- United States

- /

- Machinery

- /

- NYSE:ITT

Evaluating ITT (ITT) Valuation Following Upward Earnings Revisions and Strengthened Analyst Outlook

Reviewed by Kshitija Bhandaru

ITT (ITT) has recently drawn attention after upward earnings revisions and higher consensus estimates. These factors suggest the company is positioned for solid cash flow gains. The updates appear to be fueling positive sentiment among investors.

See our latest analysis for ITT.

ITT’s momentum has been building, with robust upward earnings revisions contributing to a 9.6% gain in share price over the past 90 days. While recent days saw some pullback, longer-term investors have enjoyed a 12.4% total return over the past year and an impressive 182% total return over five years. This highlights the stock’s enduring strength and ongoing interest from growth-focused investors.

If ITT’s growth streak has you thinking bigger, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With ITT continuing to post solid growth and analyst optimism running high, the big question is whether the current share price offers long-term value for new investors or if market enthusiasm has already accounted for future gains.

Most Popular Narrative: 11.4% Undervalued

ITT's most-followed valuation narrative sets its fair value at $193, which is well above the last close of $170.91. The narrative assumption suggests there is room for upside, hinging on unique tailwinds and specific future milestones for the company.

Operational improvements, such as automation, productivity initiatives, and strategic pricing, combined with visibility from a $2B backlog and resilient end markets, are expected to drive further gains in operating margins, free cash flow conversion, and EPS over the medium and long term.

Puzzled by how this price was calculated? The secret lies in bullish profit margin forecasts, ambitious share buybacks, and confidence that ITT can consistently outperform its competitors. Wondering which needle-moving assumptions shaped this fair value? Get the full picture inside the complete narrative.

Result: Fair Value of $193 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting market demand and potential integration challenges from recent acquisitions could present headwinds to ITT's otherwise optimistic outlook.

Find out about the key risks to this ITT narrative.

Another View: How Does ITT's Valuation Stack Up?

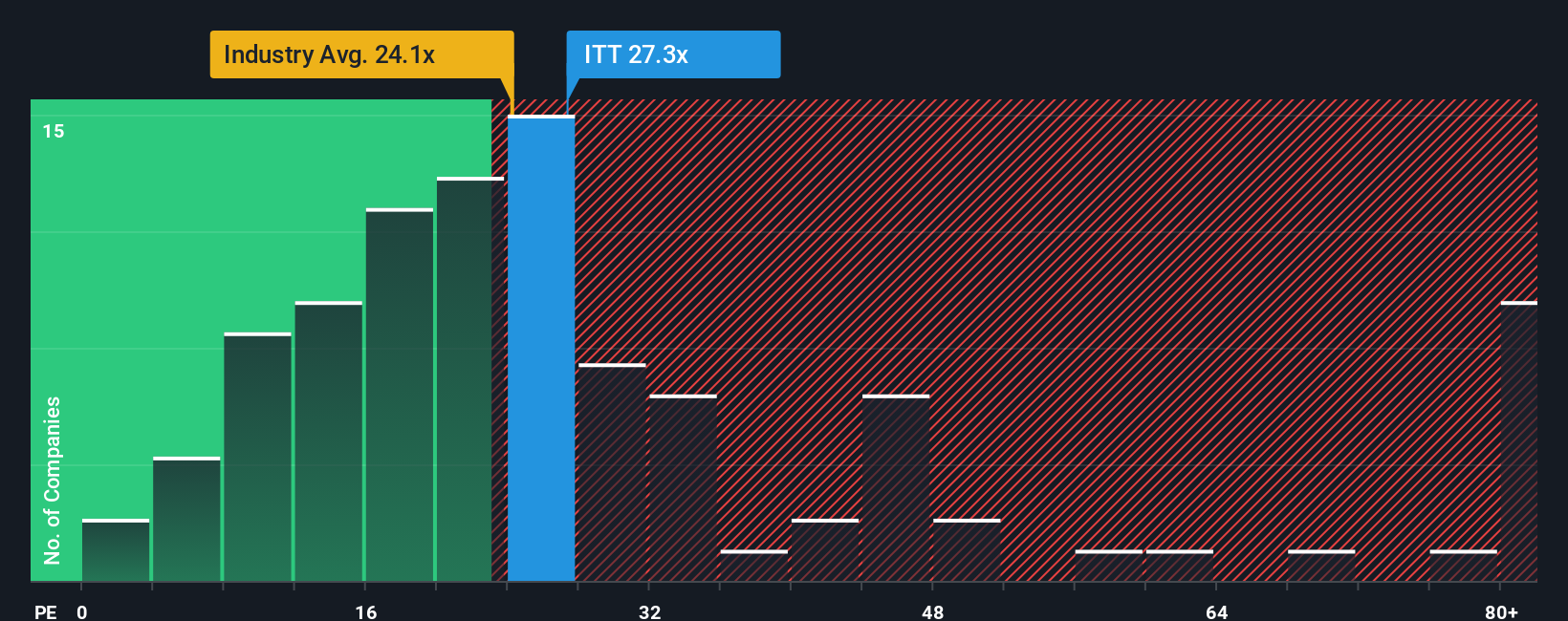

Looking through the lens of price-to-earnings, ITT is trading at a ratio of 25.8x, which is higher than the US Machinery industry average of 23.4x and well above its own fair ratio of 23x. This indicates that investors are paying a premium, raising questions about valuation risk if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ITT Narrative

If you see the numbers differently or want to run your own analysis, you can build a custom valuation in just a few minutes, your way with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ITT.

Looking for more investment ideas?

Don't settle for the usual picks. Move ahead with confidence by checking out these high-potential opportunities that could shape your portfolio's future.

- Supercharge your search for regular returns and reliability by reviewing these 19 dividend stocks with yields > 3% offering yields over 3%, which can set the stage for steady portfolio growth.

- Embrace the future of healthcare innovation by checking out these 33 healthcare AI stocks, a category that is changing the landscape with artificial intelligence breakthroughs.

- Position yourself at the forefront of the digital economy and uncover value in these 79 cryptocurrency and blockchain stocks that are harnessing blockchain and cryptocurrency advancements right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITT

ITT

Manufactures and sells engineered critical components and customized technology solutions for the transportation, industrial, and energy markets.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives