- United States

- /

- Machinery

- /

- NYSE:ITT

Assessing ITT's Valuation After Analyst Upgrades and Strengthening Earnings Outlook

Reviewed by Simply Wall St

If you’ve got ITT (NYSE:ITT) on your watchlist, Zacks Investment Research just gave investors something to consider. The firm recently highlighted ITT as a top pick in the growth stock category, pointing to strong earnings momentum and a Growth Score that sets it apart from peers. Factoring in upward revisions in earnings estimates, there is now a growing sense that ITT’s fundamentals could drive shares higher over the next year, leading many to rethink their stance on the stock.

Looking at the bigger picture, ITT has built up a steady track record, with the stock moving up 25% in the past year and climbing 20% so far this year. Momentum has been especially strong over the past few months, fueling optimism among investors interested in industrial growth. While ITT’s recent quarterly results and earnings outlook have kept buyers engaged, it is also worth noting that revenue and net income have shown consistent annual gains.

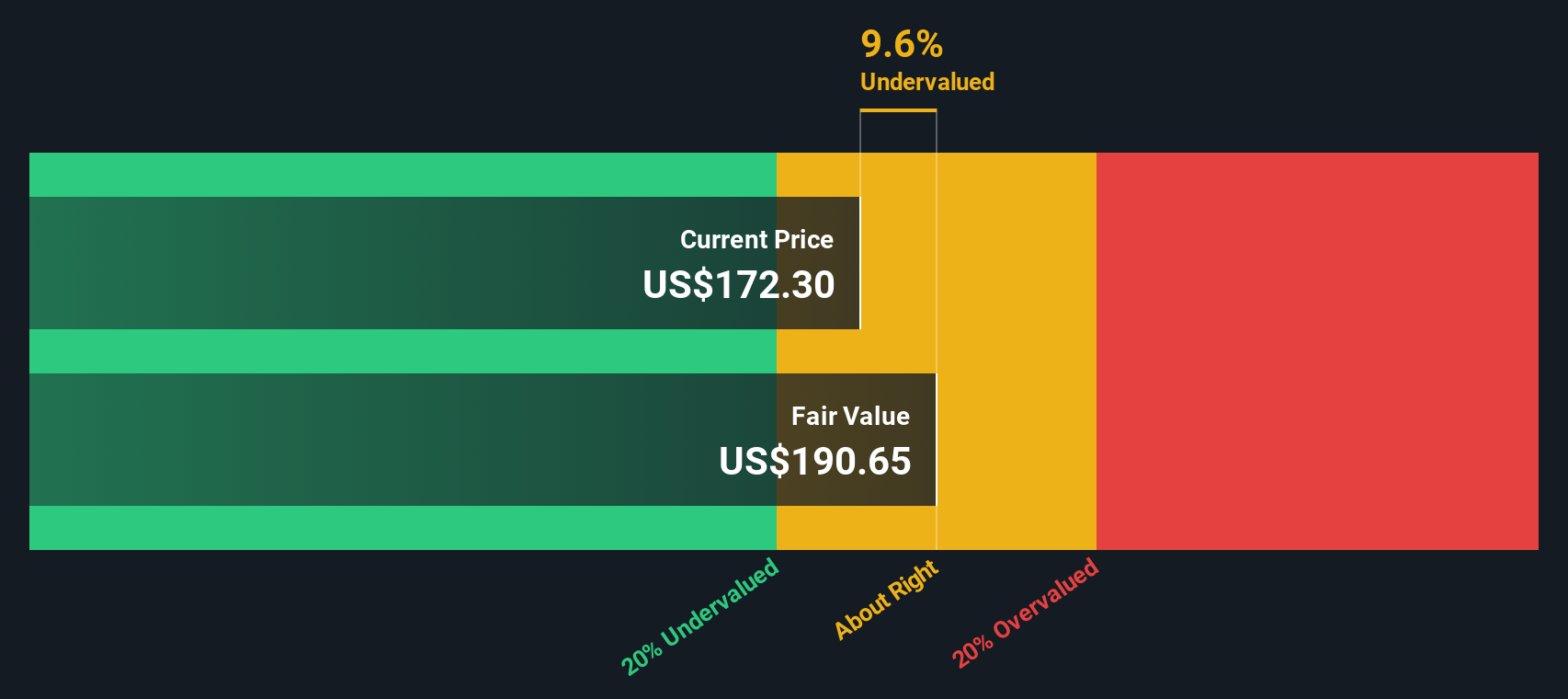

The central question now, after this run, is whether ITT’s valuation remains attractive or if the market has already factored in all the good news about future growth prospects.

Most Popular Narrative: 7.3% Undervalued

According to community narrative, ITT is trading below its estimated fair value, suggesting potential upside based on forward-looking analyst assumptions and growth projections. The fair value was calculated using a discount rate of 8.13%, considering expected improvements in the company’s financial performance and the sustainability of returns over time.

Expansion of high-margin aftermarket and services business, along with new technologies (geopolymer brake pads, advanced fuel pumps, digital monitoring), positions ITT to benefit from industry digitalization and energy efficiency standards. This supports margin expansion and stable, recurring earnings streams.

Interested in the full growth story behind ITT’s perceived undervaluation? The driving logic within this narrative focuses on ambitious financial improvements and transformative business shifts. Looking to uncover the specific profit, revenue, and multiple assumptions that shape this notable discount? The numbers may be revealing.

Result: Fair Value of $184.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, growing reliance on large projects and the risk of integration challenges from recent acquisitions could quickly change ITT’s trajectory if conditions shift.

Find out about the key risks to this ITT narrative.Another View: What Does the SWS DCF Model Say?

While the first estimate relies on comparing ITT's valuation to the market standard, our DCF model takes a different approach and suggests the stock is also trading below fair value. Does this reinforce the bullish case, or are both models missing something crucial?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ITT Narrative

If you see things differently, or want to reach your own conclusions from the numbers, it only takes a few minutes to craft a personal narrative. do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ITT.

Looking for More Investment Ideas?

Don’t let opportunity pass you by by focusing on just one stock. The right screener helps you spot exceptional companies, often before they make headlines. Broaden your outlook and set yourself up for smarter portfolios by leveraging these targeted investment ideas today:

- Capitalize on next-generation breakthroughs and invest in companies at the forefront of artificial intelligence by starting with AI penny stocks.

- Maximize passive income and tap into stocks delivering yields greater than 3% using our exclusive dividend stocks with yields > 3%.

- Catch the wave of digital transformation by targeting businesses pioneering decentralized finance and blockchain adoption with cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITT

ITT

Manufactures and sells engineered critical components and customized technology solutions for the transportation, industrial, and energy markets.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives