- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

A Look at L3Harris Technologies’s Valuation Following Record Javelin Propulsion Contract Announcement

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 6.2% Undervalued

The most widely followed analyst narrative sees L3Harris Technologies as undervalued, with a fair value noticeably above the latest share price. Analysts cite strong momentum, sector tailwinds, and improved financial guidance as key ingredients in their outlook.

The extension of defense spending growth, driven by new mandatory funding approved via the Reconciliation bill and rising global threat levels, is seen as a key positive for top-line growth.

Curious what powers this upbeat valuation? The secret sauce lies in a series of bold financial expectations and margin shifts behind the analyst consensus. These details could change how you see L3Harris’s future. Wondering which assumptions sparked this under-the-radar price estimate? Uncover the surprising projections driving this fair value call.

Result: Fair Value of $302.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, reliance on external contractors and ongoing geopolitical tensions could challenge L3Harris’s ambitious growth assumptions. This reminds investors that risks remain in focus.

Find out about the key risks to this L3Harris Technologies narrative.Another View: SWS DCF Model Adds Perspective

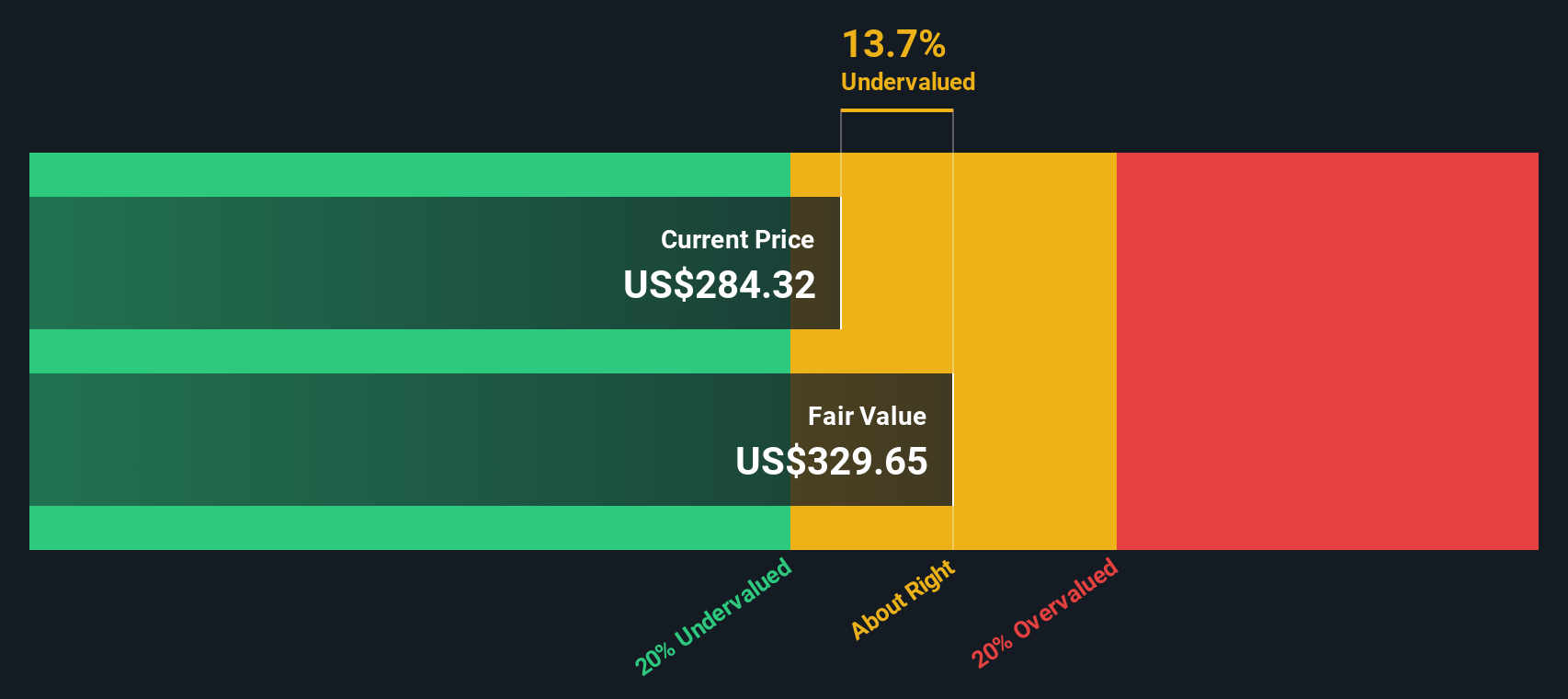

While the analyst consensus sees L3Harris as undervalued, our SWS DCF model offers another perspective. It also leans toward undervaluation, but it evaluates projected future cash flows rather than focusing on peer ratios. Can both approaches be correct about the company’s potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out L3Harris Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own L3Harris Technologies Narrative

If you think there is more to the story or want to dig into the numbers firsthand, you can shape your own outlook in just a few minutes. Do it your way.

A great starting point for your L3Harris Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for unique opportunities. Don’t let your next winning stock slip away. Use these handpicked expert tools to uncover your edge in today’s market.

- Unleash your portfolio’s income potential and make the most of market yields with dividend stocks with yields > 3%.

- Tap into emerging tech trends and spot the next big breakthrough by checking out AI penny stocks.

- Seize undervalued gems that others might miss and give yourself the first-mover advantage with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives