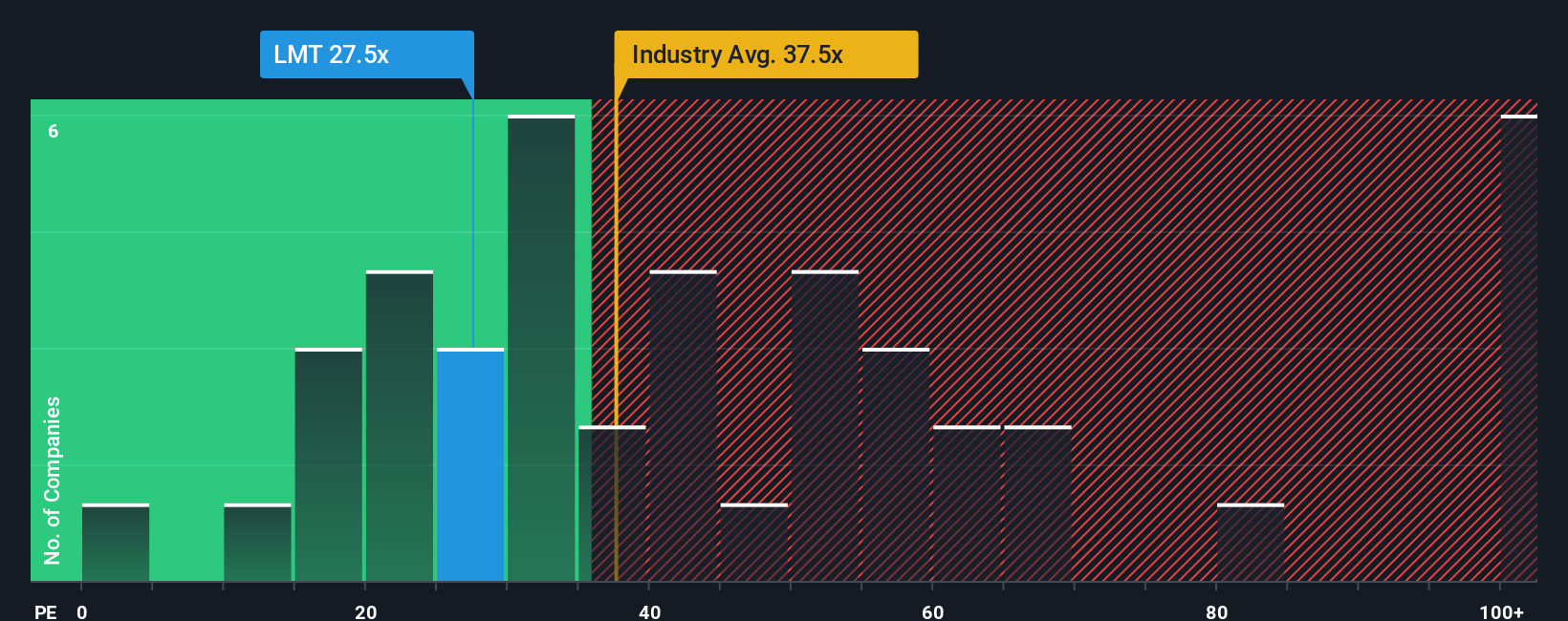

Lockheed Martin currently trades at a PE ratio of 27.7x, which sits below the industry average of 39.4x and the peer average of 33.4x. At first glance, this suggests the stock could be relatively inexpensive compared to its sector. However, context is key. Industry averages can be skewed by fast growers or distressed companies, and simple peer comparisons often miss the nuances of a company’s unique risk profile.

This is where Simply Wall St's Fair Ratio comes in. The Fair Ratio, currently at 33.2x for Lockheed Martin, is calculated based on expected earnings growth, profit margin, the company's position within its industry, and market capitalization. This makes it a more accurate measure of what the stock should trade at because it accounts for factors beyond the broad industry numbers.

Comparing the Fair Ratio to Lockheed Martin’s actual PE ratio, the gap is only about 5.5x, suggesting that while the stock trades a bit lower than its fair value, it is not dramatically cheap or expensive based on these factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lockheed Martin Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives—a smarter, more dynamic approach to investment decisions that goes beyond just numbers. A Narrative is your personal, evidence-based story about a company; it links your perspective on Lockheed Martin’s business future with specific financial forecasts and a resulting fair value. Narratives help you connect what you know, such as industry trends, leadership strengths, or risks, to concrete estimates of future revenue, earnings, and margins, giving you a clear, actionable view of whether a stock is a buy or a sell.

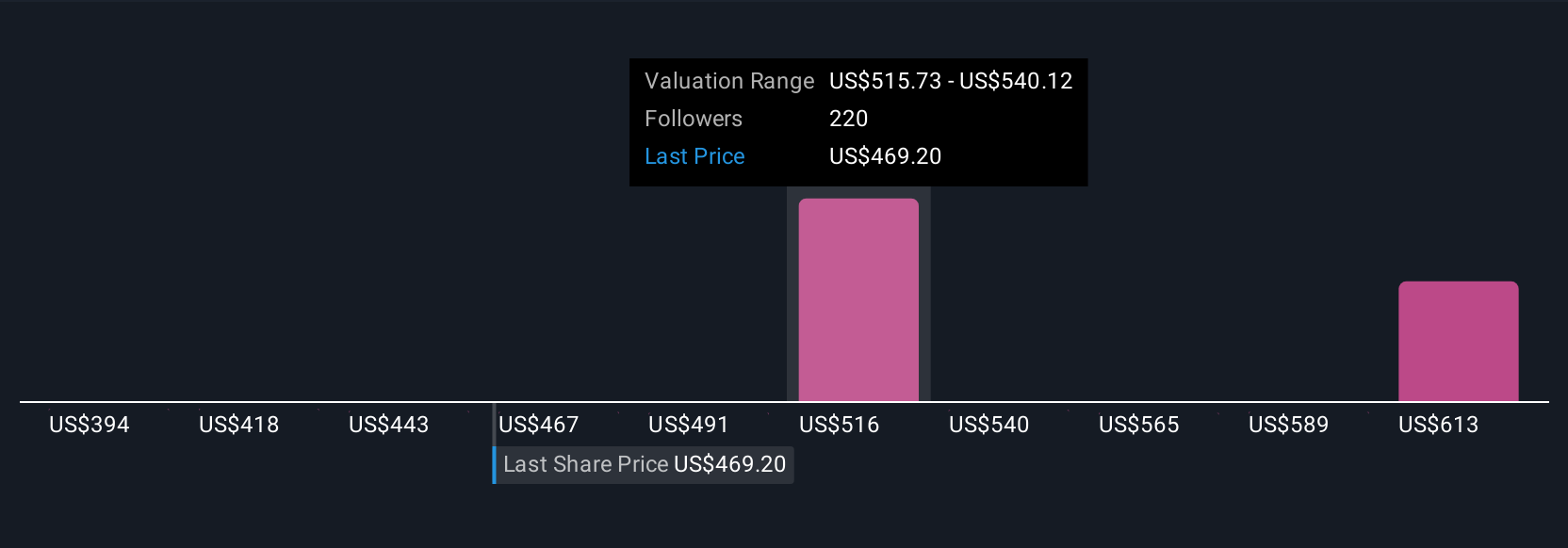

This tool is available on Simply Wall St’s Community page and is used by millions of investors as an accessible way to make sense of complex decisions. Narratives do not stand still as they automatically update when important news or fresh earnings reports come in, ensuring your story always reflects the latest facts. For example, one investor could build a bullish Narrative believing Lockheed Martin will benefit from growing global defense budgets and set a fair value near the top analyst target of $544. Another, more cautious investor might highlight execution and regulatory risks, arriving at a value closer to the lowest analyst target of $398. Narratives empower you to make decisions backed by your reasoning and to adapt quickly as market conditions change.

Do you think there's more to the story for Lockheed Martin? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMT

Lockheed Martin

An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives