- United States

- /

- Machinery

- /

- NYSE:ITW

Is ITW’s Outsized Capital Efficiency Hiding a Bigger Competitive Advantage?

Reviewed by Sasha Jovanovic

- Illinois Tool Works recently announced it achieved a return on capital employed of 34%, well above the Machinery industry average, and will release its third quarter 2025 results on October 24, 2025.

- Increased operational efficiency has driven this outperformance without requiring additional capital, highlighting a potentially underappreciated fundamental strength within the company's business model.

- We'll explore how renewed investor attention on Illinois Tool Works' capital efficiency impacts its investment narrative and long-term outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Illinois Tool Works Investment Narrative Recap

Shareholders in Illinois Tool Works are relying on the company’s ability to sustain market-leading capital efficiency while navigating revenue headwinds and ongoing challenges in key segments such as automotive and construction. The recent news of exceptional return on capital employed primarily reinforces its fundamental strengths but does not materially affect near-term risks, for instance, volatility in organic growth or revenue may still dominate the upcoming earnings release as the main catalyst for sentiment shifts.

The upcoming release of third quarter 2025 results, scheduled for October 24, is particularly relevant as it will provide fresh data on both financial performance and capital allocation outcomes. This announcement is closely watched, given the company’s prior quarters of mixed revenue trends and the heightened attention to margin preservation and capital returns among investors.

However, despite positive efficiency metrics, investors should also be aware that the revenue outlook remains pressured by...

Read the full narrative on Illinois Tool Works (it's free!)

Illinois Tool Works is projected to reach $17.6 billion in revenue and $3.6 billion in earnings by 2028. This outlook assumes a 3.7% annual revenue growth rate and a $0.2 billion increase in earnings from the current $3.4 billion.

Uncover how Illinois Tool Works' forecasts yield a $261.02 fair value, a 7% upside to its current price.

Exploring Other Perspectives

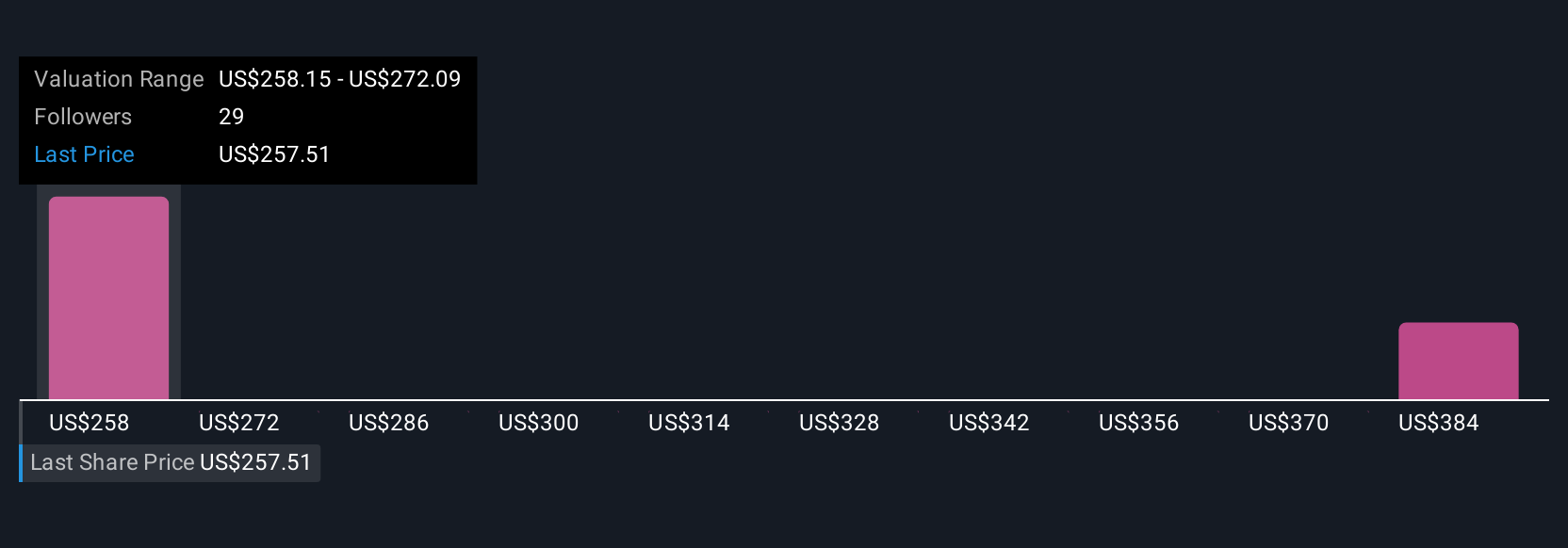

Simply Wall St Community members offered two fair value estimates for ITW shares, ranging widely from US$261.02 to US$386.99 per share. While some see deep value, ongoing challenges in organic growth and regional demand signal that multiple factors may shape future results, explore these different viewpoints to see how your own outlook compares.

Explore 2 other fair value estimates on Illinois Tool Works - why the stock might be worth just $261.02!

Build Your Own Illinois Tool Works Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Illinois Tool Works research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Illinois Tool Works research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Illinois Tool Works' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITW

Illinois Tool Works

Provides industrial products and equipment in North America, Europe, the Middle East, Africa, the Asia Pacific, and South America.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives