- United States

- /

- Machinery

- /

- NYSE:ITT

Is ITT (ITT) Undervalued After Its Recent Share Price Pullback? A Fresh Look at the Valuation

Reviewed by Simply Wall St

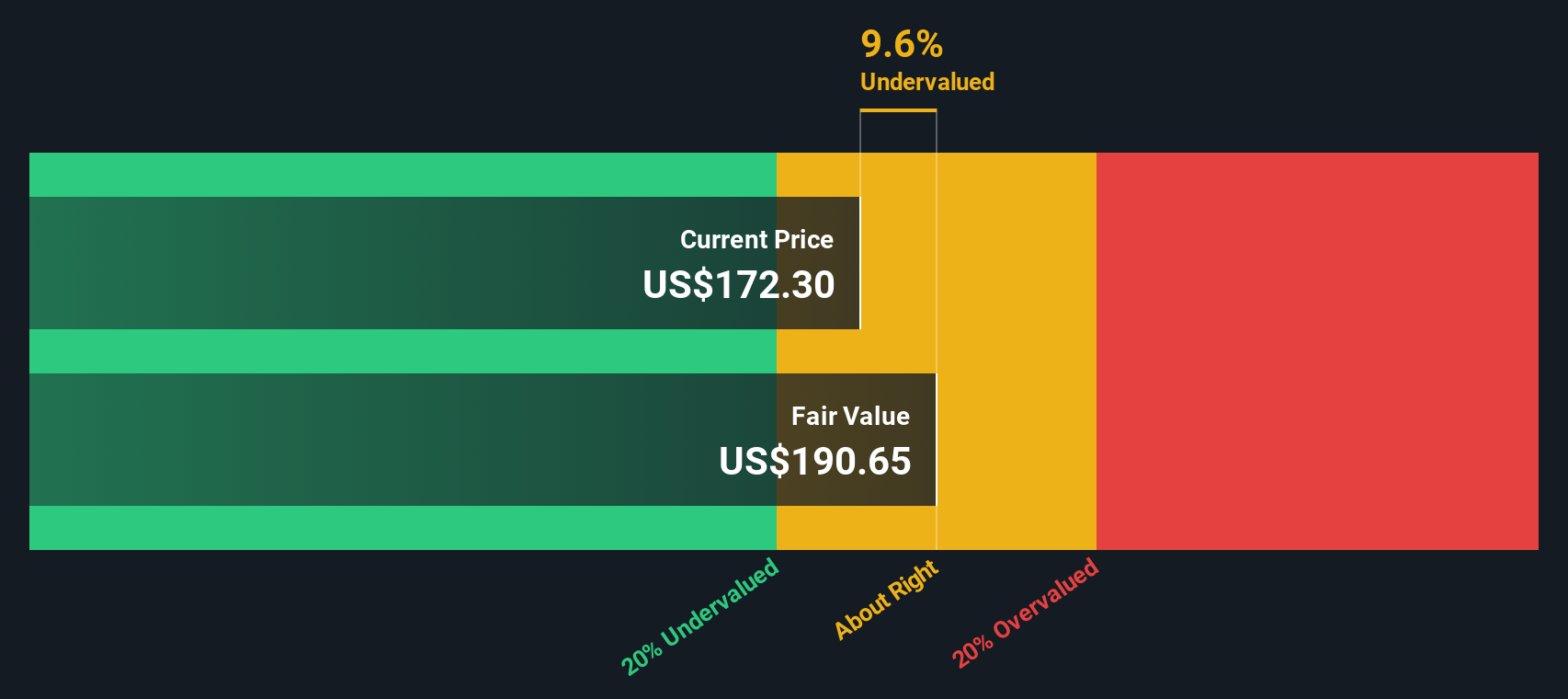

ITT (ITT) shares have cooled off over the past month after a strong year to date, slipping about 11% even as longer term returns remain solid. That gap has some investors rechecking the story.

See our latest analysis for ITT.

The recent pullback sits against a backdrop of a strong year to date share price return and a standout multi year total shareholder return, suggesting momentum is cooling slightly rather than breaking the longer term uptrend.

If ITT’s move has you reassessing the industrial space, it could be worth seeing which other aerospace and defense stocks are showing similar resilience and potential.

With shares still up strongly over the past year and trading below consensus targets, investors now face a key question: Is ITT quietly undervalued after this pullback, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 18.2% Undervalued

With the narrative fair value near $208.33 versus a last close of $170.50, the story leans toward upside, hinging on sustained growth and margin gains.

Recent and future bolt on acquisitions (e.g., Svanehøj, kSARIA, Habonim) are exceeding targets and integrating quickly, forecasted to deliver significant incremental revenue and annual margin improvement, accelerating both top line and EPS growth. Operational improvements such as automation, productivity initiatives, and strategic pricing combined with visibility from a $2B backlog and resilient end markets, are expected to drive further gains in operating margins, free cash flow conversion, and EPS over the medium and long term.

Want to see how steady mid single digit revenue growth, rising margins, and a premium earnings multiple combine into that upside case? The underlying earnings path, buyback assumptions, and discount rate all interact in a way that is less obvious than the headline target suggests. Curious which levers matter most and how sensitive that fair value is to small changes in performance? The full narrative breaks down the precise growth runway and profitability bridge that support this valuation call.

Result: Fair Value of $208.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing reliance on project based revenue and heightened M&A execution risk could quickly challenge margin expansion assumptions if demand or integrations disappoint.

Find out about the key risks to this ITT narrative.

Another Angle on Value

Our SWS DCF model paints a cooler picture, putting fair value near $163.53 versus the $170.50 share price. This implies ITT is slightly overvalued rather than an 18.2% bargain. Are expectations for growth, margins, and capital returns now a touch too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ITT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ITT Narrative

If you see things differently or want to stress test the assumptions yourself, you can spin up a tailored view in minutes. Do it your way

A great starting point for your ITT research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next move by scanning fresh opportunities from our powerful screeners, built to surface what many investors may overlook.

- Explore potential income opportunities by targeting these 15 dividend stocks with yields > 3% that combine attractive yields with financial strength to support ongoing payments through different market environments.

- Position yourself in emerging areas of technology by focusing on these 28 quantum computing stocks involved in advances in computing power and practical applications.

- Look for potential mispriced opportunities by reviewing these 900 undervalued stocks based on cash flows where current market sentiment may differ from the underlying cash flow profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITT

ITT

Manufactures and sells engineered critical components and customized technology solutions for the transportation, industrial, and energy markets.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)