- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

How L3Harris (LHX) Could Benefit from US Army Deal and VAMPIRE AI Expansion

Reviewed by Sasha Jovanovic

- In the past week, L3Harris Technologies was selected by the U.S. Army to supply advanced communication devices under a US$24 million contract and announced the expansion of its VAMPIRE™ counter-unmanned system platform to meet evolving defense needs across land, sea, air, and electronic domains.

- This expansion underscores L3Harris's agility in bringing AI-enabled, multi-domain defense solutions to market, supporting growing military demand for innovative technologies to address emerging autonomous threats.

- We'll explore how expanding the VAMPIRE system with AI-powered capabilities could influence L3Harris's growth narrative amid shifting defense priorities.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

L3Harris Technologies Investment Narrative Recap

To be a shareholder in L3Harris Technologies, you need to believe in sustained demand for advanced defense solutions, strong execution in contract fulfillment, and ongoing government support. The recent US$24 million Army contract and VAMPIRE™ system expansion signal continued near-term momentum, though the most important short-term catalyst, successfully delivering on large-scale government awards, remains largely unchanged. The major risk continues to be potential delays or challenges in executing fixed-price development contracts, which could impact profitability and revenue streams.

Among the recent news, the expansion of the VAMPIRE™ system is especially relevant, highlighting L3Harris's efforts to broaden its AI-enabled counter-unmanned systems lineup across multiple domains. This development supports the company’s catalyst of capitalizing on rising demand for integrated, multi-domain defense technologies while addressing urgent military needs.

Yet, in contrast, investors should remain aware of the ongoing risks posed by fixed-price contract challenges...

Read the full narrative on L3Harris Technologies (it's free!)

L3Harris Technologies' outlook anticipates $24.9 billion in revenue and $2.7 billion in earnings by 2028. This scenario is based on a projected yearly revenue growth rate of 5.2% and implies a $1.0 billion increase in earnings from the current $1.7 billion.

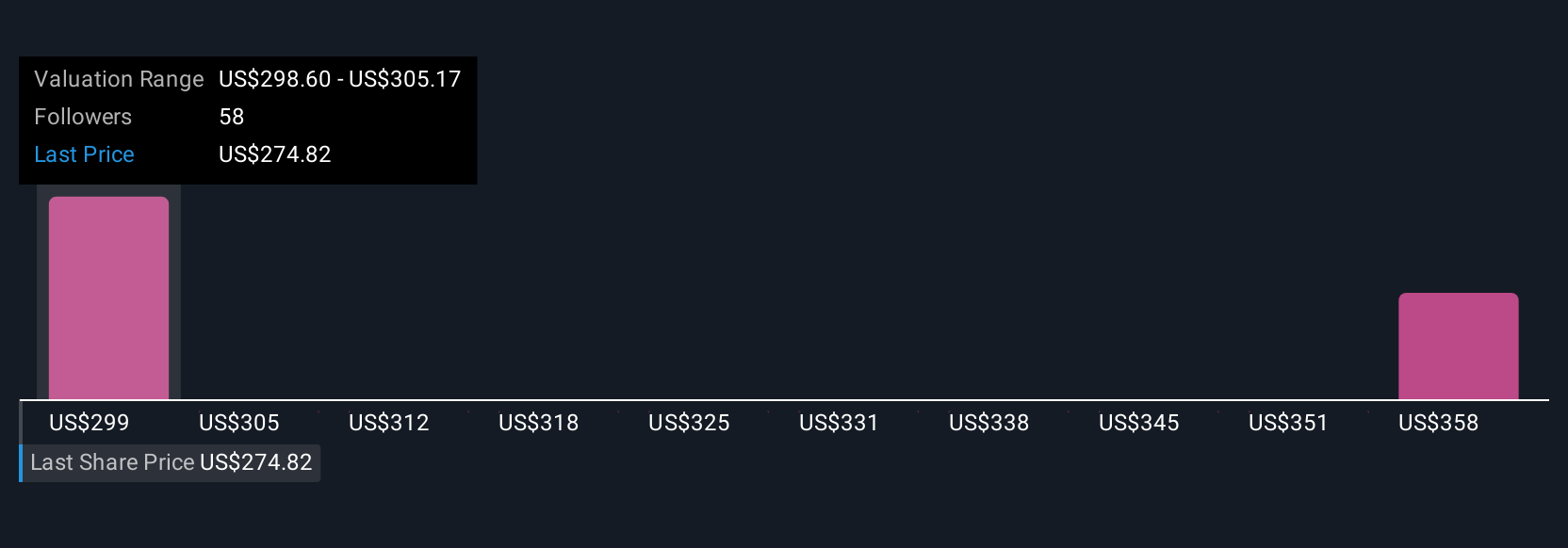

Uncover how L3Harris Technologies' forecasts yield a $309.11 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two fair value estimates ranging from US$309 to US$328 per share before this news. With fixed-price contracts presenting potential margin risks, your interpretation may differ, open the discussion to see several viewpoints.

Explore 2 other fair value estimates on L3Harris Technologies - why the stock might be worth just $309.11!

Build Your Own L3Harris Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your L3Harris Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free L3Harris Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate L3Harris Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives