- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

Lockheed Martin (NYSE:LMT) Delivers Final F-35 Jets to Norway's Air Force Fleet Completion

Reviewed by Simply Wall St

Lockheed Martin (NYSE:LMT) recently marked a significant milestone by delivering the 51st and 52nd F-35A aircraft to Norway, reinforcing its pivotal role in global defense. This event coincided with the company's share price climbing 1.5% over the past week. Meanwhile, broader market trends, stirred by anticipations of President Trump's tariff announcements, saw the Dow Jones and other indexes experiencing gains. Lockheed’s advancements were made amid the volatile trading environment, where the S&P 500 closed higher after previous declines. This period highlights LMT's resilience and strategic positioning in both defense technology and market dynamics.

You should learn about the 2 risks we've spotted with Lockheed Martin.

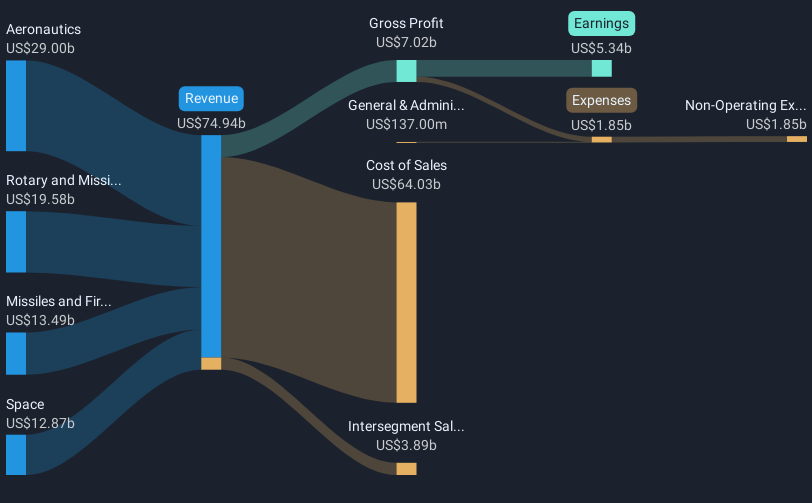

Over the past five years, Lockheed Martin (NYSE:LMT) has achieved a total shareholder return of 44.50%. This performance was influenced by several key developments. The company's record-high backlog of $176 billion across all business areas indicates strong demand, suggesting a potential for sustained revenue. Significant R&D investments totaling US$3.3 billion have been directed towards enhancing programs like the F-35, offering opportunities for operational efficiencies. Additionally, Lockheed's collaboration with Google to integrate advanced AI into their ecosystem underscores an emphasis on innovation.

In earlier years, Lockheed faced challenges such as volatility from reliance on classified programs, but recent advancements, including a US$383 million contract for the Trident II Strategic Weapons System, have fostered stability. However, its recent underperformance relative to the US Aerospace & Defense industry may reflect a disparity in immediate growth. Despite this, Lockheed's sustained focus on innovation and backlog growth continues to support its long-term market position.

Review our growth performance report to gain insights into Lockheed Martin's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMT

Lockheed Martin

An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives